Traders who largely rely on technical analysis cannot overlook the importance of support and resistance levels. These two lines answer a simple question: At what points does the price seem to fluctuate within at a specific time interval?

By knowing these levels, it then becomes easy to know your possible trade entry points as well as where the trend is likely to reverse.

Another huge advantage of using support and resistance levels is that they can be used alongside many technical indicators. This increases the probability of entering winning trades.

Finally, they are not complicated as you’ll see in this guide.

Overview of Support and Resistance

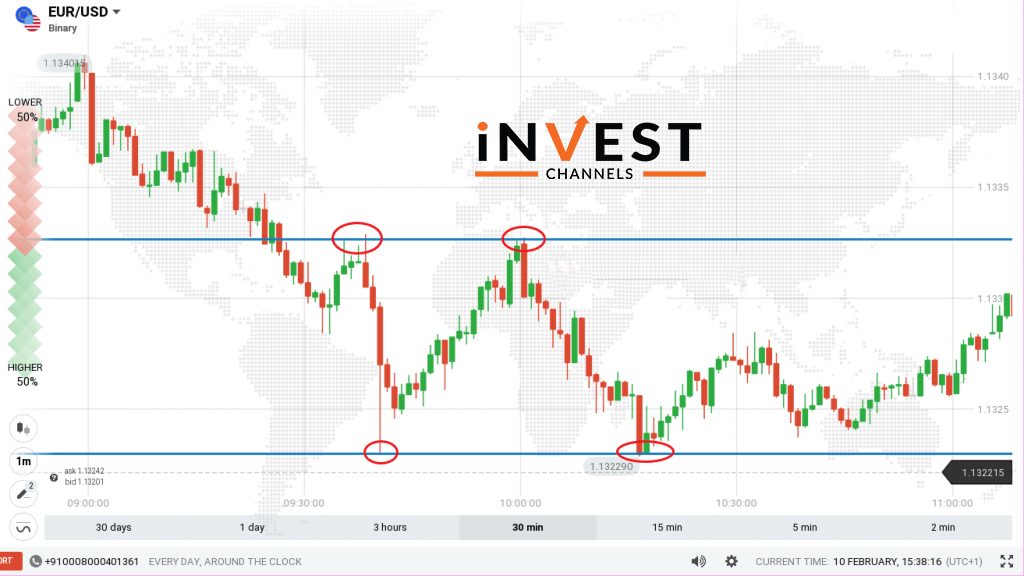

Support lines are drawn to mark the lowest price ranges a chart reaches during a specific period. For example, during a 1 hour period, you’ll notice a certain low price range where prices reach in the chart before bouncing back upwards. To have valid support, your horizontal line must touch at least 2 lows.

Resistance lines on the other hand are drawn to mark the highest price ranges a chart reaches during a specific period. For example, during a 1 hour period, the price might reach a certain price range several times before it bounces back down.

You should note that the price points do not have to be exactly the same. But they must be within the same price range. In addition, support and resistance lines do not necessarily have to be horizontal. In the case of an uptrend, the resistance line can be charted to connect the higher lows of the trend.

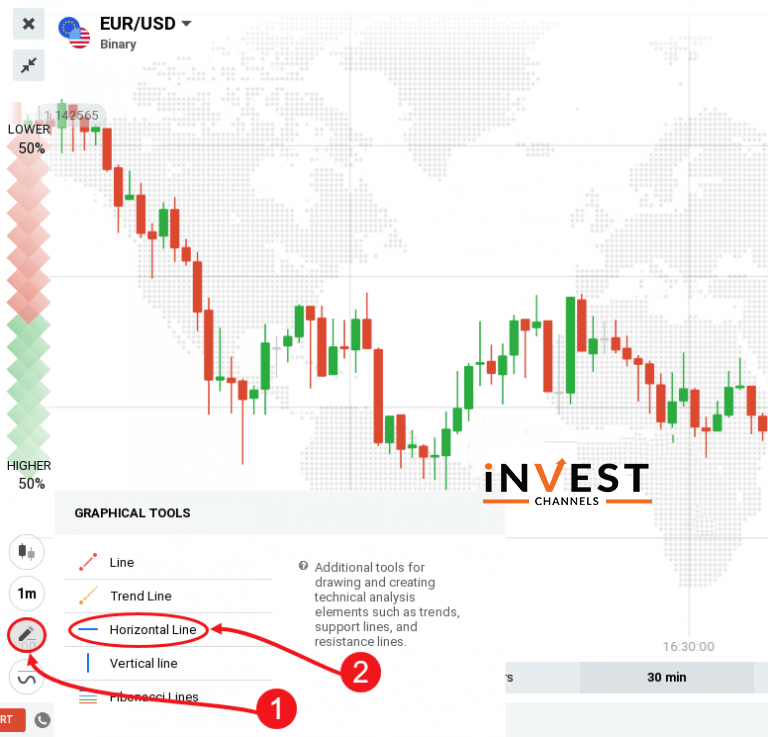

Setting up support and resistance on IQ Option

The easiest way to set up support and resistance on IQ Option is by using the horizontal line provided in the graphical tools feature as seen in the image above.

To draw a support line, select a horizontal line. Next place one end on the low of a particular session. Then extend it to touch one or more lows of that session.

To draw a resistance line, use the same technique. However, the line should connect the highs of that session.

If your line touches more than 2 price points, the support or resistance is considered a strong one. If prices manage to break out of a strong support/resistance, the resulting trend is usually quite strong.

What to remember when using support and resistance

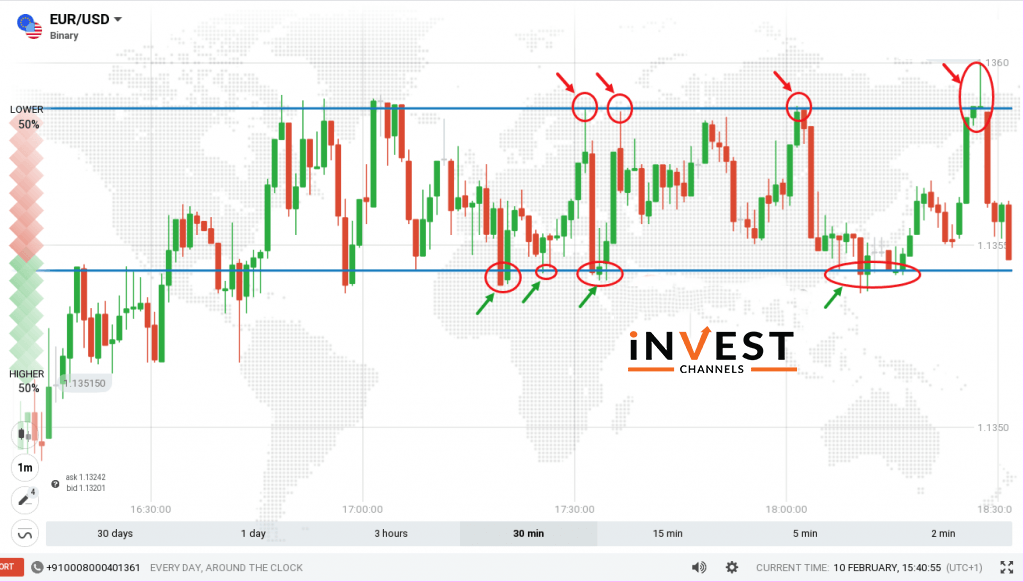

When a support line touches many lows, it’s considered strong support. On the other hand, if a resistance line touches many highs, it’s considered a strong resistance. Prices will take a while before they break out of these levels. Thus, price action trading within these levels is more reliable.

When support and resistance levels are weak, prices tend to break out of them quite easily. Price action trading, therefore, becomes quite difficult since you’ll have no idea where the markets will turn.

As prices break out of a support or resistance line, new support and resistance levels are created. For example, if prices break out of a support level, it now becomes the resistance level and vice versa.

Trading using Support and Resistance on IQ Option

Using the chart above, there are clearly strong support and resistance levels. This means that the chances of prices breaking out of these levels is quite low. The points where price touches either support or resistance are your trade entries.

If the price touches the support, you should enter a long buy position (about 5 minutes). If the price touches the resistance, you should also enter a long sell position.

Learning how to spot and draw support and resistance levels is one of the crucial skills you must learn as a trader. As you’ve seen, trading using these technical tools is quite easy. However, the profit potential they present is massive.

Now that you know how to use support and resistance in your trading, practice using them in your IQ Option demo account. We’d love to hear your results in the comments section below.

Good luck!

Top 5 Trending

In the world of online trading — often filled with risk and uncertainty — verifying the credibility of a platform… [Read More]

Starting your trading journey can feel overwhelming — there are countless assets to choose from, and it’s hard to know… [Read More]

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]