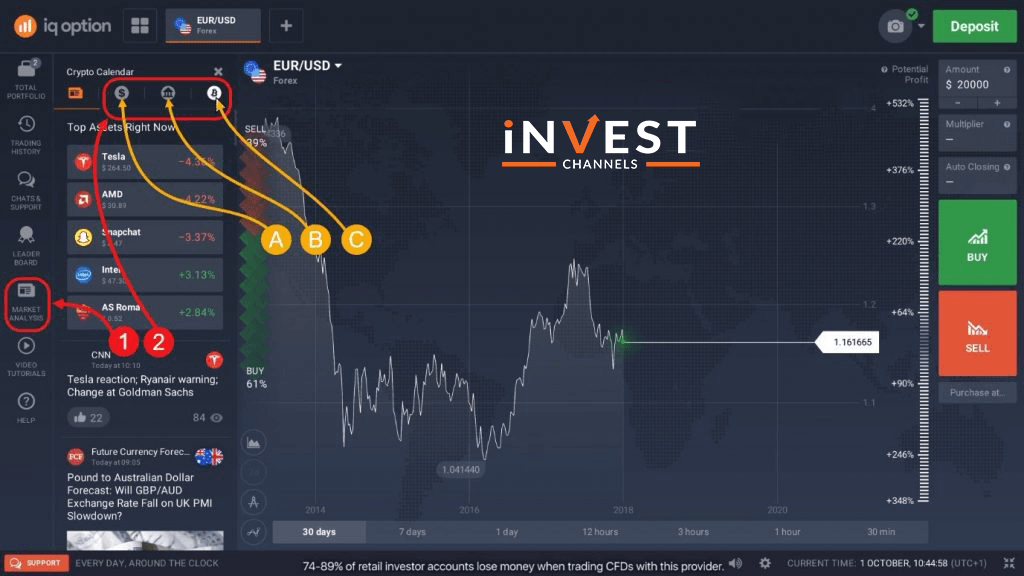

Accessing the economic calendar at IQ Option

You have options for a calendar to use as a forex calendar, earning calendar and a crypto calendar. You can find these calendar options on the left-hand side panel in the market analysis section at the IQ Option trading platform.

Forex Calendar

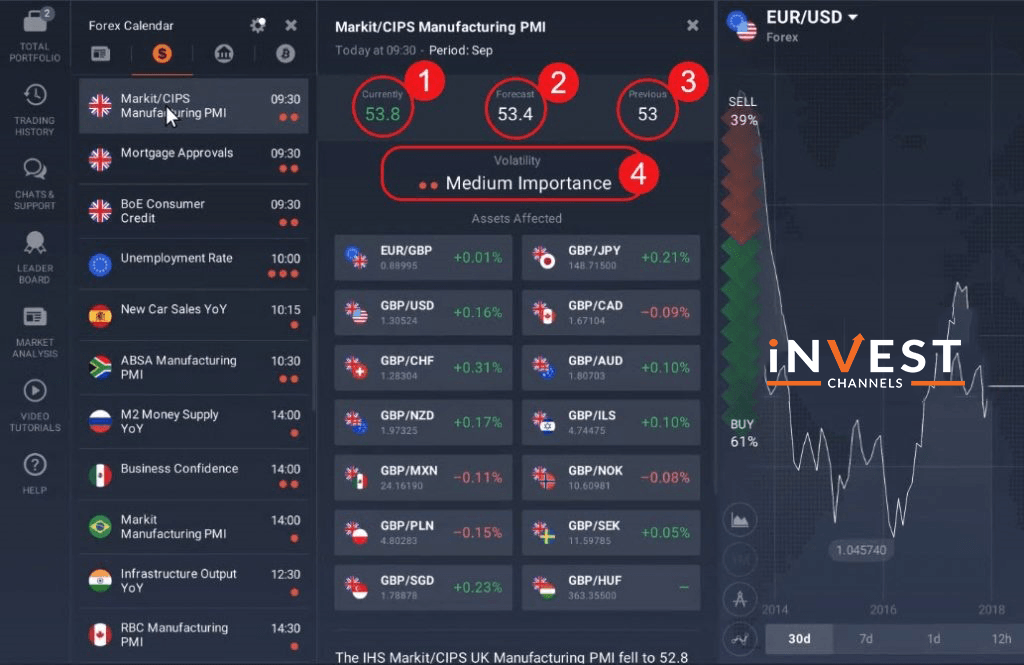

Let us take the Forex calendar and study it. Open the forex calendar and you will find a list of economic reports that are released by the country which is indicated by the flag. Open the report which you want to by clicking on its name.

After selecting the report, a new tab will open where you will see the release date and the period that it covers. You will also find the three values: currently, forecast, and previous.

Currently is one of the three values which means actual reading that appears at the time of release. This field will remain empty if a report has not been released. There is also a forecast that reflects the predictions of an average analyst before the news release

Secondly, the value that is published in the previous release is known as ‘Previous’. The volatility index follows each event which may be low, medium, or high. This volatility index represents how much a report can influence the volatility of assets.

You also have an option to set the filter releases by volatility impact, country, or category just by clicking on the settings icon. There is a general rule for reading the forex calendar which is “Currency will appreciate if the actual reading is better than the forecast”

And the currency will depreciate if it is worse than the forecast. Indicators like unemployment claims and unemployment rates influence the currency in a good way if they are lower than the forecast.

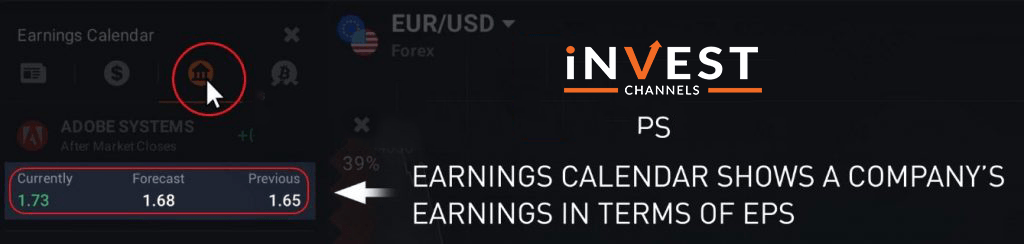

Earnings Calendar

Now let us talk about the earnings calendar. If you want to look for EPS of companies whose stocks are traded on the IQ Option platform then you can check for the earnings calendar. EPA means earnings per share. As these are the main indicators companies publish them when they file financial reports.

As we have discussed there are three values of EPS i.e. current forecast and previous. The stock price will move higher if the EPS is better. In the case where EPS meets the estimate then the stock price will most likely not move.

And the case where EPS will be lower than estimated, the stock price will fall and as compared to forecast, the previous values are usually less important. Also, if the difference between the forecast and the actual earnings is large then the market reaction will be stronger.

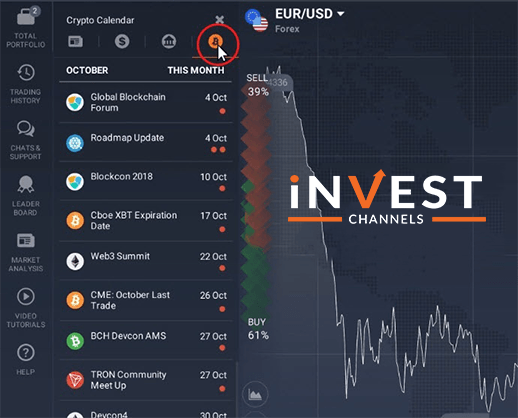

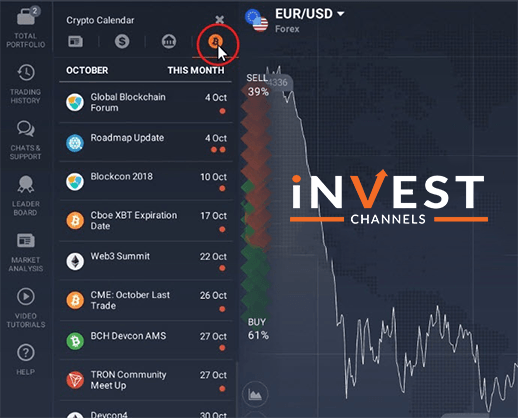

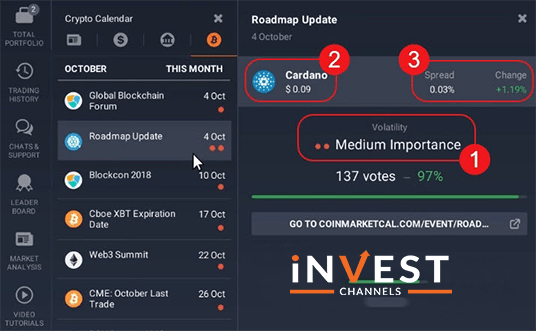

Crypto Calendar

Now, the third calendar is a crypto calendar at the IQ Option platform which represents the major events in the crypto and blockchain sector.

Once you click an event you will see when that particular event will take places such as the volatility important index as well as the current price of a digital asset, change in percentage, and spread.

We wish you successful trading.

Top 5 Trending

In the world of online trading — often filled with risk and uncertainty — verifying the credibility of a platform… [Read More]

Starting your trading journey can feel overwhelming — there are countless assets to choose from, and it’s hard to know… [Read More]

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]