When trading candlestick charts on iq option, you will occasionally notice a space that occurs between two candles. That is, the open, close, high and low of the candles do not overlap each other. This space is aptly called a gap.

Overview of the gap

This is simply a blank space that appears between two candles on the chart. It represents a sudden price change during periods where no apparent trading takes place. Normally, this occurs between one day’s close and the other day’s open. However, it can also occur during the day. For example, after a significant news release where prices suddenly change.

There are two types of gaps. The up gap develops when the low price at the close of the session is higher than high price of the previous session. The down gap on the other hand develops when the high price at the close of the session is lower than the low price of the previous session.

How to trade using gaps on IQ Option

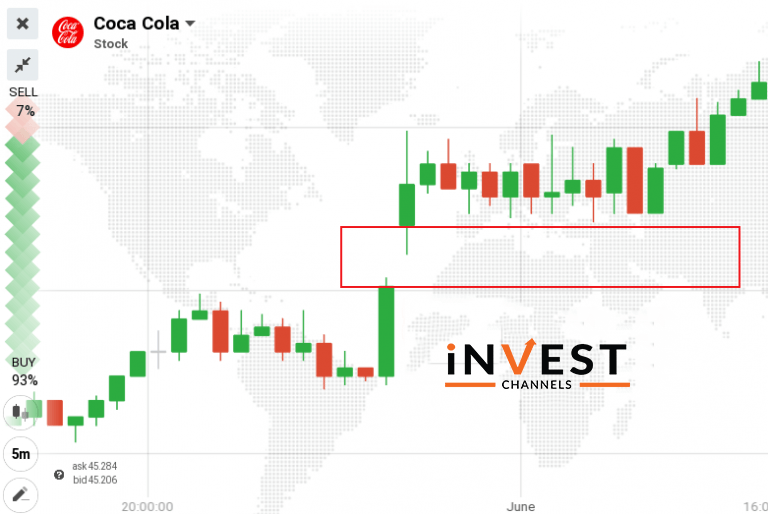

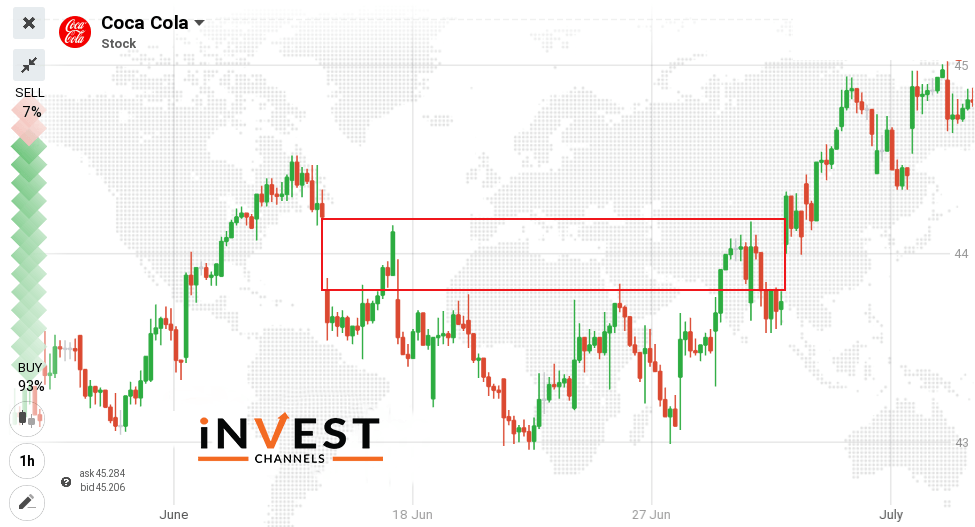

Using gaps as support/resistance

Once a gap develops, the space created forms a support/resistance range. In the example above, a down gap is created. You should expect that once the price rises and enters this range, it will start falling again.

Most IQ option traders refer to this support/resistance range as a gap test. This means that at a later time, this gap eventually gets filled where prices fluctuate up and down within this range.

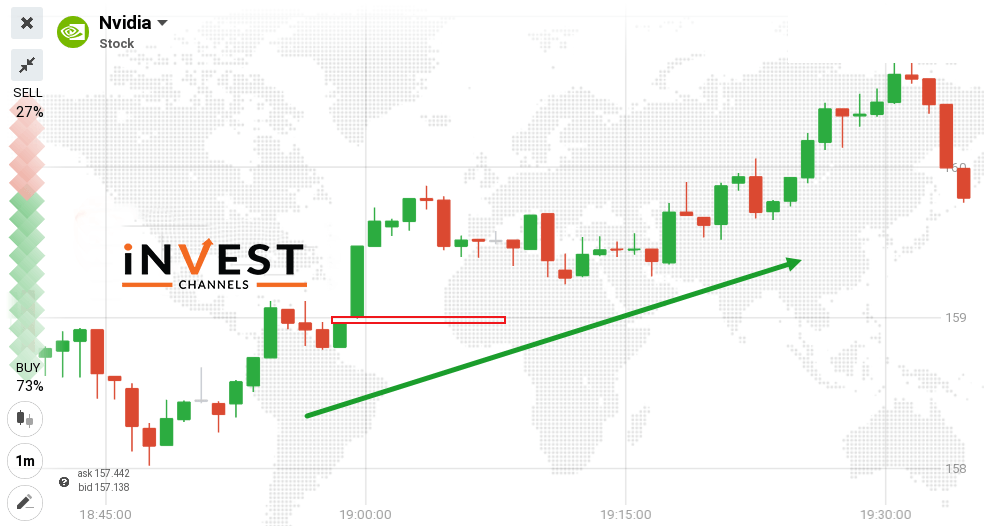

Using gaps to trade a trend

In the example above, you’ll notice that a gap develops along the uptrend. This type of gap is a runaway gap. These are created due to increased interest in the underlying asset.

For example, bulls might have thought that the trend is exhausted. However, price retracement doesn’t happen. This results in the buyers suddenly jumping into the market resulting in a sudden price spike.

This gap can also be the result of a significant news release which results in a sudden change in prices.

The good thing about runaway gaps is that the develop along the trend. Once you see this type of gap, your trade position should be along the direction of the trend.

Gaps are quite rare. But when they occur, they offer excellent short term trading opportunities. Now that you know how to trade gaps, try them out on your IQ Option demo account today. Share your results in the comments section below.

Good luck!

Top 5 Trending

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]

The Psychological Line (PSY) Indicator is a versatile, oscillator-type trading tool that compares the number of periods with positive price… [Read More]

Have you ever felt like your trading approach could benefit from a little extra energy? That’s where the Relative Vigor… [Read More]