The majority of traders will avoid markets when an important news item is about to be announced. Why? News items often affect the markets concerned creating volatility.

The problem is, you cannot accurately predict how the markets will move immediately after the news item is released. But one thing is for sure, the markets are bound to experience a period of high volatility after the news release.

Another group of traders specializes in trading when the markets are volatile. The high volatility gives them a chance to make huge profits before the markets finally settle down.

Whatever type of trader you are, you must be prepared for the news item release. IQ Option provides a good feature that makes this possible – their market analysis feature.

This guide will help you make use of this tool and decide whether you should trade when the news release occurs or not. I’ll mainly focus on forex trading.

Let’s get started.

Finding the market analysis tool on IQ Option

Next, you must change the settings to complement your trading strategy.

There are three main settings to change.

The impact of the news item. Here, I’ve selected medium and high impact. These news items are the ones that are most likely to affect the markets.

The second setting is the countries. Choose this based on where you’re trading from.

Finally, change the categories section. I prefer to leave all categories checked.

Click on apply to save these settings.

Once you’ve made these changes and clicked on “Apply”, you’ll be reverted to the forex news tab.

How do the filters work?

The impact filter simply tells you how a specific news item will affect the currency pair you’re trading. If it’s low impact, you won’t see a lot of volatility in the markets as you’d see in medium or high-impact news.

The countries filter simply indicates how the news is expected to be felt in a particular country. For example, news released about the EUR/USD is very likely to affect the US and European markets.

Finally, the categories filter allows you to select the different market sectors that the news item will affect. I usually select all categories.

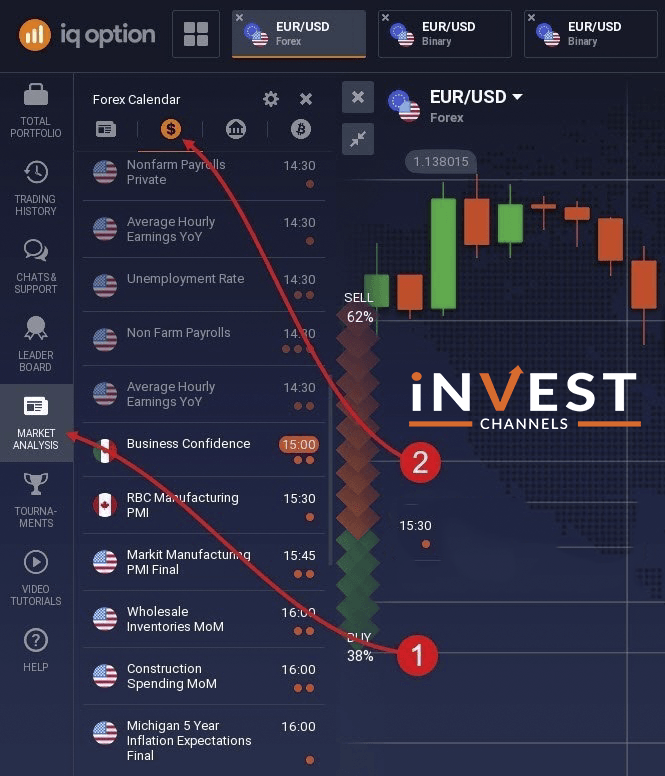

At the market analysis window

Finally, select the particular date the news item will be released as well as the time.

Different types of financial news that will affect the markets

On the IQ Option platform, the impact of a news item is measured using dots.

1 A single dot indicates low-impact news. It shouldn’t cause high market volatility.

2 Two dots indicate medium-impact news. It should cause some short-term volatility.

3 Three dots indicate high-impact news. It should cause high volatility which might last for a while.

Another form of news that isn’t easy to represent is unexpected. For example, a terrorist attack might affect the currency and economy of the country where the attack occurs. This is a form of high-impact unexpected news where extreme volatility will result.

How will the news affect the markets?

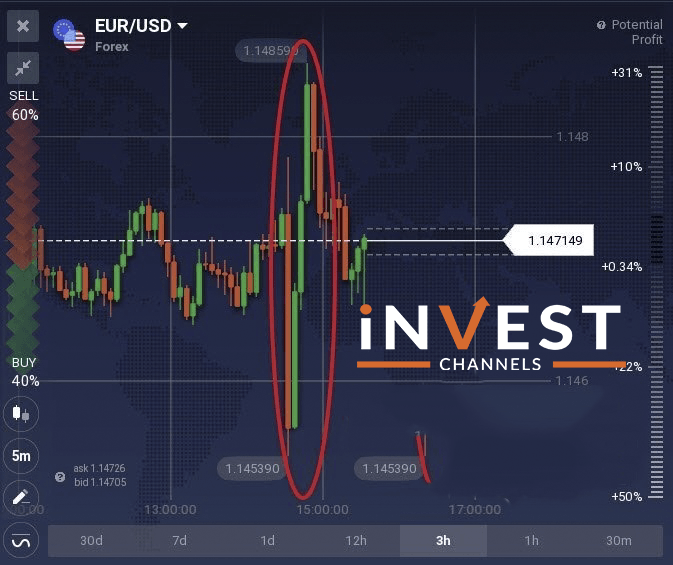

Depending on its nature, a news item might cause the markets to move up or down. I’ll use the January 25 EUR/USD currency pair to show you how. I’ll also use a 5 minute candle chart to show you how this particular news item affected the EUR/USD forex markets.

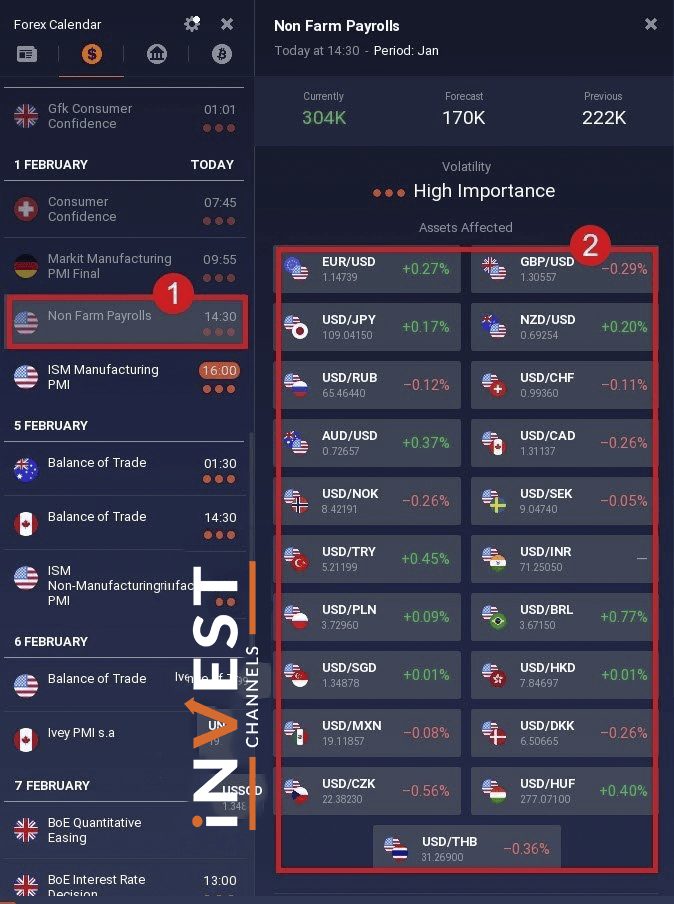

Here’s a snapshot of the market analysis of the EUR/USD on January 25 at 14.30

Here, you can see that the particular news item regarded the release of Non-Farm Payrolls in the US.

During the morning hours, the EUR/USD markets were ranging. There were small uptrends followed by small downtrends. Right up to around 12.30 pm, You can notice a small uptrend which is then followed by a downtrend. At around 13.30 pm, the markets began to range right up to around 14.30 pm when the news item was released.

At around this time, you can see a sharp drop in prices reaching a low of 1.145390. The prices then reversed with 3 consecutive solid candles. The price then peaked at 1.148590 before starting to drop again.

If you look at the chart closely, this volatility occurred for about 1 hour after the news was released. Then the prices started to stabilize at around the same level they were before the news release.

Should we trade before or after the news release?

It’s important that you analyze the market hours before the news release. Trends begin to develop hours before the news release. However, the best time to get into the market is after the news release if you want to profit from the price swings that develop.

You should also expect that these huge price fluctuations will not last long. If you prefer trading in quieter markets, wait until the news effects on the market die out. In the EUR/USD case above, this means you should have waited approximately 1 hour for markets to quiet down again.

Determining how the news will affect the markets should not worry you. The price movements will tell you where the markets are heading. All you need to do is be prepared for the change when it occurs.

You might be probably asking this question. The answer largely depends on your preferences.

If you prefer dealing with certainty and low risk, trading on markets where news items are about to be released should be avoided. On the other hand, if you prefer trading in volatile markets, this might be a good idea for you.

Choosing the right markets to trade in is an important part of trading with market news. I’ve created an extensive guide showing you the Instructions for choosing the safest currency pair to trade at IQ Option.

If you don’t want to trade markets with news releases, read this Guide to trading at IQ Option simply but effectively.

Trading with news is one of the best ways to make quick profits by leveraging market volatility. However, it’s not suitable for all traders. One reason for this is that you don’t know how far the markets will swing before reversing. This can result in huge losses.

Have you ever traded in markets after a news release? Please share your experience in the comments section below.

Good luck!

Top 5 Trending

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]

The Psychological Line (PSY) Indicator is a versatile, oscillator-type trading tool that compares the number of periods with positive price… [Read More]

Have you ever felt like your trading approach could benefit from a little extra energy? That’s where the Relative Vigor… [Read More]