If you’re a trader struggling to spot profitable candlestick patterns, don’t worry! Let’s explore three powerful candlestick patterns: the Bearish Engulfing, the Shooting Star candle, and Triangle patterns. These are some of the best candlestick patterns for binary options, easy to spot on the chart, and offer valuable trend insights.

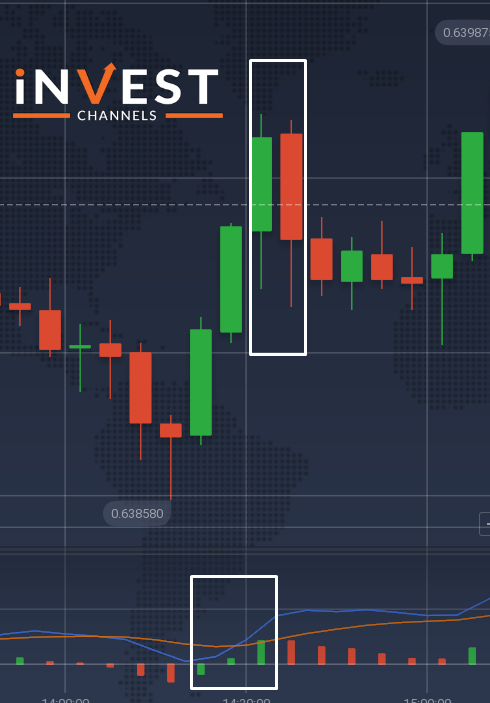

1. The Bearish Engulfing Pattern

This pattern suggests a possible shift from a bullish to a bearish trend. It tells you that buyers (bulls) are losing momentum, and sellers (bears) are taking control.

How to identify this pattern?

Picture a market in an uptrend. Suddenly, you see a green candlestick, followed by a red one that completely engulfs the previous candle. This is the Bearish Engulfing pattern!

- First candle: A green candle showing upward movement.

- Second candle: A red candle opening higher but closing lower than the first, fully engulfing it.

How to trade the Bearish Engulfing Pattern?

Here are some tips to use this powerful candlestick pattern for binary options:

- Wait for confirmation: Use secondary indicators like MACD or Stochastic Oscillator to confirm the trend change.

- Take early profits: If you have open long positions, consider closing some of them in profit before the trend reverses.

With the Bearish Engulfing Pattern, you can enhance your day trading or swing trading strategy by anticipating reversals.

2. The Shooting Star Candle Pattern

A Shooting Star candle shows that buyers pushed the price up, but sellers took over by the close, causing the price to end near its low. This signals that the uptrend might be weakening.

How to identify it?

If you’re watching an asset rise, and a candlestick forms with a small body near the low and a long upper shadow, that’s a Shooting Star — a sign that a reversal might be on the way.

- Small body: Near the candle’s low.

- Long upper shadow: At least twice the length of the body.

- Little to no lower shadow: The body sits at the lower end of the range.

Due to its unique shape, the Shooting Star is considered one of the best candlestick patterns for binary options and day trading.

Trading tips:

- Wait for confirmation: Ensure the next candle confirms the reversal by closing lower.

- Don’t confuse it with the Inverted Hammer: Though both have long upper shadows, a Shooting Star occurs after a price advance, while an Inverted Hammer occurs after a decline.

- Short selling: If confirmed, it may be time to consider short selling.

- Volume matters: High volume during the Shooting Star formation strengthens the signal. You can enable the Volume widget on platforms like IQ Option for better analysis.

3. The Triangle Pattern

There are three types of triangles: Ascending, Descending, and Symmetrical. In all cases, the pattern is formed by converging trend lines, and their difference lies in how these lines come together.

Ascending (Bullish) Triangle

Picture a rising support line meeting a horizontal resistance line. This indicates that prices will likely continue rising after a brief pause in the bullish trend. A buy signal occurs when the price breaks above the resistance.

Trading tips:

- Ensure you have at least two higher lows to confirm the structure.

- Enter a trade once the price breaks above the resistance.

- Place your Stop Loss at one of the previous lows, depending on your risk tolerance.

Descending (Bearish) Triangle

Imagine flipping the ascending triangle upside down. You’ll get a descending resistance line meeting a horizontal support line. This signals a bearish continuation, often leading to price drops once support is broken.

Trading tips:

- Make sure you have at least two lower highs to confirm the structure.

- Enter a trade once the price breaks below the support line.

- Place your Stop Loss at a previous high.

Symmetrical Triangle

The symmetrical triangle forms when both support and resistance lines slope towards each other, forming a cone shape. This pattern doesn’t predict direction but suggests a significant move is coming. Traders often wait for the breakout, whether up or down.

This pattern is often driven by events such as key economic data or earnings reports, so identifying potential catalysts can help in trading.

Conclusion

We’ve explored three reliable candlestick patterns: the Bearish Engulfing, the Shooting Star, and Triangles. The Bearish Engulfing suggests a potential bearish reversal, the Shooting Star indicates a possible peak in an uptrend, and Triangle patterns signal a continuation or early reversal of a trend. Whether you’re into binary options, day trading, or swing trading, these patterns are essential tools for your trading strategy.

Top 5 Trending

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]

The Psychological Line (PSY) Indicator is a versatile, oscillator-type trading tool that compares the number of periods with positive price… [Read More]

Have you ever felt like your trading approach could benefit from a little extra energy? That’s where the Relative Vigor… [Read More]