Commodity trading transforms everyday essentials like oil, gold, and agricultural products into investment assets. This dynamic market is influenced by global events, supply-demand shifts, and economic trends. Let’s dive into the essentials of trading commodities and what factors affect their prices.

Understanding Commodities

Commodities are raw materials fueling the world. Think of gasoline powering cars, wheat for bread, or gold in jewelry—these assets can be traded like stocks or currencies. Profits are made by predicting price movements accurately.

What Are Commodity CFDs?

Commodity CFDs (Contracts for Difference) allow you to trade price fluctuations without owning physical commodities, like barrels of oil or bushels of wheat. On IQ Option, you can go long or short, profiting whether prices rise or fall. There’s no need to manage commodity exchanges (e.g., CME, ICE, NYMEX) as you’re merely speculating on price shifts.

Key Commodity Types

- Metals: Gold, silver, copper, and platinum are popular, with gold traditionally seen as a safe haven. Its demand also grows with technology’s need for rare earth metals in smartphones, EV batteries, and more.

- Energy: Oil, natural gas, and gasoline anchor energy commodities. With shrinking oil reserves and rising renewables, energy markets fluctuate with broader economic and tech shifts.

- Agriculture: Corn, soybeans, wheat, and coffee form agriculture’s backbone. As populations grow and arable land limits, these commodities may rise as demand outpaces supply.

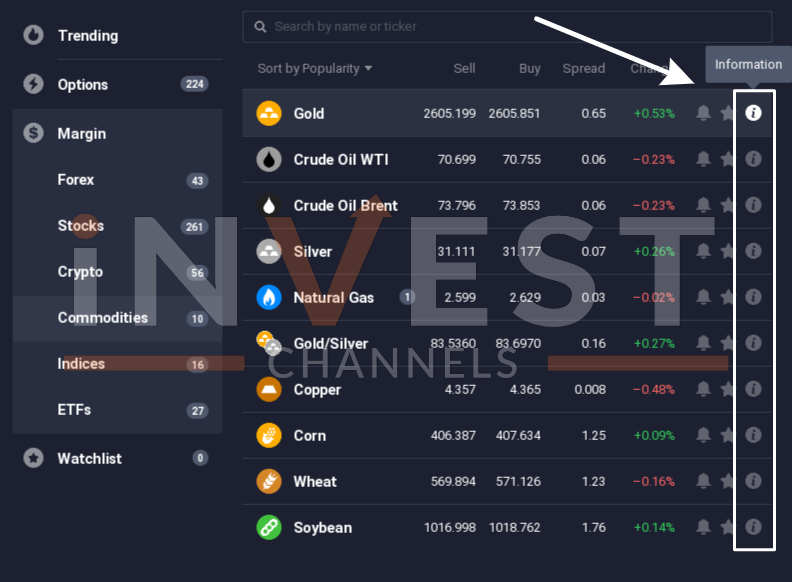

What Commodities Can You Trade on IQ Option?

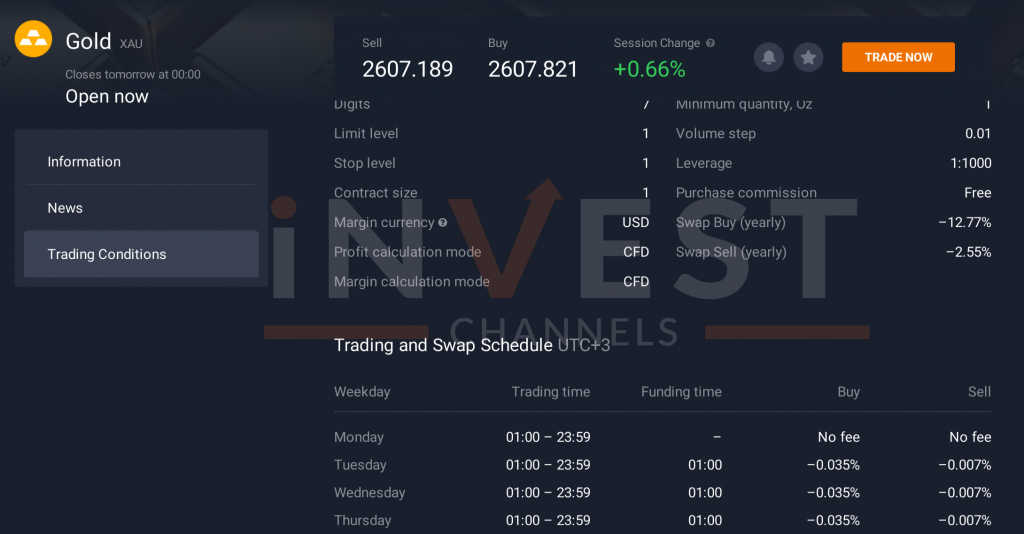

IQ Option offers a wide range of commodities, from oil to precious metals. You can even trade gold options or the gold/silver pair on weekends via OTC trading, making it easy to leverage after-hours opportunities. Check trading hours by selecting the “Info” tab to view specific conditions and asset insights.

Wondering what time do commodities start trading on the IQ Option platform? Check the trading hours by clicking on the ‘Info’ tab to view specific trading conditions.

Here’s where you can check detailed information about specific assets and get additional insights to improve your strategy.

What are the Key Drivers of Commodity Prices?

Understanding what moves commodity prices is crucial for trading.

| Costs: Logistics like transport, storage, and insurance impact pricing. | Currency Fluctuations: Since most commodities are priced in U.S. dollars, a weaker dollar can boost demand globally. | Geopolitical Instability: Wars, unrest, or sanctions can drive up commodity prices by disrupting supply. |

| Economic Trends: Strong economies spur demand for raw materials, while recessions reduce it. | Government Policies: Tariffs, subsidies, and regulations influence supply and demand. | Inflation & Interest Rates: Commodities often hedge against inflation, so higher inflation usually raises commodity prices. |

| Speculation: Traders’ bets on future prices affect current pricing. | Tech Advances: Innovations can make commodities cheaper to produce or open new demand markets, like lithium in EV batteries. | Weather Events: Natural disasters heavily impact agricultural and energy commodities. |

Tools for Trading Commodities on IQ Option

Mastering commodity trading starts with solid market analysis. IQ Option supports two types: technical and fundamental, each with different tools.

1. Technical Indicators

With over 100 indicators, IQ Option helps analyze price charts. Popular ones include Moving Averages, RSI, and MACD. The Commodity Channel Index (CCI) is a standout:

- Bullish Trend: CCI above 0 and nearing 100 signals an uptrend.

- Bearish Trend: CCI below 0 and nearing -100 signals a downtrend.

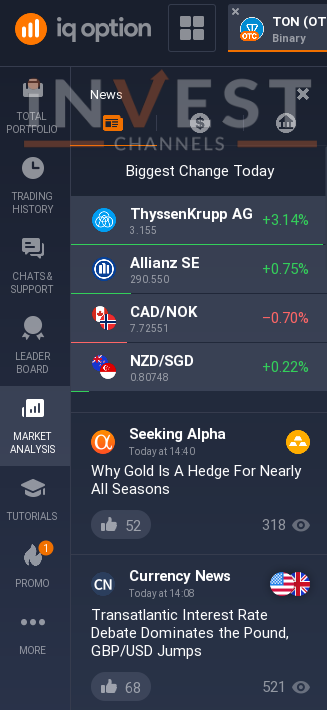

2. Newsfeed

Stay informed about global events via IQ Option’s newsfeed, focusing on influential reports like U.S. Non-Farm Payrolls, CPI, and oil inventories.

You can find the latest news in the ‘Market Analysis’ section of the IQ Option traderoom in the left menu.

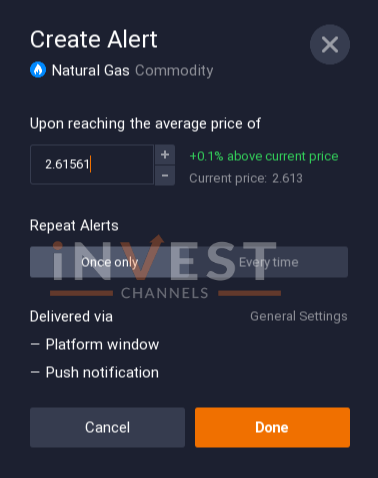

3. Price Alerts

Set price alerts to track targets without monitoring constantly. You’ll be notified if prices reach your specified level.

Click on the bell below the asset title in the traderoom.

Then type in the price you’d like to be notified about. You’ll receive an alert via the platform or a push if the price reaches this new level.

Choosing the Best Commodities to Trade

The best commodity depends on current market trends and your strategy. Gold and oil are go-to choices for liquidity and volatility, while agricultural commodities like corn and soybeans can yield returns during specific seasons. Metals such as silver and copper have gained appeal due to tech demand.

Conclusion

Learning to trade commodities on IQ Option involves understanding price drivers and using the right tools to make informed trades. Whether you’re speculating on oil, following tech metals, or predicting agricultural demand, IQ Option provides the resources and platform to explore top commodities for trading.

Top 5 Trending

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]

The Psychological Line (PSY) Indicator is a versatile, oscillator-type trading tool that compares the number of periods with positive price… [Read More]

Have you ever felt like your trading approach could benefit from a little extra energy? That’s where the Relative Vigor… [Read More]