Trading indices is more than just a financial pursuit; it’s both an art and science, demanding attention to detail, a grasp of economic indicators, and the capacity to anticipate market trends.

This guide dives into the complexities of index trading, beginning with a clear explanation of what an index is. We’ll explore methods to trade indices on IQ Option, compare trading strategies for indices vs. stocks, and answer common questions that many traders have about trading indices.

Some of the questions addressed include: What is the US 30? Are stocks a better choice than indices? When is the best time to trade indices? Let’s get started!

Understanding an Index in Trading

An index in trading is a tool that tracks the performance of a group of assets, providing insight into market trends and overall movements.

Indices can be broad-based, covering a large scope of major stocks, or specialized, focusing on specific segments, like small-cap stocks. This allows traders to gain exposure to an entire sector or industry through a single position.

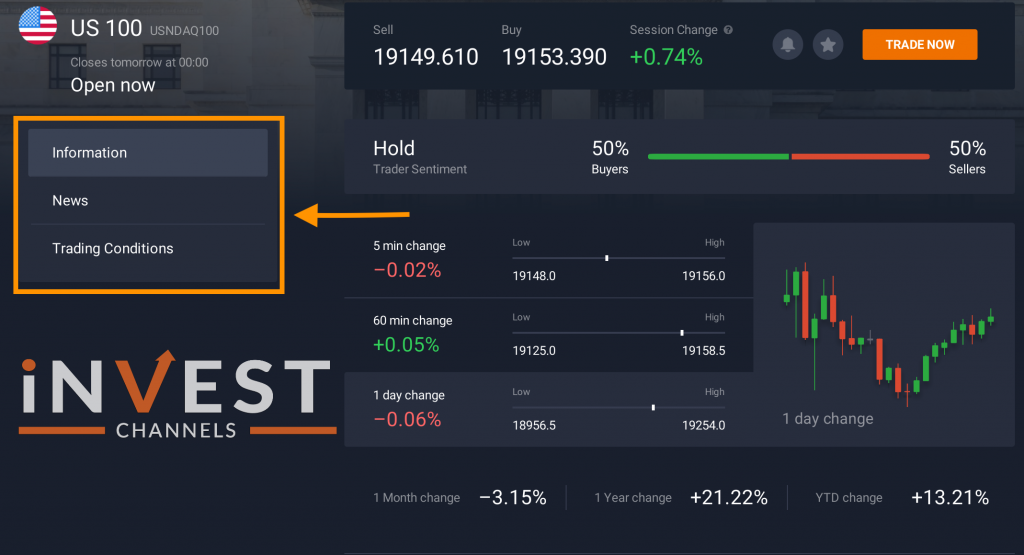

The IQ Option platform offers a range of indices, each providing access to different market areas. For instance, the US 100 is often viewed as a critical benchmark for the American stock market, as it tracks the largest 100 liquid companies listed on the NASDAQ.

So, what about the US 30? This index reflects the performance of 30 prominent U.S. companies.

IQ Option’s platform allows users to explore each index further, reviewing recent price changes, related news, and trading conditions for each one.

You might also come across a mini-index term. Mini-indices represent a subset within a larger index, typically focusing on a particular sector. For example, a mini-index could specifically track technology stocks within a broader index.

Some traders may ask, “What does each point on the mini-index represent?” The answer varies, as it’s tied to the price of the larger index it’s tracking. It’s essential to understand this relationship between a mini-index and its parent index.

Mini-indices are less common on platforms like IQ Option because they demand more detailed analysis due to their narrower focus. At present, mini-indices aren’t available on the IQ Option platform.

Types of Indices

Several types of indices cater to different asset classes and strategies. Stock indices, for instance, measure a collection of stocks, while commodity indices track commodity prices, like those for gold, silver, and oil. Meanwhile, currency indices focus on currency prices. The US Dollar Index (DXY), for example, measures the value of the U.S. dollar against major global currencies and serves as an essential indicator of currency strength.

Each index type offers unique insights and fits various trading strategies, helping traders to tailor their approach based on market conditions and individual goals.

Trading Indices on IQ Option: Key Strategies

IQ Option offers several strategies for trading indices. Here are some effective approaches you may find useful:

Day Trading

Day trading involves opening and closing positions within the same day to avoid overnight risks and fees. This method relies on capturing small price changes over a short period and requires close monitoring of the market.

Day traders often follow economic or geopolitical news to understand short-term trends and make timely buy or sell decisions. The goal is to make quick, moderate profits by reacting to immediate market events.

Trend Trading

Trend trading capitalizes on the general direction in which an index price moves over time. Traders use technical analysis tools to identify whether the price is likely to keep moving in the same direction or reverse.

This method allows traders to buy or sell based on the expectation of trend continuation or reversal, making it suitable for those looking to identify the best indices for potentially profitable trades.

Position Trading

Position trading focuses on the long-term movement of an index. This strategy involves holding positions for longer durations, from weeks to even months, to benefit from broader market trends.

Position traders may enter and exit positions based on key economic events or reports, with the goal of achieving larger profits from substantial market movements. While this strategy involves fewer trades, the extended holding period also presents increased risk.

Factors Influencing Index Prices

Understanding what affects index prices is crucial to successful trading. Here are some primary factors that drive index movements and how they can impact the market:

| Factor | Description | Potential Impact on Index Prices |

| Economic News | Central bank announcements, interest rates, inflation, etc. | Impacts investor sentiment, potentially creating market volatility and price changes. |

| Corporate Reports | Earnings detailing company profits, losses, future guidance | Can significantly influence stock prices within an index, changing its overall value. |

| Company Announcements | Events like management changes, mergers | May cause individual stock fluctuations, affecting the broader index, either positively or negatively. |

| Currency Fluctuations | Exchange rates impacting companies’ foreign revenue | Can alter stock prices and the index value due to changes in currency strength and revenue impact. |

| Geopolitical Events | Political instability, trade agreements, elections | Often leads to market volatility, causing shifts in index prices based on sentiment. |

| Changes in Index Composition | Rebalancing, adding or removing assets from an index | Adjustments can shift index prices as traders realign their positions with the new composition. |

| Investor Sentiment | The collective mood influenced by news and company performance | Bullish sentiment can drive index prices up, while bearish sentiment can lead to a drop in values. |

Common Questions About Index Trading on IQ Option

Can You Trade Indices on Weekends?

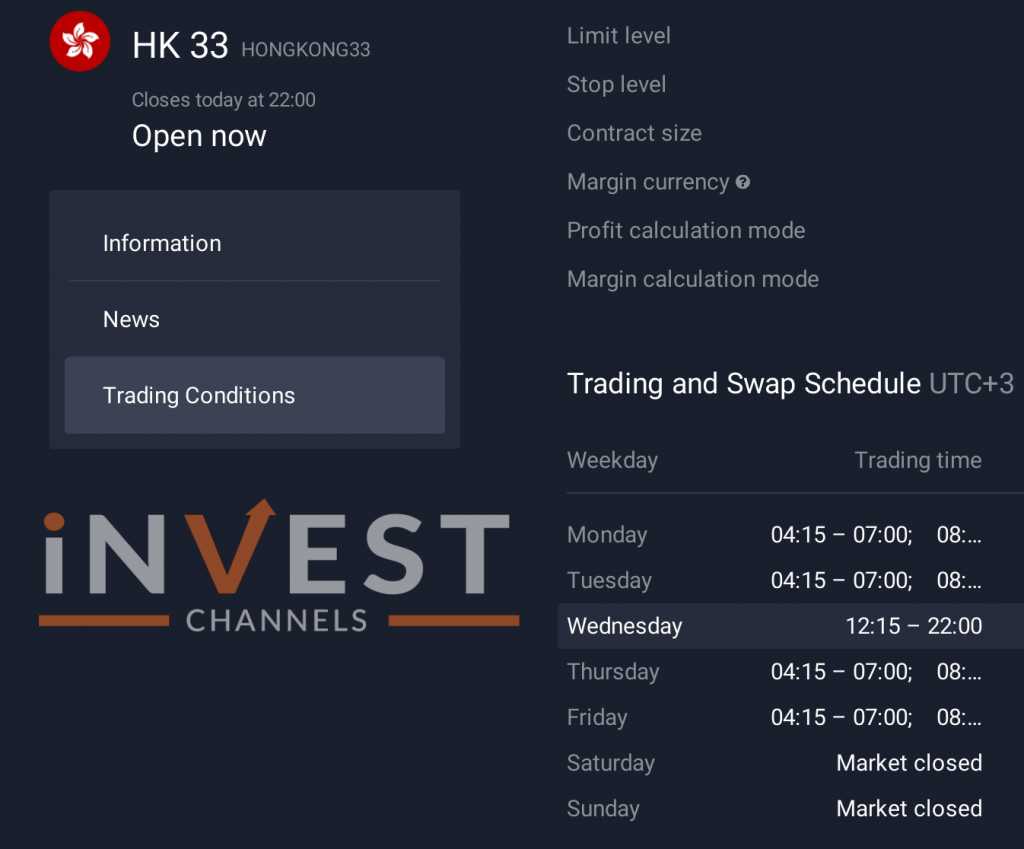

On IQ Option, indices are only available for trading on weekdays, from Monday to Friday. This means indices cannot be traded over the weekend. Some indices may have specific trading hours, so it’s essential to review each one’s schedule. You can access this information by selecting the “Info” tab on the asset page, followed by the “Trading Conditions” tab on the left side.

How to Set Price Alerts on IQ Option?

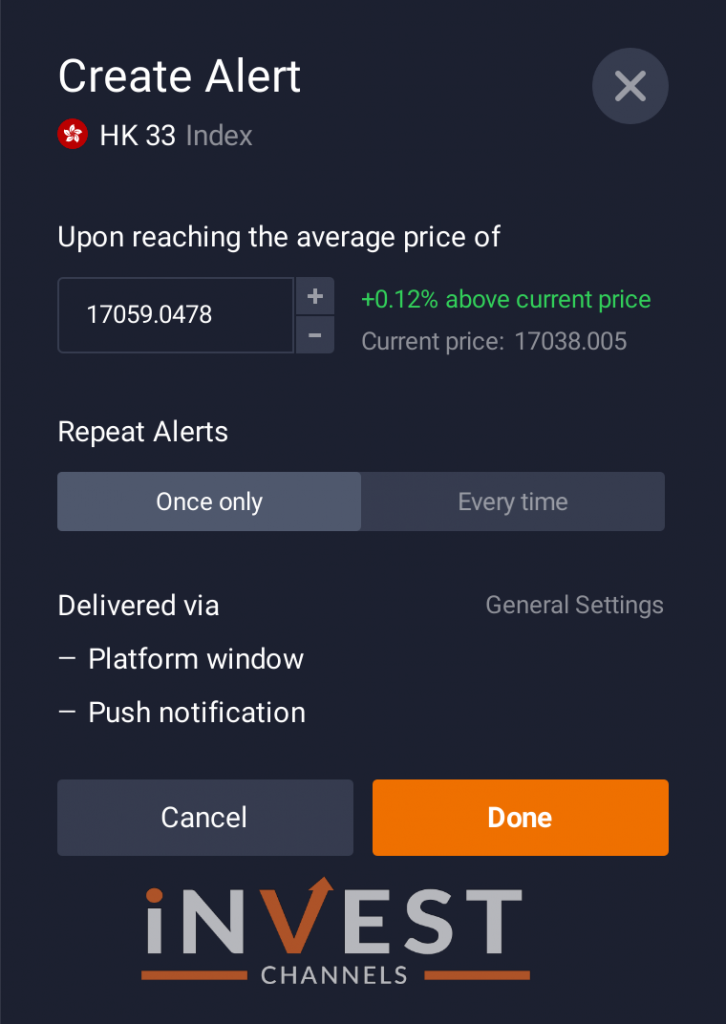

To streamline your trading, IQ Option allows you to set alerts for specific assets. This feature notifies you when the asset reaches a specified price, so you don’t have to monitor price changes constantly.

You can choose the price level you want to be alerted about and the frequency of alerts, making it easier to stay on top of market movements.

IQ Option’s platform also includes various features to help save time and improve trading efficiency. For more details, check out their material on IQ Option Traderoom: Top Features You Need to Know.

Indices vs. Stocks: Which Is Better?

When deciding between trading indices and individual stocks, it’s essential to consider key distinctions, as each offers unique benefits and risks. Here’s a breakdown:

| Aspect | Stock Trading | Index Trading |

| Exposure | Focuses on specific companies, offering no diversification. | Provides diversification by covering a range of assets in a single position. |

| Volatility | Can be high due to company-specific news and events. | Generally stable but can be volatile during major economic events. |

| Risk | Higher risk; if a company fails, its stock value declines. | Lower risk due to diversification; failing companies are often replaced. |

Getting Started with Indices Trading on IQ Option

If you’re ready to start trading indices on IQ Option, consider using their free demo account, loaded with $10,000 in virtual funds. Practicing with a demo account helps you refine your strategies before trading with real money. To succeed in index trading, avoid common beginner mistakes, keep learning, and experiment with various tools and techniques.

In conclusion, trading indices on IQ Option offers diversified exposure and multiple strategies tailored to different trader profiles. Whether you prefer day trading, trend trading, or position trading, a solid understanding of index fundamentals and market factors can set you on the path to making informed, strategic trades.

Top 5 Trending

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]

The Psychological Line (PSY) Indicator is a versatile, oscillator-type trading tool that compares the number of periods with positive price… [Read More]

Have you ever felt like your trading approach could benefit from a little extra energy? That’s where the Relative Vigor… [Read More]