Can’t wait for the markets to reopen on Monday? Whether your weekdays are packed or you want to trade on weekends, OTC (over-the-counter) trading might be just what you’re looking for. This unique trading option lets you explore exclusive opportunities and trade during non-standard hours.

Let’s take a closer look at OTC trading and how it can become your go-to strategy for after-hours trades.

What is the OTC Market?

OTC stands for “over-the-counter,” which simply means you’re not following the typical, highly regulated market structure. Unlike traditional exchanges that run on tight schedules, OTC trading allows transactions to take place directly between traders and brokers, without going through a public exchange. This flexibility lets you trade outside regular market hours, potentially offering rare trading opportunities.

Key Conditions in OTC Trading

Because OTC trading deals are private, they often come with unique price quotes that aren’t publicly available. These quotes are influenced by multiple factors, such as weekday trading session trends, the number of options bought, and investment values.

This means that, as an OTC trader, you might gain access to distinctive opportunities that are off-limits during regular market hours. However, it’s worth noting that with this flexibility comes the need for caution: weekend and after-hours markets can be more volatile. OTC assets can also lack liquidity, potentially leading to longer execution times and wider spreads between bid and ask prices.

Available OTC Assets on IQ Option

The IQ Option platform allows traders to engage with a variety of OTC assets, offering options that range from Forex currency pairs to stocks, cryptocurrencies, and indices.

Here are the types of OTC assets you can expect to find:

OTC Currency Pairs (Forex):

| USD/JPY |

| GBP/JPY |

| USD/MXN |

Cryptocurrency OTC:

| Bitcoin Cash | Polkadot | Beam | Celestia |

| Dash | TON | Dogwifhat | Graph |

| Pepe | Cosmos | Stacks | Pyth |

| NOT | Injective | Floki | ORDI |

| IOTA | Gala | ICP | Polygon |

| Sandbox | Decentraland | NEAR | Arbitrum |

| 1000Sats | Immutable | Worldcoin | Jupiter |

| Chainlink | Ronin | I know | Bonk |

OTC Stocks and Commodities:

| Amazon/Alibaba | Netflix/Amazon |

| Amazon/Ebay | Tesla/Ford |

| Alphabet/Microsoft | Intel/IBM |

| Microsoft/Apple | Meta/Alphabet |

| Nvidia/AMD | Gold/Silver |

OTC Indices:

| US500 | EU50 | HK33 | US30/JP225 |

| US100 | JP225 | GER30 | US100/JP225 |

| US30 | AUS200 | SP35 | US500/JP225 |

| UK100 | FR40 | GER30/UK100 |

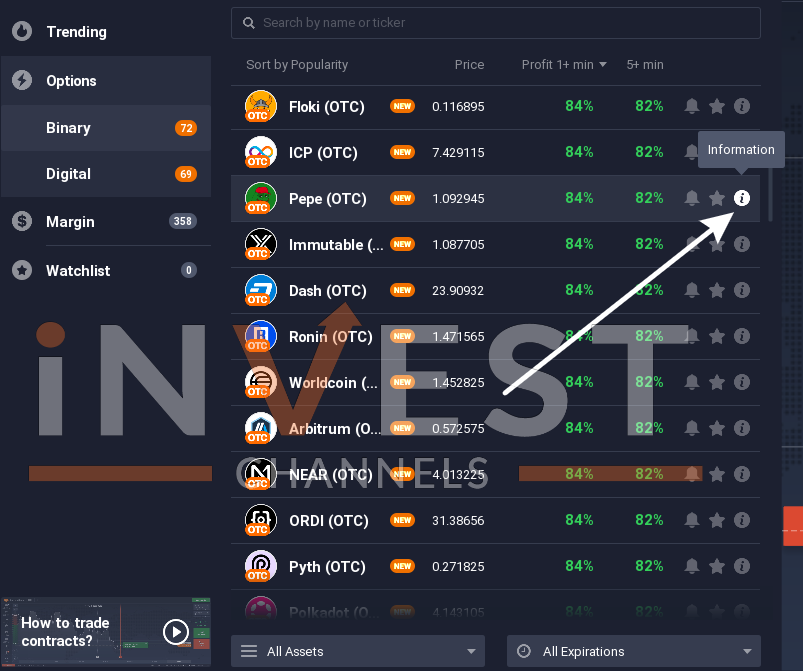

Each of these assets is marked with an “OTC” label on IQ Option, making it easy to identify them for after-hours trading.

How to choose an asset for OTC trading

Your asset choice will depend on your trading style and risk tolerance:

- For those who embrace volatility: OTC cryptocurrency trading is ideal. Crypto markets are active around the clock, providing endless trading opportunities.

- For those who value stability: Forex pairs and major indices are generally less volatile and may offer more predictable patterns outside regular trading hours.

- For those who like variety: You can explore stocks matchups, such as Amazon versus Alibaba, to speculate on the relative performance of two industry giants.

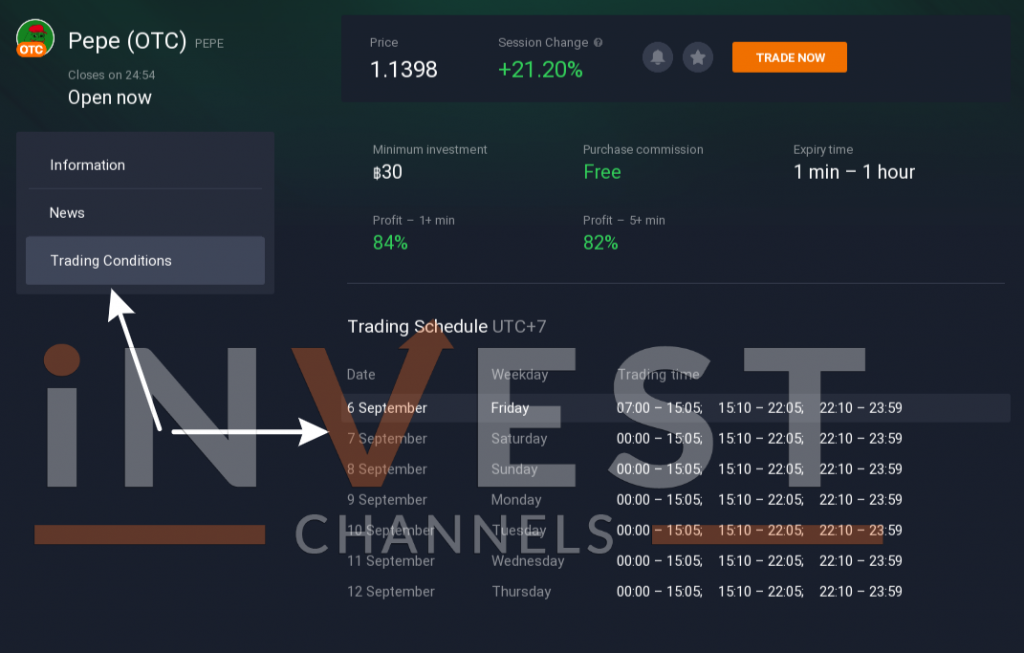

Whatever your choice, make sure you’re aware of the trading hours specific to each asset on the IQ Option platform by clicking on the “i” icon next to the asset in the selector and checking the Trading Conditions section.

Effective Indicators for OTC Trading

When trading OTC assets, you can apply many of the indicators and strategies you’d normally use. However, remember that the OTC market can behave differently during off hours, so it’s wise to use multiple indicators. For instance, you might try blending Moving Average (MA) and Commodity Channel Index (CCI) indicators for a balanced strategy.

Essential OTC Trading Tips

To make the most of OTC trading, keep these tips in mind:

- Start with smaller trades. The OTC market can be unpredictable, so it’s best to ease in with smaller amounts before committing more funds.

- Stay informed. Keep up with market news and updates, as significant events can have a heightened impact on OTC trades.

- Double-check the schedule. Ensure you know when the assets you’re interested in will be available on IQ Option.

- Avoid overtrading. Just because you can trade around the clock doesn’t mean you always should. Be strategic in your choices.

In Conclusion

OTC trading on IQ Option provides a flexible way to trade outside standard market hours, making it a great option for those with packed schedules or a preference for weekend trading. Offering access to Forex pairs, cryptocurrencies, stocks, commodities, and indices, the OTC market brings unique opportunities.

However, with its higher potential for volatility and limited liquidity, OTC trading requires a cautious approach. Start with smaller trades, stay updated on market trends, and use diverse indicators to optimize your strategy. By following these best practices, you can unlock the potential of OTC trading while managing your risks effectively.

Top 5 Trending

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]

The Psychological Line (PSY) Indicator is a versatile, oscillator-type trading tool that compares the number of periods with positive price… [Read More]

Have you ever felt like your trading approach could benefit from a little extra energy? That’s where the Relative Vigor… [Read More]