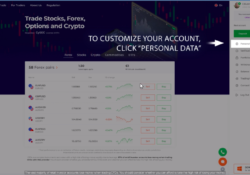

A Complete Guide to Trading Indices on IQ Option

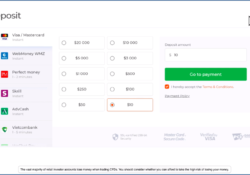

Trading indices is more than just a financial pursuit; it’s both an art and science, demanding attention to detail, a grasp of economic indicators, and the capacity to anticipate market trends. This guide dives into the complexities of index trading, beginning with a clear explanation of what an index is. Continue Reading