Bollinger bands are also known as ”B Bands”

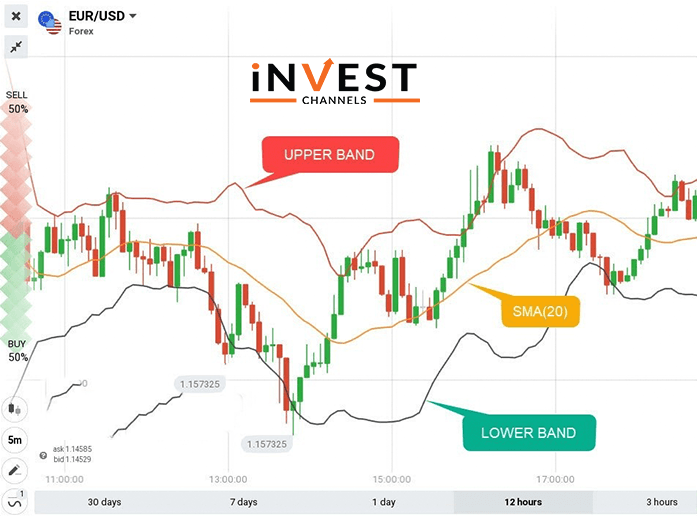

Bollinger bands are used to measure volatility relative to the moving average. They consist of two lines that run on either side of a 20 simple moving average. As the gap between the bands widens, the higher the volatility and vice-versa.

In this guide, I’ll teach you, how to set up Bollinger Bands on the IQ Option platform. Next, I’ll show you how to read Bollinger Bands to determine the best trade entry points.

Bollinger Bands Indicator overview

Bollinger Bands are created by two bands (lines) that run on either side of an SMA20 line. This indicator is used to measure market volatility. As such, they can be used to help you predict the best trade entry points.

The three lines of the Bollinger Bands indicator are as follows:

The upper band is equal to the SMA20 added to twice the 20-day standard deviation of the price.

The lower band is equal to the SMA20 minus twice the 20-day standard deviation of the price.

The middle band is the 20-day simple moving average.

Setting up the Bollinger Bands indicator on IQ Option

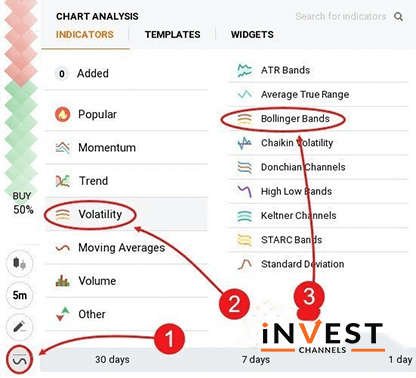

After logging into your trading account and setting up your chart, click on the indicators feature ad select volatility. Next, select Bollinger bands.

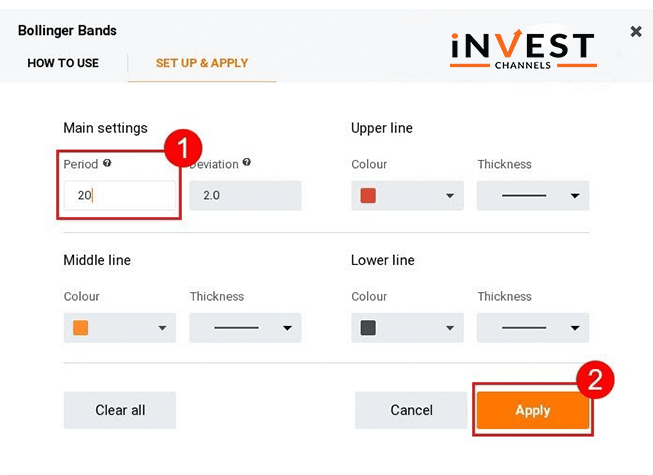

Click on the Setup and apply tab on the Bollinger bands window.

Set the period to 20. Finally, click Apply to save the changes.

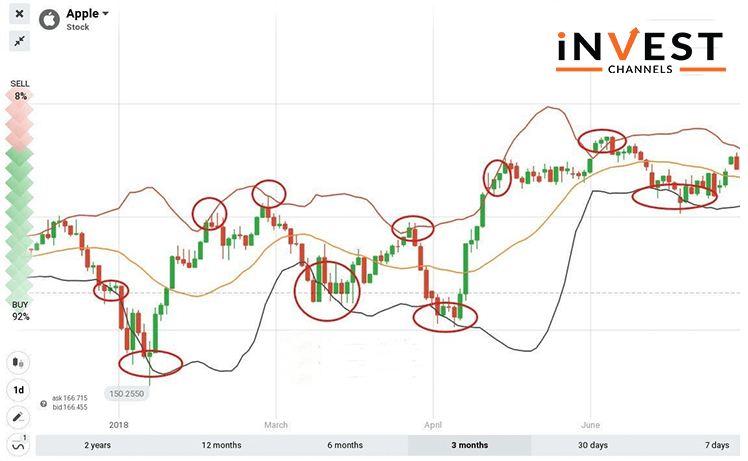

Trading using Bollinger Bands on IQ Option

Whenever the price touches either the top or bottom band and starts falling, enter a short sell position. Conversely, if the price touches either the upper or lower band and starts rising, enter a short buy position.

Now that you’ve learned how to trade Bollinger Bands on IQ Option, go ahead and try this indicator on your IQ Option trading account. Please share your findings in the comments section below.

Good luck

Top 5 Trending

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]

The Psychological Line (PSY) Indicator is a versatile, oscillator-type trading tool that compares the number of periods with positive price… [Read More]

Have you ever felt like your trading approach could benefit from a little extra energy? That’s where the Relative Vigor… [Read More]