One of the advantages of using candlestick charts is that they can be used alongside many different technical indicators. In this guide, I’ll teach you how to use Bollinger Bands alongside support and resistance levels to trade on the IQ Option platform. This trading strategy is used to trade trend reversals. Let’s get started.

What must you know first?

Before trading using Bollinger Bands and support/resistance on IQ Option, you must have some prior knowledge about these two technical indicators. I have created detailed guides which cover them.

The Guide to trading using Bollinger Bands on IQ Option will get you started with the Bollinger Bands indicator. Next, you can read the Guide to Trading using Support and Resistance on IQ Option.

As a bonus, you should also read the Guide for trading using Candles on IQ Option. Now that you’ve read the three guides, let’s start trading using Bollinger Bands alongside support and resistance on the IQ Option platform.

Guidelines for trading using Bollinger Bands alongside Support and Resistance

The first thing to do is to select one currency pair. I usually use the EUR/USD pair to trade. Second, trade a specific time frame. You should choose to trade on specific days and at specific time intervals.

This is when your chosen currency pair doesn’t have a lot of volatility making it easier to follow market movements. Third, I’ll trade 1-minute candles and trades will also last 1 minute only.

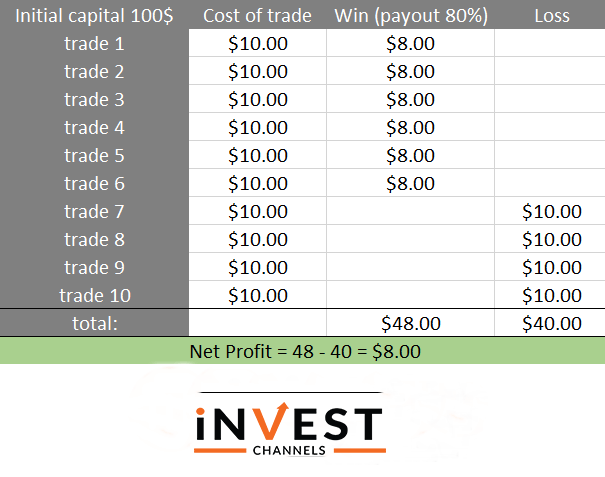

Finally, I’ll employ a simple money management strategy. Each trade will have a $10 investment. The expected return per trade is 80%. Here’s a chart showing my money management strategy.

When using the Bollinger Bands alongside Support and Resistance, I’ll only enter a trade when the trend reverses. The following rules will apply. Enter a buy order: When the price falls below the lower band on a downtrend and breaks out of the support level.

This is signalled by a long bearish candle that breaks the support. It’s followed by a long bullish candle. Once the price breaks the support on the bearish candle, I’ll immediately enter a buy position lasting 1 minute.

Enter a sell order: When the price rises above the upper band on an uptrend and breaks out of the resistance. This is signalled by a long bullish candle followed by a long bearish candle. As soon as the price breaks the support and goes above the upper band, I’ll immediately enter a 1-minute sell position.

Steps for trading using Bollinger Bands and Support/Resistance on IQ Option

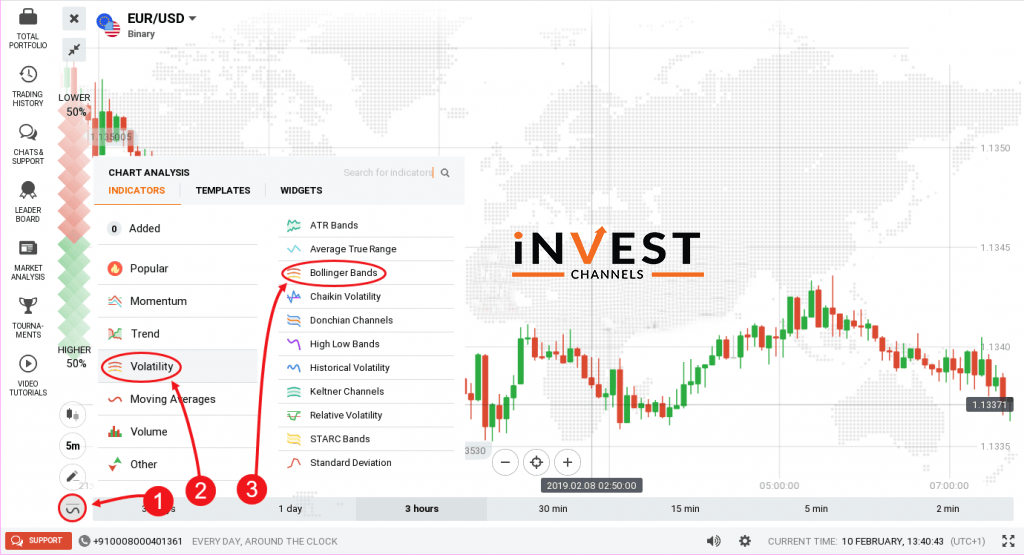

Set up the Bollinger Bands indicator on your 1-minute candles EUR/USD chart

After logging in to your IQ Option account, set up the EUR/USD candles chart with 1-minute intervals. Next, set up the Bollinger Bands indicator as follows: Click on the indicators feature and select volatility. Finally, select Bollinger Bands. To set up the support and resistance levels, use horizontal lines selected from the graphical tools feature on your IQ Option trading interface.

Focus on when the candle starts developing

In our trade entry rules above, you’ll only enter a buy or sell trade whenever the price breaks out above or below a support or resistance. In addition, the price should also break above or below the upper or lower bands. It’s therefore important that you look at where exactly this happens. As the next different coloured candle starts developing, enter your trade based on this candle colour. Your trades should last 1 minute.

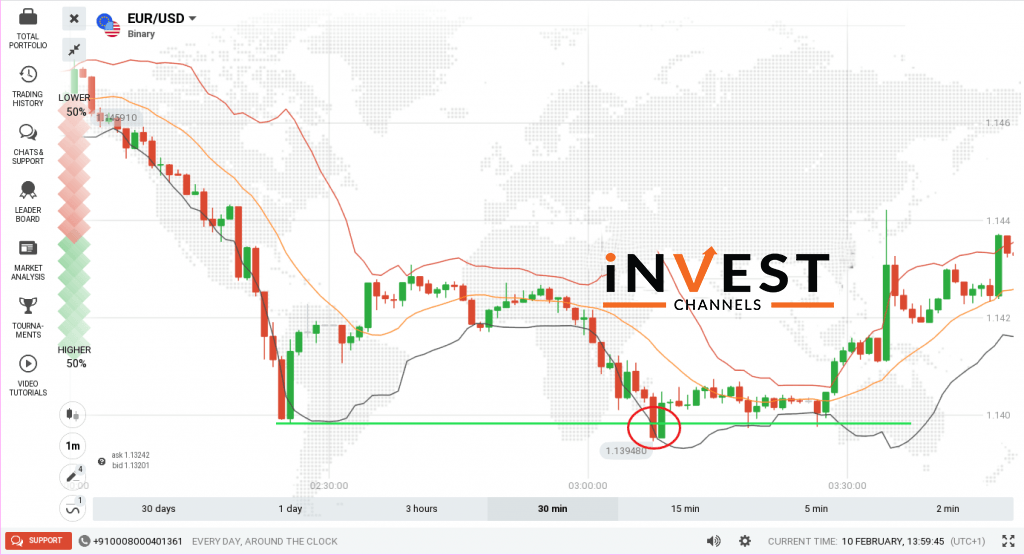

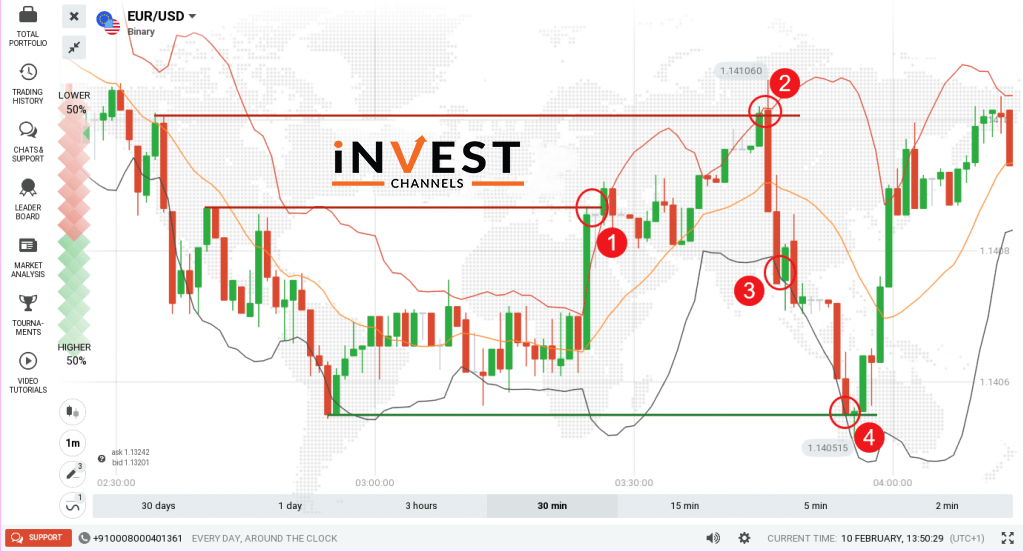

My trades as they occurred on 10 February on the IQ Option platform

From 12.00 to 14.00

During the first session, I saw 4 entry points. The first entry point showed a long bullish candle and I entered a sell order immediately after the bull candle ended. This trade lost because the uptrend wasn’t completely exhausted.

The second entry point occurred when the long bullish candle broke the upper resistance line. It also slightly broke the upper band. I immediately entered a 1-minute sell order. This was a winning trade. The third entry point occurred when the price fell under the lower band.

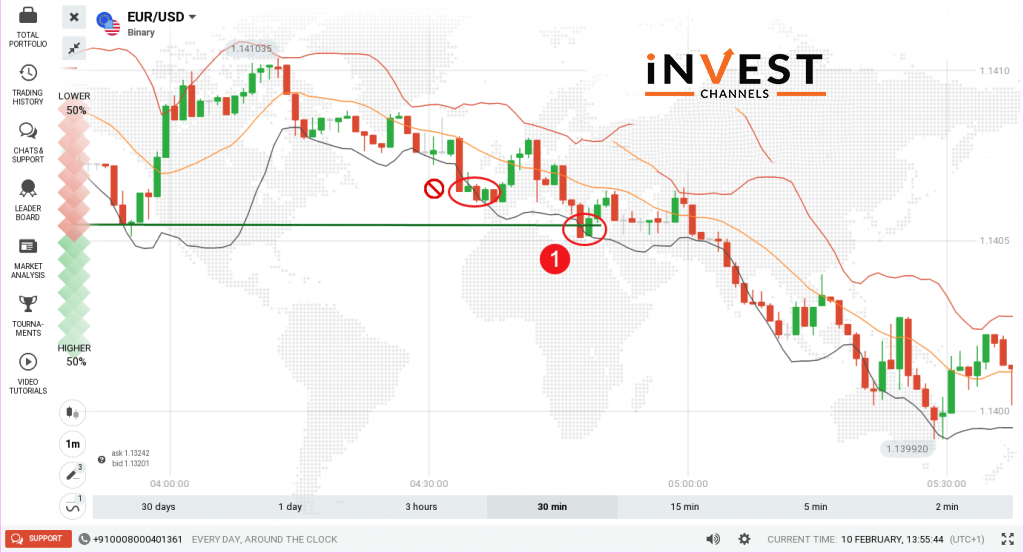

Notice I didn’t have a support level drawn here. But relying on the break under the lower band, I immediately entered a 1-minute buy position which was a winner. The fourth and final entry point occurred when the price also broke through the support. It also fell under the lower band. I entered a 1-minute buy order which was a winner. From 13.30 to 14.00

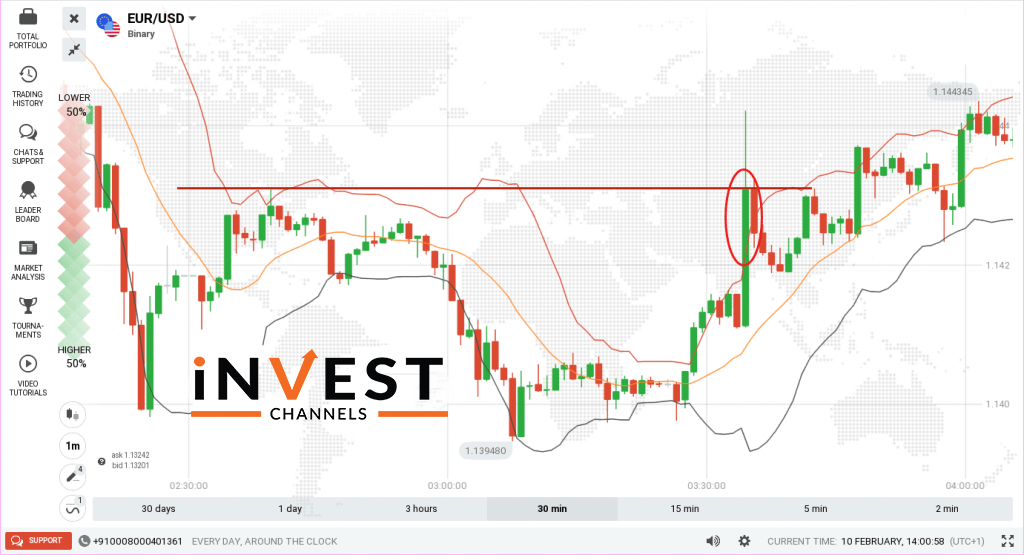

Before my 13.00 to 14.00 trading session ended, I found only 1 entry point. This was during the downtrend. Notice the first false entry point? Here, the prices fell below the lower band. However, the reversal was pretty minimal and I decided not to take the risk. The true entry point occurred where the price fell below the support and the lower band. Here, it was safe to enter a 1-minute buy position which turned out a winner.

An analysis of the effectiveness of this trading strategy

It’s hard to trade it with 1-minute intervals

Although I used 1-minute candles to trade in my examples, I usually recommend trading longer candle intervals (5 minutes or more). 1-minute intervals have too many fluctuations such that a 2-second fluctuation can result in a trade going against you. The 5 minute or longer intervals, however, makes it easy to spot possible entry points when using this strategy. 1-minute intervals, on the other hand, show more trend reversals per given session. That’s the only reason why I used it in my examples.

It works best when trading trend reversals

The objective of using Bollinger Bands alongside support and resistance is to identify possible trade entries where trend reversals occur. This makes it an efficient strategy for trading even when markets are affected by news items. All you need to analyze are the candle patterns.

In some instances, trend reversal doesn’t occur immediately or the reversal is too minimal to result in a winning trade. Remember my first trade? It, therefore, requires a bit of patience studying the price charts to identify the best trade entry points.

You will get very few trade entry points

At times, you’ll get several good entry points in a trading session. But in most instances, your entry points will be few and scattered. However, many of these will give the right signals resulting in winning trades.

Advantages of using Bollinger Bands alongside Support and Resistance to trade on IQ Option

High probability of winning trades

One thing that sets this strategy apart is that has a very high probability of winning trades. I recommend you test this out on your IQ Options practice account. The reason for this is that you’re essentially using 2 indicators alongside candles. In addition, you should only enter into a trading position when specific conditions are met.

High probability of winning trades

All you need to do is study the price charts, draw your support and resistance levels and wait for prices to cross these lines before entering a single trade.

A good strategy to build patience

Patience is one of the most essential skills every trader must develop. If you rely on this strategy to make money, you’re likely to spend hours waiting for the right conditions to present themselves. Once you’ve developed patience using this strategy, making money on IQ Option becomes quite easy.

Proper money management keeps your account healthy

If you look at my money management chart above, you’ll notice that my intention is to trade $10 on each trade. If I had $200 in my account, I’d have to get 20 consecutive losing trades for my account balance to become depleted. However, given the high winning odds of this strategy, it’s very unlikely that your account will become depleted.

As a beginner trader, your main goal should be ensuring that your account balance doesn’t drop beyond say 20%. Once you’ve managed to do this, your next goal should be to grow your account balance by a certain percentage every month. That’s how many successful traders manage to remain in the game.

Trade and make your own conclusions about trading Bollinger Bands alongside Support and Resistance

I used 1-minute candles to trade using this strategy on IQ Option. However, I advise you to use longer time frames to get better results. Start by trading on your IQ Options practice account. Make notes about how well or poorly this strategy fits in with your trading style.

Find the best time to trade a specific instrument. Practice sound money management techniques. Most of all, be patient and wait for the right conditions to present themselves.

Good luck!

Top 5 Trending

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]

The Psychological Line (PSY) Indicator is a versatile, oscillator-type trading tool that compares the number of periods with positive price… [Read More]

Have you ever felt like your trading approach could benefit from a little extra energy? That’s where the Relative Vigor… [Read More]