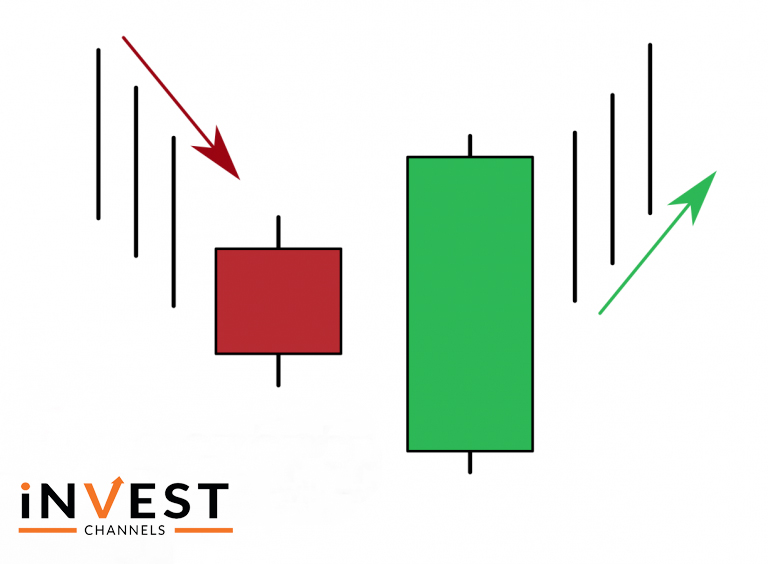

The bullish engulfing candle pattern is a trend reversal pattern. In particular, it develops at the end of a downtrend signalling a developing uptrend. It consists of a pair of candles.

The first candle is an orange bearish candle. On the IQ Option platform, it will have short wicks.

Right after this candle is a longer bullish (green candle). What’s special about this candle is that the opening and closing are both lower and higher than those of the previous bearish candle. Thus the engulfing bullish pattern means this candle completely engulfs the previous bearish candle.

How all this is interpreted

As the downtrend continues, the sellers are becoming exhausted. The small bearish candle at the end signals this. At the beginning of the next session, prices fall dramatically. But the buyers jump in driving the prices higher. At the end of this session, the trend reversed and started rising. This is a good time to enter a buy position to take advantage of the rising trend.

Using the bullish engulfing candle pattern on IQ Option

As mentioned, this is a trend reversal pattern that signals a change from a bearing trend to a bullish trend. This means that immediately after you spot this pattern, you must enter a buy trade.

Using the chart above, we have a 30 minute Japanese candle sticks chart with 5-minute candles. There are 3 bullish engulfing patterns. It’s worth noting that in this chart, the green candles don’t completely engulf the orange candles. Their opening prices are at almost the same level as the close of the orange candles. But what we’re looking for is whether the green candles’ closes are higher than those of the orange ones.

Now, when should you enter a buy position?

As the 5 minute green candle develops, wait until the price reaches the opening of the previous orange candle. Enter a 1 minute buy trade. This ensures that your trade will be a winner by the time the trade expires and the green candle ends. If you’re using candles of a longer time frame for example 30 minutes, you can enter longer buy positions lasting 5 minutes or more.

The only way to learn how to identify the bullish engulfing candle pattern is by actually trading. Open an IQ Option practice account today and start practising with it. We’d love to hear about your experiences in the comments section below.

Good luck.

Top 5 Trending

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]

The Psychological Line (PSY) Indicator is a versatile, oscillator-type trading tool that compares the number of periods with positive price… [Read More]

Have you ever felt like your trading approach could benefit from a little extra energy? That’s where the Relative Vigor… [Read More]