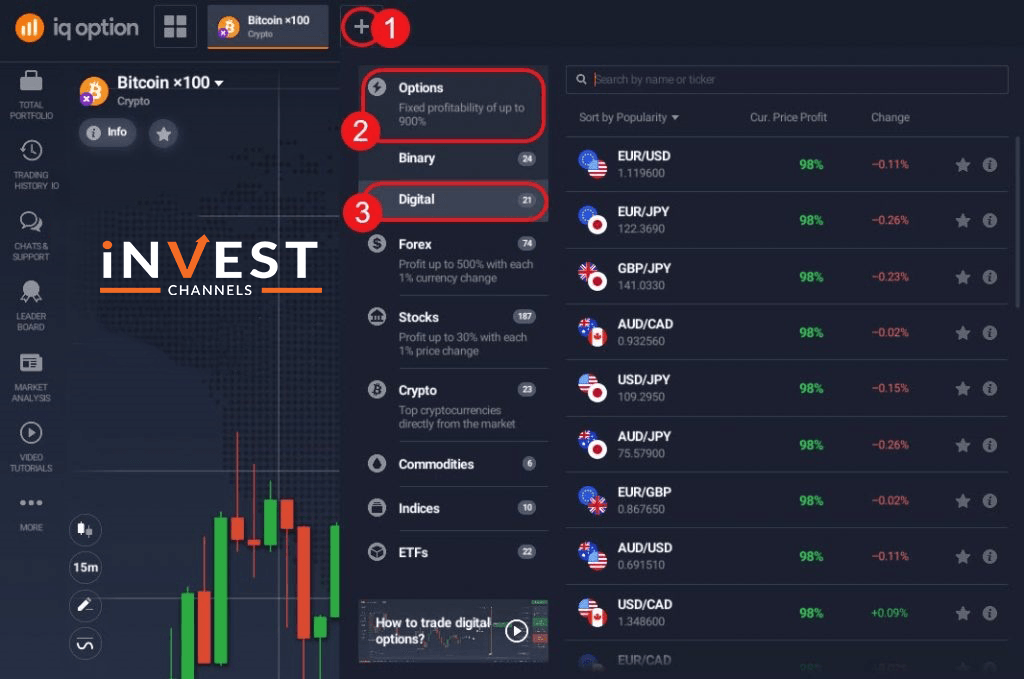

Choosing asset for a digital option

Select the asset which you like to trade from the list of trading instruments.

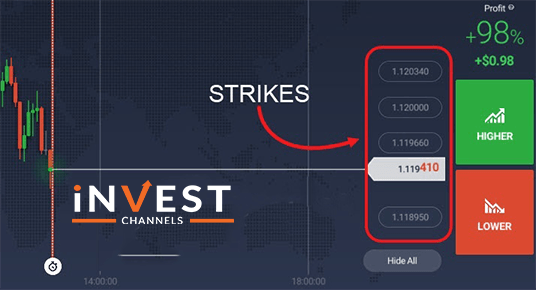

What are strikes in digital option

You will notice that the chart is followed by many parallel lines and those lines are called strikes. Target price levels that the market is supposed to either surpass or stay below.

Set your strike price that you think you can achieve and in real-time you will see the profitability for both call and put options change accordingly.

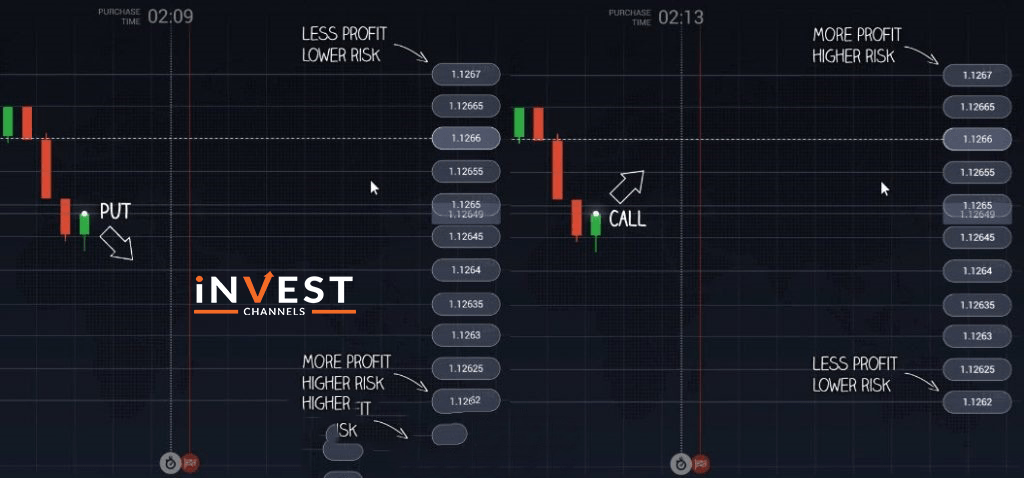

Keep in mind the more available the strike price the lower the profit is going to be and vice versa.

Profit potential with digital options

If the price of the underlying asset is moving firmly in your favour then the single digital option can generate up to 900% of the profit.

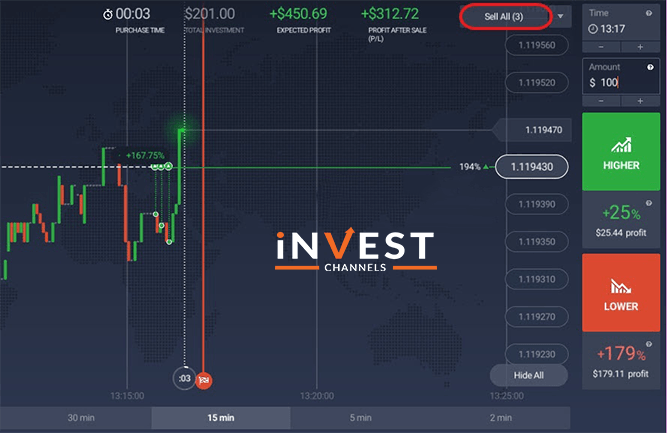

Selling digital option before expiration

You can secure your profit at any point and do not have to wait for the option to expire. Just click on sell the option. You will get more flexibility in managing the outcome.

At various strike prices, you can purchase multiple digital options of the same asset. This can give you the ability to experiment with different strategies to maximize profit and lower the risk.

Click here if you want to know the difference between Binary Option and Digital Options

We wish you a pleasant trading experience.

Top 5 Trending

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]

The Psychological Line (PSY) Indicator is a versatile, oscillator-type trading tool that compares the number of periods with positive price… [Read More]

Have you ever felt like your trading approach could benefit from a little extra energy? That’s where the Relative Vigor… [Read More]