There is 90 percent of people who lose their money while trading. According to reports, 80 per cent of traders end their trading just in the first two years of unsuccessful trading.

This is the bitter truth that trading is not that easy and as a trader you should know what you are doing and how it is performed. These things are very important to keep in mind to stick in the game for a long time.

Overbought and oversold levels are not reliable in the long term

Continue reading if you want to overcome your mistakes and want to learn some important lessons. I will share some insights into trading that I’ve learned with my experience. Firstly, the concept of overbought and oversold levels.

This is important to clear in your mind that overbought and oversold levels are not that reliable for the long term. Many people think that by this they can make a profit at least in one level which is no at all true.

At the initial stage of my trading, I read many books on overbought and oversold levels and took much advice on this. The important thing which I learned from book about overbought and oversold is that when the market reaches overboard levels it signifies that there are too many new buyers and the prices should go lower.

And if the market reaches oversold levels, it signifies that there are too many sellers and the prices should increase. I have lost a lot of money and after I realized that trading is not that tough as a market which is overbought and oversold does not signify that the market price will immediately reverse in the opposite direction.

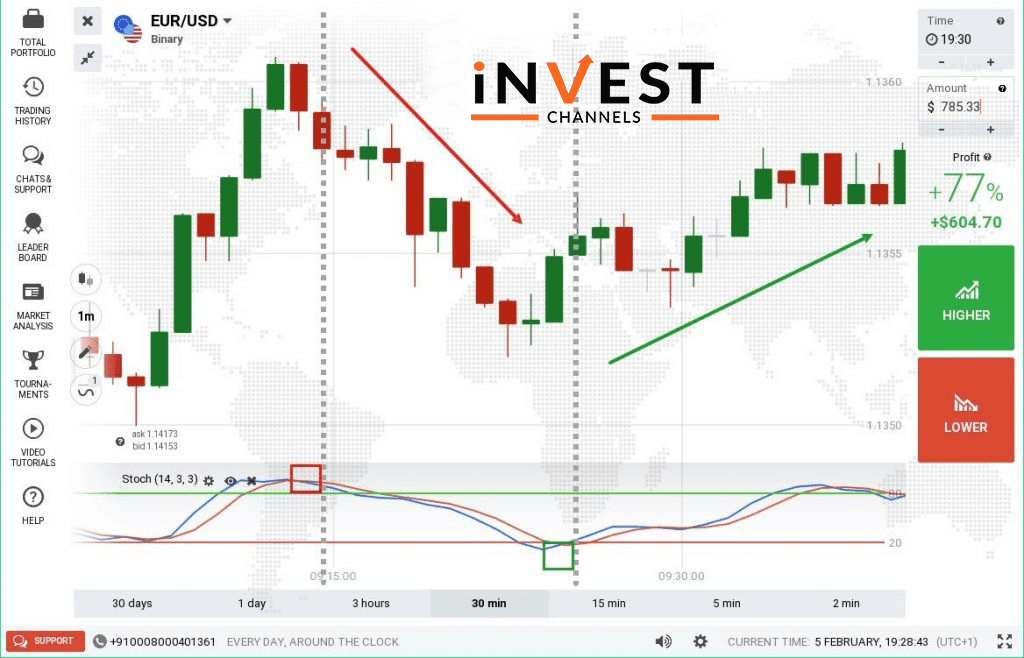

Throughout the periods of strong got bought trends or downward trends signifies that the market will remain in the overbought and oversold areas for the next few days or even months. There are many traders who believe that when the RSI or the stochastic indicator beats the values of 70 or 30 they should begin in the opposite direction.

Well, this is not the right approach to adopt. There may be times when the prices can stay for a long time in overbought and oversold areas. And this is the time they can continue to go higher or lower.

There are also false signals to chase overbought and oversold levels is not profitable on every valid overbought or oversold signal offered by these indicators. Well, I have stopped looking at these levels a long time ago and never looked back.

200 DMA only moving average needed on charts

200 DMA was very important for me. This was the only moving average I wanted on my charts. What if you plot 5 or 6 indicators on the charts and after a very long hard week you remove the indicators and next week you again perform the same process.

Well, I was not following this process at all when I started using many indicators on my charts. Once I removed from my charts all the other indicators and moving averages are directed only on 200 DMA that improved my trading a lot.

For me, 200 DMA turned out to be very useful and productive during my trading periods and also a very effective tool for identifying trends to establishing potential areas of dynamic support with perfect entry points on the market.

There is a question, why 200 DMA story is liable in technical analysis. Well, the answer is that it is believed that many institutions or dealers follow this indicator. If we see EMEA on any currency pair, commodity or even a cryptocurrency, we can see immediate results.

Less is more

Another lesson to learn was thinking that more trading will make you predict the trading market with real money which is not at all true. There is no simple and obvious. If there is no real money you eliminate the most important variables that can affect the trading decisions.

There is a psychological pressure of risking real money if you are performing really good trading on a demo account. It does not mean that if you perform very well in the demo account you can easily trade in the real market. Until you feel comfortable and confident in taking a risk.

I will recommend first build up your strategy and once you tested your strategy and managed to have the position and positive results on your demo account, practise your trade for couple of months and then start your trading with a few money instead of large dollars.

It is not possible to sense the real market while trading on a demo account. It is better to have practice also in the real market.

Losing money is in fact a good thing.

As mentioned earlier that trading is not that easy and everyone should take it as a learning experience and losing money is the most common practice and very important to learn for every trader’s development which will teach you so many things that you should know and not aware of.

Let me clear that losing money is not fun. Where it is not enjoyable to lose the trade but losing money will teach you a lot more trading instead of winning a trade.

If you lose money, the important thing is to learn from that loss and learn from the experience and not to repeat the same thing. If you learn from your mistake you will get be careful and come out a little smarter in the future.

By this, you will secure a huge future loss. The main motive is that you should first have a strategy that matches your personality that means always work for you. You can also join an online course where you can learn more about how to build strategies and trading.

This practice claimed a high success rate and tried different different approaches for a couple of weeks. Again you can see that the key for successful trading is getting a perfect strategy that works very well which fits your personality.

If you have wrong strategy then it will end up losing a lot of money. You need to find your risk aversion if you want your trade to be successful. You should look for the time frame that suits your trading style.

Build your strategy on the basis of your style. See if you are a day trader, a position trader or a scalper.

Preserve your capital

For your trading strategies, you can choose the indicators or many other tools that will help you to build your strategy that will fit your personality and the way of trading. Another important lesson which I learned is not to think about the huge profits and keep the focus on preserving my capital.

If you want to be a successful trader then it is important to concentrate your efforts on how much money you could lose before thinking about how much money you can make. Key to make money over a long period from trading is just staying in the game.

It is important to preserve your capital so that you can stay in the market for a longer period of time and can see the positive results. As long as you will survive in the market you can see your trading will reward you. Many of you may think like a gambler which is very common and obvious and also many of you have thought to make money without any loss.

Keep in mind that whenever you start trading do not ask yourself, how much profit you will make. How to trade while preserving the capital and how to live with losses and be in the game for one month to one year.

If you keep these lessons in mind the probability of losing money will be very less and guess what you will be ahead over 90 per cent of traders. There may be ups and downs and might have doubts when taking the trade.

You don’t lose money. And guess what. You will be ahead over 90 percent of traders. Those were the most important lessons I’ve learned in the past 10 years. During my trading journey I have had my ups and downs. I’m still losing trades and I still have my doubts when taking the trade.

Top 5 Trending

In the world of online trading — often filled with risk and uncertainty — verifying the credibility of a platform… [Read More]

Starting your trading journey can feel overwhelming — there are countless assets to choose from, and it’s hard to know… [Read More]

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]