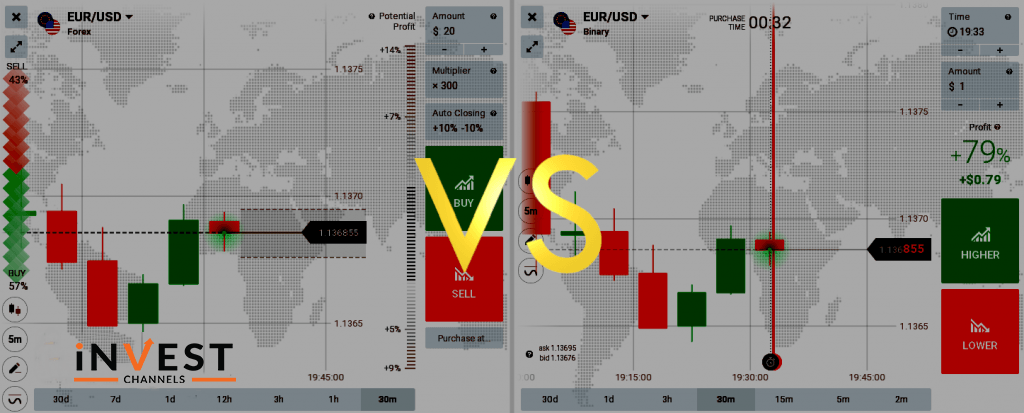

Which one is better IQ Option forex or IQ Option options? It’s a question asked countless times by new traders. Many experienced traders have traded both. Some will trade forex and options while others stick to one. Those supporting either forex or options will fiercely defend their stand. But at the end of the day, whatever consistently makes you money is what counts.

However, this guide is meant to give you a better picture of IQ Option options vs IQ Option forex markets. It will compare both markets on certain key points that will determine long term profitability.

So let’s get to it.

Trading forex is a waiting game while options get results faster

IQ Option forex traders need the price to reach a specific price point before their order is executed. This means that it could be minutes or even hours before the price reaches its trade entry point.

And that’s not all, depending on factors such as price direction, their take profit/stop loss and leverage, you will need to wait until a number of conditions are fulfilled before you get your profit.

Options traders on the other hand will see their trades executed immediately after they press the higher or lower button. In addition, their trades will last as little as 60 seconds meaning results are achieved faster.

IQ Option forex has leverage to multiply profits options have a fixed return

Waiting several hours or even days to make some profit doesn’t sound like fun. But what if your profit can be multiplied 1000 times? That’s surely worth waiting for. IQ Option forex offers leverage which significantly increases your profit potential.

However, your losses are also multiplied by the same amount. It’s therefore important that you use leverage with caution. Also, use tools such as trailing stop loss to minimize losses as well as take profit to lock in profits earned.

IQ Option digital options on the other hand have a fixed return. Whatever you make as a profit is calculated as a percentage of your investment. This can be as high as 92%. In addition, the only loss you can incur is the amount you invested in a trade.

Many factors go into how much forex makes while with options it’s just the amount invested

IQ Option traders changing from options trading to forex trading often find the forex market difficult. Why?

In options trading, only the amount invested plays a role in determining how much you will eventually make. Forex is a different animal altogether.

In IQ Options forex trading, the number of factors will determine how much you end up making (or losing). These include the spread, your investment, your take profit and or stop loss as well as the leverage. Time is also an important determining factor. With all these to keep in mind, many options traders consider forex a difficult market to make money in.

How far the market moves in any direction matters a lot in forex trading

IQ Option options traders will make a fixed amount or lose a fixed amount regardless of how far the market moves in a certain direction.

Forex traders on the other hand will earn more profit the further the market moves in their direction. This coupled with leverage could mean profits exceeding 100%. If the markets move against them the losses will start eating into their account balances.

This means that the losses too could exceed 100%. Forex traders however have tools which can help minimize these losses such as the stop loss. They can also manually close open trades to lock in profits or minimize losses.

IQ Option forex traders have more control over how much profit or loss they can make

As mentioned, options traders can only lose their total investment or make a certain percentage profit. That’s why many forex traders consider options trading similar to gambling.

Forex traders on the other hand have more control over their profits or losses. Let’s look at an example.

Suppose an options trader wants to trade EUR/USD with a return of 81%. His investment is $100. This means that he will potentially make $81 profit on this trade. If the trade loses, he loses his $100 investment.

Suppose a forex trader wants to trade EUR/USD. The current price is 1.127760. He places a take profit of +50% and stop loss of 20%. The leverage is X200 and he invests $100. This means that the trader is willing to make a profit of $50 if the markets move in his favour. But with the X20 leverage, this becomes $1000.

If the trade goes against him, he will potentially lose $20. But with the leverage placed, total losses could be $400. But here’s the good part. If the trader notices that the trade is going, either way, he can manually exit it before it reaches the take profit or stop loss points.

Forex is better for long term gains while options are better for short term gains

Forex traders are patient, waiting for the markets to show the right signals. They live by the classic trend follower’s creed “ride your profits and cut your losses”.

This makes forex trading an ideal investment vehicle where your initial investment can increase in value hundreds of times over. But like every other long term investment vehicle, losses can result. That’s why it’s essential to get out early when the losses start to accrue. Options on the other hand are better suited for short term gains.

On IQ Option, a single trade can last as little as 60 seconds. There are longer periods that last several months.

But who wants to wait 1 month to earn 82% on an investment when that initial investment can be increased by 200% over that same period through forex trading?

One losing forex trade can be recovered in a single winning trade. It’s not the same with options

I’ve pointed out several times that forex traders can limit how much of their investment they are willing to lose using stop losses or manually exiting a losing trade. I’ve also pointed out that by using leverage you can easily make more than 100% of your initial investment when trading forex. This makes it easy to recover money lost in a single trade.

Options traders aren’t so fortunate though. Losing your entire investment on a single trade means that you’ll require two consecutive winning trades to recover your loss and make a small profit (if the return is high of course).

This makes it harder to recover your money as an options trader after suffering several consecutive losing trades.

Conclusion

There are many reasons why to trade forex or options. There’s potential for making a profit in both markets. The potential for loss is also there. Regardless of which market you prefer it all comes down to three things.

The first is your knowledge about the market and the instruments you’re trading. Without this knowledge, any trade you make will be a gamble that’s founded on luck.

The second is your trading strategy. Whether you make money or not relies on your trading and money management strategy. When will you trade or stay on the sidelines? How much will you invest per trade and how will you protect your account from being wiped out? These are just a few questions your strategy should answer.

Finally, making money in either forex or options relies on your emotional setup. Greed, fear, and impatience are just a few of the emotions that can cause financial ruin for any trader. How you manage them regardless of the market you trade plays an important role in long term success.

What’s your take about trading forex or options? We’d like to hear your opinion and experience trading either or both.

Good luck!

Top 5 Trending

In the world of online trading — often filled with risk and uncertainty — verifying the credibility of a platform… [Read More]

Starting your trading journey can feel overwhelming — there are countless assets to choose from, and it’s hard to know… [Read More]

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]