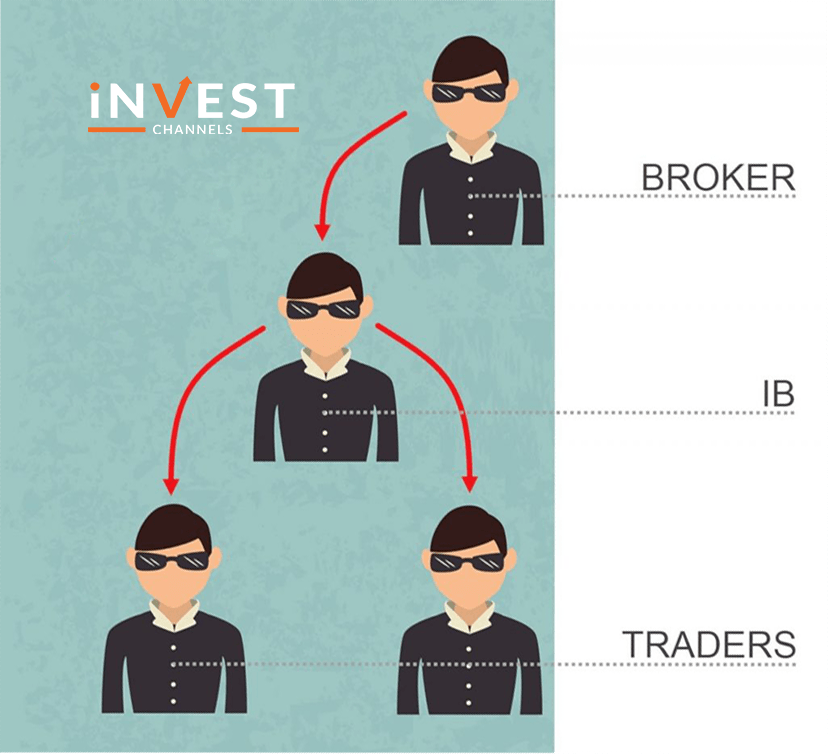

In this guide, we will discuss the IBS. Let’s get started.

Overview of Introducing Brokers

The options broker runs the marketing campaigns online and offline to make new clients and the progress of these marketing campaigns mainly depends on their targeted regions and the popularity of the platform.

Nevertheless, marketing campaigns are now treated with doubt given the dozens of scam platforms popping up each year.

That’s where IBs come in.

The primary job for introducing a broker that acts as an affiliate partner to the broker is to refer new traders to a particular broker and in return, the broker agrees to pay the IB a commission for each new trader and does money transaction the platform.

Let me use a familiar example to explain the IBs role. In real estate, there are real estate owners who seek out the services of real estate brokers.

The brokers in turn employ a network of well-connected individuals who act as referrals. These individuals’ job is to find people or organizations who might be interested in purchasing real estate.

If the referral buys the real estate, the owner pays the broker their commission. The broker in turn shares a portion of this commission with the individual who referred the buyer.

Two types of IB

There are two types of introducing brokers.

The first one is the one who makes out money for you and knows nothing about financial trading and does anything possible to convince you to join a specific platform.

They are not traders but have marketing skills as their strong weapon to convince you.

Their strategy is to convince beginners as they know that beginner traders want to make money fast.

Many brokers will go to any extent by giving away free signals on the condition as if you first join the platform they recommend.

Secondly, IB will provide you with all types of knowledge that you need to know to decide if you should join a particular platform or not.

There are also many IBs who genuinely want you to trade successfully and are willing to put their credit on the line and will always present tips and guides on how to trade better.

They know that as long as their referrals keep trading and making money, so will they.

How do IBs make commissions?

Every trading platform has its commission model. Following are some of the popular models:

Types of commission models

- Commission paid for every new trader that signs up and starts trading (one-time commission).

- Commissions paid on total volume traded by traders referred (recurring commission).

- Commissions are paid out based on the losses referred to traders incur (although no supporting evidence is available).

- Bonus commissions if IB refers to a huge number of traders or, referred traders trade a huge volume.

As you can see that lucrative earning opportunity for IBs is offered by all the commission models and that is the reason why many are opting to provide quality information to new traders. IBs can make recurring commissions based on volume if a referral opens a successful account.

Also, there are many other groups that are ready to squeeze every penny out of your pocket. Their main motive is to make more and more trade from you, whether you win or lose their main objective is to make money as the more trades you make, the bigger the volume and therefore their commissions check.

How do you distinguish between good and bad IBs?

There is an easy way to judge good and bad IBs. The first is by looking at the information they provide on their websites. Do they have any knowledge about the platform they are promoting? Knowledge about trading the different markets provided by the platform they’re promoting?

If the IB is good then they will have tons of knowledge about the platform they are promoting.

On the other hand, if the IB is bad then they will be more secretive.

However, both good and bad introducing brokers use a similar approach to attract new traders.

The approach used by IBs to attract new traders

For IB, every new trader matters and it is their new revenue stream. They follow the approach to attract new traders is kind of similar which involves 3 steps.

- Friendly and approachable demeanour

- Come across as a knowledgeable and expert trader often showing off winning trades

- Promise trader IB is the best teacher that will make him money

- Recommend a specific broker

This is what they show on their website but the reality is not the same. What happens behind the scene is what separates the good IBs from the bad ones.

Bad IBs grab those traders who are slightly interested in trading. If you send them an email or any comment they will use every strategy and marketing trick to get you to sign up with their broker.

They will make promises to provide you with personalized training to ensure all your trades win. But all this personalization is only when you open a trading account with them and once you open your account then IB will simply go silent and move on to find the next trader to recruit.

Well, it is difficult to choose an IB but there are some points on which you can select your trustable IB.

What to do to identify trustworthy IBs

What markets does the introducing broker recommend?

IBs will generally recommend forex markets to trade but as the new markets are growing like options, they will also recommend these. Lookout the time frame if any IB suggests you trade options.

It is obvious that 30 seconds and 60 seconds will earn you more profit than 5 minutes or more time frames. But it can also lead you to lose money faster and the more your trade, the larger volume will become ensuring that the IB makes commission.

If any IB recommends you for the shorter time frames then it is an alert, stay away from them. They are only after the commission generated from your trading volume.

What money management strategy does the IB recommend?

Every trader is concerned about money management as it plays an important role and uses many strategies for it.

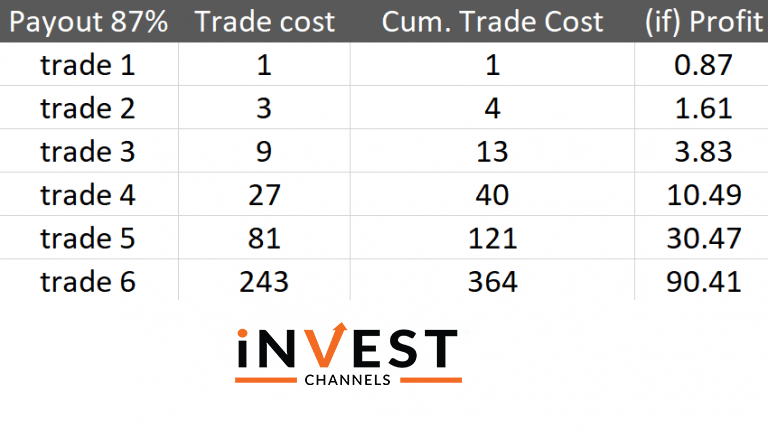

If any IB recommends any type of money management strategy then consider the risk it places on your account balance.

There are strategies like Martingale which are high risk-reward.

Well, this strategy is only for experienced traders to try and for beginner traders, we’ll only recommend you try it out on your IQ Options practice account before trading real money with it.

How many trades per session does the IB recommend?

Trade at least one financial instrument using one trading strategy until you are an experienced trader and also limit your daily trades to 10 or less.

If an IB recommends you open several simultaneous trades, then their main motive is to earn a commission from your increased trading volume.

Claims to have taught traders who ended up millionaires?

Many IBs will claim that they have made many traders millionaires but with that, they will also claim that due to some legal agreements they will not able to disclose the identities of those traders. These types of IBs will also claim that you could join their select group of millionaire students if you join their recommended platform. This is a clear No No!

It does not mean that all the IBs are in the market to make money only. It is only that you should be careful before trusting an IBs word and joining options. So it is important to do research before making your first deposit.

If you come across an IB making such claims, don’t shy away from asking about their strategy. If they cannot provide it, it’s likely that their claims are also false.

Most genuine IBs will document their strategies in guides explaining each trade as it went down. They’re also willing to provide information to would-be traders when requested for.

Claims to have taught traders who ended up millionaires

Many IBs will claim to have taught students who ended up millionaires. The problem is, they will also claim that due to some legal agreements, they cannot disclose their student’s identities. This IB will further claim that you could join their select group of millionaire students if you join their recommended platform. This should be a red flag. The IB probably made their millions from commissions earned through referring new students.

This however doesn’t mean that all introducing brokers are out to make money from new traders. It simply means that you must be careful before trusting an IBs word and joining an options platform they recommend. Take time to research both the IB and the platform they’re recommending before making your first deposit.

That’s the world of introducing brokers. I hope you’ve learned something from this guide.

Have you joined a platform recommended by an IB? How did our relationship with the IB fair after you joined the platform? Share your views in the comments section below.

Good luck!

Top 5 Trending

In the world of online trading — often filled with risk and uncertainty — verifying the credibility of a platform… [Read More]

Starting your trading journey can feel overwhelming — there are countless assets to choose from, and it’s hard to know… [Read More]

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]