In general, you have to manage your money to attain the profit. But as like in every business in trading also there is a chance of facing the loss. Hence, at that time also you have to play with the mind and eventually try to increase the profit and decrease the loss.

For the same reason, a martingale strategy in IQ option is very commonly approached father traders to incur their losses. We will discuss anent a lower-risk martingale strategy in detail further.

What exactly the strategy is all about?

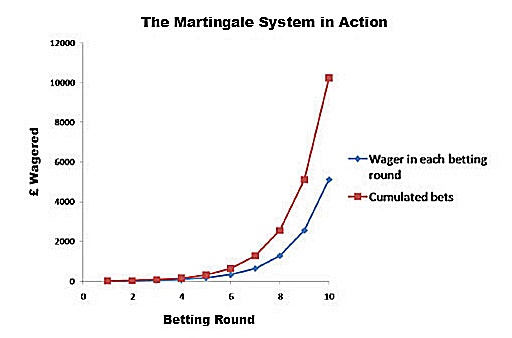

Under this strategy, it states that you have to increase your investment to incur your loss. One needs to invest in the trades in the multiple of the previous loss so that if the profit comes up with this investment will be double and will stabilize the losses of the last sale also.

But this strategy is based on risk as you never know that in the next step you are going to get the profit or the lost again.

But the strategy says that even if you face lost again in the next investment you have to bit in the same pattern.

Hence, the strategy is based on the betting that once you get the profit all the losses will be covered under the winning trade.

As there is a half chance of winning or losing in a particular trade and hence once you win you will cover all the losses because of your betting strategy.

What are the other factors of the strategy and how it applies to trade?

- The first fact is the difference bet psychology and profitably.

Yes, will the strategy there is 50-50 chance of winning or losing and as psychology says that whenever there is a chance of losing people get back and ever built because of thinking of the loss. But in the strategy, if you win you will cover all the losses along with the profit.

- You can sustain the profit.

As in every business, there would be a loss and there would be a profit at a particular time. Therefore, one cannot stick to the point that they will only get a loss on only get a profit through trade. Same like the strategy never ensures you of the profit for long-term.

- You will win or lose?

There is no guarantee that you will get profit or the loss in a trade. Hence, it is a luck and mind game that at one point of time you will get a very good profit by your winning trade and at another point of time, you will get lost at a losing trade. Even sometimes the winning trades in not be able to cover the previous losses hence you have to play smartly in next trading also.

- Secure the money with your mind and strategy.

When you are in a trading business or in any other business the main objective of the trader is to save the money for getting the profit. But in the strategy, you are based on betting your money on a single trade in which you are not even sure about the result of the trade that you will lose or win. Martingale strategy trading is a good option if played with mind.

How to apply the strategy on IQ option?

To apply the strategy in the IQ option you have to see for 5 consecutive trades. In first three states observe that your betting is generating a winning trade or losing trade and if you are winning in three consecutive trades then precede further otherwise stop there.

Therefore, you have to play with the mind to generate the profit from your trade.

How to use it for a long time?

Even know the martingale strategy explained in different ways. Hence, not even in three or five consecutive trades, you can apply it for long term basis. In this, you have to set free beating time that is morning, afternoon and evening and according to that you have to invest money on daily basis and if you are getting the profit then you will be able to invest more in the next trade.

Hence, the strategy is too good to generate the profits for your winning trades and we hope you will get the profit and cover all your losses by applying the strategy in your trading.

Top 5 Trending

In the world of online trading — often filled with risk and uncertainty — verifying the credibility of a platform… [Read More]

Starting your trading journey can feel overwhelming — there are countless assets to choose from, and it’s hard to know… [Read More]

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]