One of the main ways to sustain profitable options trading is money management. You’ll want to minimize losses and increase your winning trades. This way, winners will offset the losing trades and leave you with some profit.

But when you incur a loss, adjusting your trading to reflect the remaining capital is vital to long term trading. Common sense dictates that you lower the amount you place on trades following a loss. But one strategy advises the opposite. This is the Martingale strategy.

How does the Martingale strategy work?

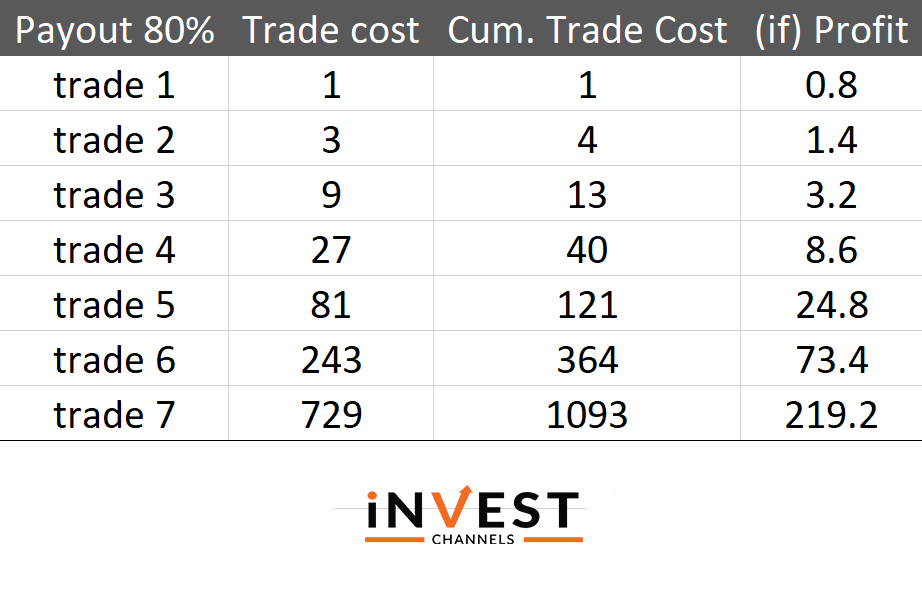

The Martingale strategy requires that you increase your bet amount even if you lose. That is, if you lose on a trade, the amount you invest on the next trade should be a multiple of what you lost. If you lose again, increase your investment until you finally get a winning trade. Once you get a winning trade, start all over again with the initial small investment.

How does the Martingale Strategy work? What’s the point of increasing your stake even after losing? Martingale practitioners argue that if you eventually hit a winning trade, it will be able to offset the losses incurred in previous trades.

See Martingale evangelists view options trading like betting. Each trade has a 50/50 chance of winning or losing. In addition, there’s no way that you can have an infinite losing streak. More so, the probability of losing decreases with the number of trades you make.

Can Martingale be practically applied to options trading?

Probability vs psychology

If you view the Martingale strategy from a probabilistic standpoint it can work in options trading. Every trade has a 50/50 chance of winning or losing. In addition, it’s unlikely to lose many consecutive trades.

Every trade has a 50/50 chance of winning or losing On the other hand if you view this strategy from a psychological standpoint it’s probably the worst money management strategy for an options trader.

No one wants to lose money. And while a trader might be comfortable losing small amounts in the first few trades, fear might set in when the losses accumulate.

Conversely, winning the first few trades might motivate the trader. However, a single huge loss in subsequent trades could wipe out all profits generated by the small winners.

Long term profitability isn’t possible

For the Martingale strategy to work, you’ll need huge amounts of capital at your disposal. Even then, you’re counting on the winning trades to offset the losses. You might have winning trades at the onset.

But one losing trade in the future might take out a huge chunk off your account. On the other hand, a winning trade might offset the losses incurred in earlier trades. However, whatever profit is left might be too small to justify your huge investment in that one single trade.

There’s no guarantee that you’ll eventually hit a winning trade

Although Martingale advocates argue that there’s no chance of getting an infinite number of losing trades, it’s still possible to make so many losses that your account is totally depleted.

Without hitting a winning trade. Even if you get a winning trade, it might not be enough to offset previous losses meaning your account will have incurred a loss. Over time, you might find that your account is slowly being depleted until it’s wiped out.

Your first objective as a trader is to safeguard your money

Your first objective as a trader is safeguarding your money As an options trader, you’re using your own money to make money. Your goal isn’t to lose money.

Many successful traders agree that in order to make money, you must first safeguard whatever money you have. The Martingale system on the other hand advises you bet a good chunk of your money hoping you’ll eventually make money.

In the end, you might end up investing your entire account on a single losing trade which wipes out your account.

Can you apply the Martingale strategy to trade in your IQ Option account?

Suppose, you’ve identified a downtrend and decided to use the Martingale strategy. Each candle represents a 5 minute time interval. You decide to enter 2-minute sell trades.

Your strategy could involve placing sell trades for 3 consecutive bearish candles then observing if they produce winning trades or not. If they all make money, you can continue increasing your trading amount on 3 more sell trades.

Martingale strategy, In theory, the strategy might work. However, you cannot predict how the market will be in the future. The trend might suddenly reverse in response to an event or news story.

A single change in the markets might mean you’ll lose all the money you invested in one trade. Overall, the Martingale strategy carries an enormous risk when applied to options trading.

Tips for applying the Martingale strategy to options trading

Applying the Martingale strategy in your IQ Options account is by no means impossible. However, rather than blindly risk larger amounts of money on each trade, you can adopt a simple trading system. It goes like this.

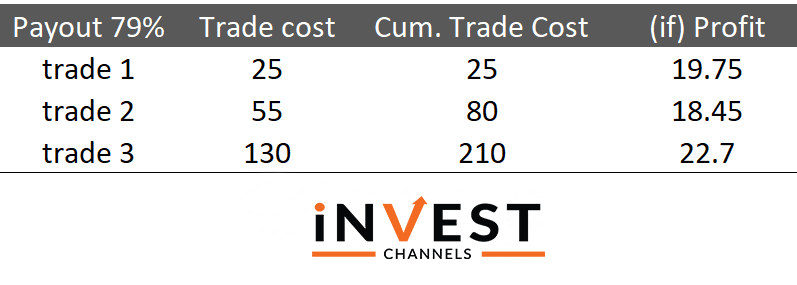

Have a set amount you’ll trade for a specific cycle

Rather than continuously increase the trading amount, you can decide to use just a small portion of your account. For example, you can decide to only risk a total of $200 for one cycle of trading.

This can be broken down into $50 for the first trade, $70 for the second and $80 for the third. Note that the $200 is a fraction of your total account balance. In addition, you’ll only trade this amount until it’s depleted.

Set a maximum amount to trade in a single cycle If you’re wondering what I mean with the term cycle, it’s a set time frame. For example, in a downtrend, you can decide to trade three bearish candles along with the trend.

One common feature about cycles is that when the price enters a cycle, the probability of the trend reversing is high. However, you don’t know when exactly this will happen. So your objective is to ride the cycle and make as much profit as possible before the trend finally reverses.

For example, if the price reaches the support or resistance level, you expect it to the range, reverse or breakthrough. You just don’t know when. But since you’ve identified the resistance/support level, you can use the Martingale system to test the direction of the markets.

The small amounts invested might result in losing trades. But by the time you’re investing larger amounts, you’ll have determined the market direction.

You can use the Martingale system for longer trades

If you prefer remaining in position longer, the Martingale system can prove useful. You can decide to enter 3 different trades; in the morning, afternoon and evening.

Using Martingale for longer positions The morning trade will essentially be used to test the markets and therefore need a smaller amount.

The afternoon trade is used to confirm the market’s trend. If both win, you can enter the evening trade in the same way as you did the morning and afternoon trades.

This strategy has several advantages. One is that you have more time to analyze the markets based on the success of your trades. Second, it allows you to test the market direction using small amounts. This way, your chances of making a winning trade are increased.

Although I wouldn’t advise using the Martingale strategy, it does have its merits. Only use it when you have a proper money management strategy (no one should ever risk a large portion of their account on a single trade).

In addition, flexibility is needed when applying this strategy or else you might end up losing all your money on a single trade.

Good Luck!

Top 5 Trending

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]

The Psychological Line (PSY) Indicator is a versatile, oscillator-type trading tool that compares the number of periods with positive price… [Read More]

Have you ever felt like your trading approach could benefit from a little extra energy? That’s where the Relative Vigor… [Read More]