When trading in the financial markets, the risk of losing your money is always there. Once you enter a trade, there’s a 50/50 chance of it going either way. On the IQ Option platform, you can exit a trade before it expires. However, this will mean forfeiting a fraction of your money.

Besides trading only when the market conditions are right, capital management is necessary if you’re to ensure that your account balance remains intact. This guide will teach you some of the capital management strategies successful traders use on IQ Option.

Capital management strategies used by successful traders

Investing the same amount on each trade

Losing trades can put a dent in your account balance. You want to recover your money. So you decide to increase the amount to invest in the next trade. Hoping it will be a winner and therefore recover your lost money.

Unfortunately, if this trade loses, your account balance will be worse off.

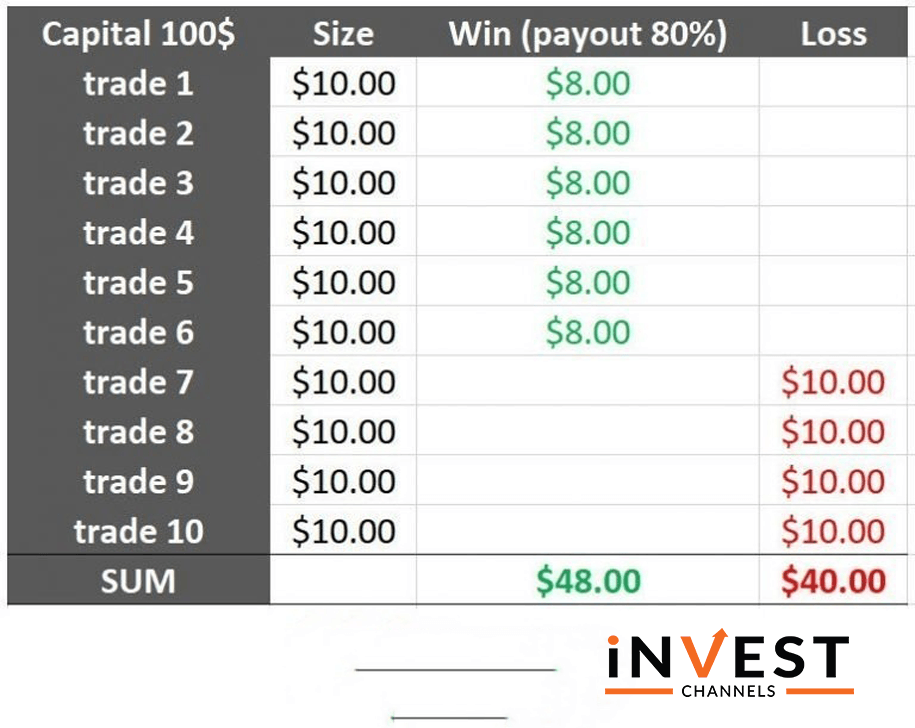

One of the common capital management strategies successful traders use is investing the same amount per trade. Take a look at the example below.

If 6 out of your 10 trades are profitable, you should be able to offset losses and make an $8 profit.

Use profits to trade

With this strategy, you will only use profits earned to trade. This means that if your first trade is a winner, you should use the total earnings for subsequent trades.

Let’s look at an example. Assume you start trading options with a return of 80% with $10. If the first trade is a winner, your profit will be $8. However, you will use the $18 earned on the next trade and so on. Look at the chart below.

In the table above, you’ll notice that the second trade lost. However, the potential earning for this trade was $32.40. That’s the amount to trade in the next session. In total, the loss was $10. However, since the third trade was a winner, the total profit was $15.92 (deduct the $10 loss and $32.40 invested in the trade).

This strategy uses the power of compounding to ensure that winning trades offset losses incurred in previous trades. It’s best suited for experienced traders who only trade two to three times each day.

This however is a high-risk strategy. It implies investing an amount you would have made (but didn’t) in a trade. If you’re a beginner trader, it’s advisable to avoid using this capital management strategy especially if you don’t have a huge account balance.

In addition, if you choose to use this strategy, it’s advisable to stop trading if you make two or three losing trades. Making additional trades might increase the risk on your account.

Martingale strategy

I created a guide that analyzes the suitability of the Martingale strategy in money management. Here it is: Is the Martingale Strategy Suitable for Money Management in Options Trading?

This is probably one of the riskiest money management strategies out there. It suggests increasing the amount you invest per trade until you finally get a winning trade. Once, you have a winning trade, you should start the cycle again with a small amount.

The disadvantages associated with this strategy are more than the advantages. For example, unless you have lost capital, you might end up losing all your money if you suffer several consecutive losing trades. Another disadvantage is that the profit earned in winning trades cannot be justified by the amount invested. Remember that winning trades must offset losses incurred in previous trades.

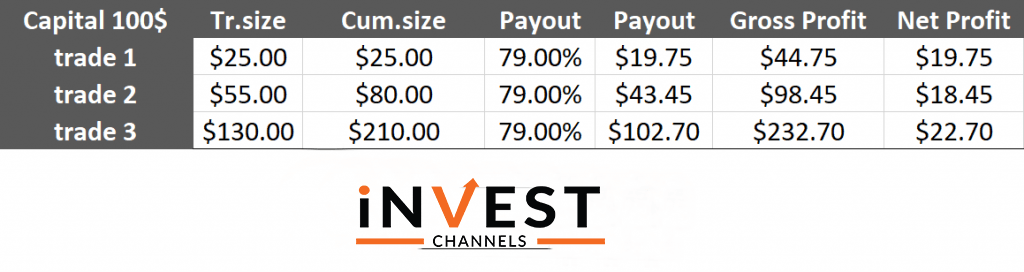

Below is an example of the Martingale strategy at work.

Trading with your gut

This is a high risk – huge returns capital management strategy. It simply involves investing amounts based on how “likely” you think a trade will go. For example, if you identify a trend, chances of your trade winning are quite high. So, you can decide to invest a large amount in a single trade. If however, you’re not sure whether the trade will be a winner or not, you can choose to trade a smaller amount.

The problem with this strategy is that emotions will eventually get in the way. If you invest a large amount on a losing trade, fear might grip you discouraging you from trading large amounts in the future. If on the other hand, small trades make you money, you might become overconfident trading huge sums in subsequent trades.

The point is, trading with your gut doesn’t truly count as a money management strategy.

Why must you have a capital management strategy?

As a trader, you must anticipate days when you’ll incur losses. But what effect will the losses have on your trading account? If you use a high-risk capital management strategy such as the Martingale system, chances are that a loss can wipe out your entire account.

Your main objective as a trader is to protect your money. This means that you should do everything you can to make sure that you don’t lose a huge chunk of your capital on a few trades. It’s therefore important that your capital management strategy have ways of protecting your account from excess risk.

For example, besides having a certain amount set for trading each time, you must also decide how many consecutive losing trades you’re willing to incur before stopping for the day. In addition, your strategy should state when to trade and when not to trade.

There are many different capital management strategies you can use when trading on IQ Option. You can choose one among those described above or, create one which meets your trading goals and preferences. Trading forex or any other financial instrument carries some risk. However, if done right, it can result in you making good profits.

Trading involves probability and you’re not guaranteed profits always. However, by employing a good money management strategy, you can always be sure that your account will continue to grow.

Best of Luck!

Top 5 Trending

In the world of online trading — often filled with risk and uncertainty — verifying the credibility of a platform… [Read More]

Starting your trading journey can feel overwhelming — there are countless assets to choose from, and it’s hard to know… [Read More]

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]