Overview of the Parabolic SAR indicator

The Parabolic SAR is a price and time-based indicator. The SAR stands for stop and reverse. This indicator tracks price as the trend develops over time. On the IQ Option platform, it appears as a series of consecutive dots moving above or below the price.

The stop and reverse in the indicator’s name simply suggest that the indicator will stop and reverse when the trend does so. In this guide, I’ll show you how to set up this indicator as well as how to use it to trade.

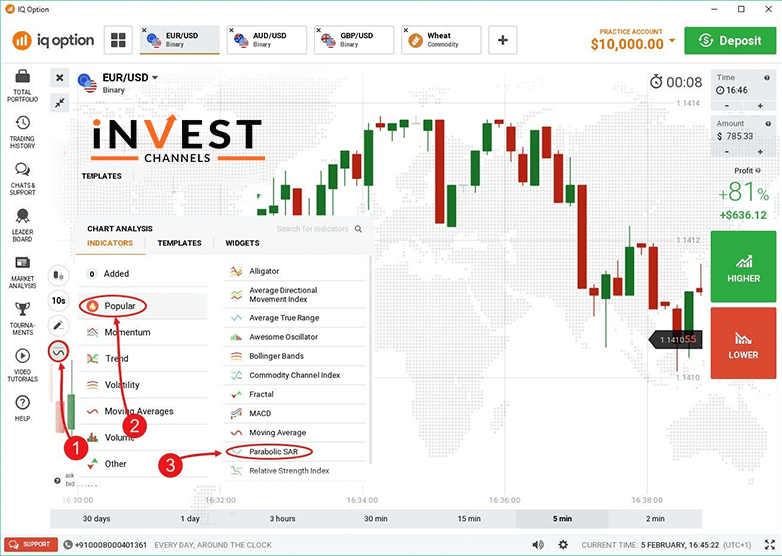

Setting up the Parabolic SAR indicator on IQ Option

Start by logging in to your account. Select your preferred trading instruments and use the Japanese candle stick chart.

Next, click on the indicators feature. Select “popular” and then Parabolic SAR.

Trading using Parabolic SAR on the IQ Option platform

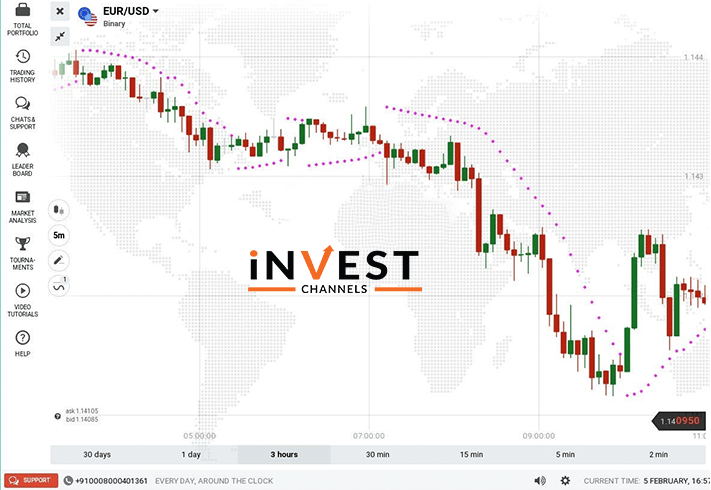

First, let’s cover how to read the Parabolic SAR indicator.

If the indicator is moving below the prices, the trend is rising and you should enter a buy position. If it breaks and crosses above the prices, the trend is falling and you should enter a sell position.

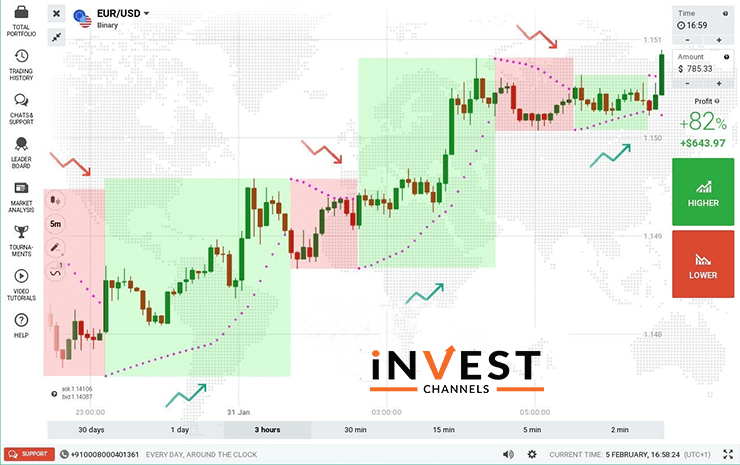

Your objective should be trading using the Parabolic SAR during trend reversals. This way, you’ll enter the market early before the trend becomes exhausted and eventually reverses.

Now, when the trend is up and the indicator is moving below it, wait until the indicator crosses the price and breaks. It will then start moving above the prices. When the trend is down and the indicator is moving above the prices, wait until the indicator crosses and breaks the price. It’s time to enter a long sell position.

Observe the first SAR dot that appears when the indicator crosses and breaks the price chart

If the trend was down and the SAR breaks below the price, look at the first candle that starts developing. If it’s a bullish (green) candle, it’s an indicator that the trend is about to reverse. It’s time to enter a long buy position.

Similarly, if the trend is up and the SAR breaks above price, there’s an impending trend reversal. Look at the first candle that appears after the break. If it’s a bearish (orange) candle, you should enter a long sell position to take advantage of the developing downtrend.

Considerations to make when using the Parabolic SAR

The Parabolic SAR is one of the most reliable indicators. However, it’s most reliable when trading longer time frames. Avoid using it for 1-minute trades because a small price fluctuation might turn the trend against you. If you look at the chart above, many of the trends run for longer time frames. However, price fluctuations within these time frames are also visible. If you traded long, the trend is sustained and will most likely end a winner. If you opted for short trades, the likelihood of losing most of them is high.

The best way to learn how to trade using Parabolic SAR is by practising. Try out this indicator on the IQ Option practice account. We’d love to hear your views regarding this indicator in the comments section below.

Good luck!

Top 5 Trending

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]

The Psychological Line (PSY) Indicator is a versatile, oscillator-type trading tool that compares the number of periods with positive price… [Read More]

Have you ever felt like your trading approach could benefit from a little extra energy? That’s where the Relative Vigor… [Read More]