It is a fact that many people think that there is a scam where the money is involved. As options gain its popularity millions of traders try a hand at it and the majority of traders lost their money in a very easy way to make profits.

This gave rise to a new breed of scammers who grab the unsuspecting traders who lost their money and these scammers do brainwash and convenience you to invest money in options trading.

Note that investment funds are a business model but Ponzi schemes are not. In this guide, you will know about the scam and how to avoid it.

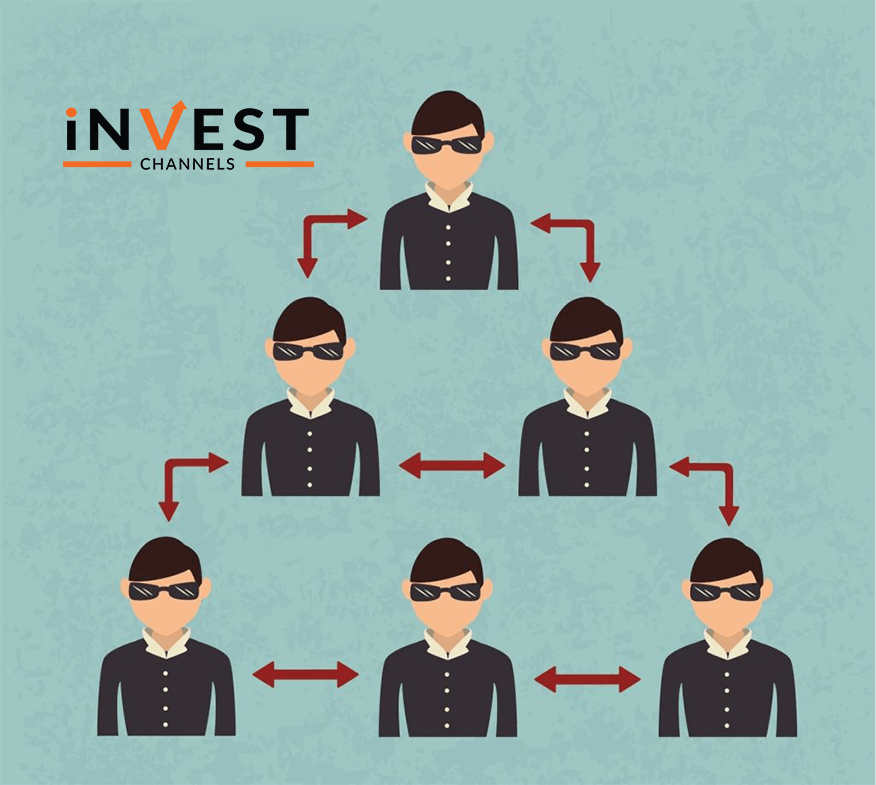

Overview of Ponzi schemes

At the top Ponzi scheme consist of a leader and under that leader there are two or more people and each of these people has two or more people and so on.

Each new member is sponsored to join the group and is expected to pay the fee but in this case, the fee is your investment.

If you want your investment or money back then you can get it by sponsoring new members and make sure that they sponsor other new members. And when this scheme stops sponsoring new members, it collapses and tons of money is lost.

It is clear that this is not an investment fund in any way. These investment funds allow you to make money from your investment. With the Ponzi scheme, you need to work for the group in order to make money after taking your investment.

Why options trading Ponzi schemes look attractive

Ponzi schemes are an easy way to hide their underlying intent. Ponzi schemes advertise as investment funds rather than themselves as Ponzi schemes. In their advertisement, they include huge amounts to make each day. Like, if they advertise a scheme which gives a return of 30% on a daily basis on their $10 million funds, So, by this nobody wants to lose this type of opportunity of getting such a huge amount each day.

But note that especially on options trading nobody guarantees a 30% return per day. A decent return of 3%-5% can be possible but not consistently.

There is a huge risk of making money in option. Therefore you should not transfer your risk to a complete stranger and allowing someone to trade on your behalf. If you do so it means that you do not care about your money.

The main point behind this explanation is that you open your own options account and be an options trader.

If you follow the Ponzi scheme, do not wait and get out fast! That business model pressurizes you to add many new members to make your investment back. You will also be forced to add your family members to join the platform which will lead only to monitory loss with the loss of trust between people.

Keep your IQ Option account secure

There are many traders who claim to help you make money and come to you with many money-making options and put a condition that this is only possible if you allow them to trade with your funds.

Always remember that never give access to your account to anyone. whether they claim that they are pro traders. They will ask for the strategies instead of asking for your account.

There are reports that many traders lost their money because of the third parties claiming to make hundreds of thousands for their “clients”. To be a successful trader, follow the steps of successful traders and learn to trade, build strategies, and only trust yourself when it comes to handling your money.

Good luck!

Top 5 Trending

In the world of online trading — often filled with risk and uncertainty — verifying the credibility of a platform… [Read More]

Starting your trading journey can feel overwhelming — there are countless assets to choose from, and it’s hard to know… [Read More]

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]