The Simple Moving Average (SMA) is one of the most popular moving average tools used for technical analysis. Using a single SMA has its drawbacks. The main disadvantage is the resulting lag due to the fact that SMA doesn’t take many previous price points when calculating the average. Using 2 SMA indicators on the same chart, however, can give you excellent trade entry points.

This guide will teach you how to use the SMA4 and SMA30 to trade 5 minute long positions on the IQ Option platform.

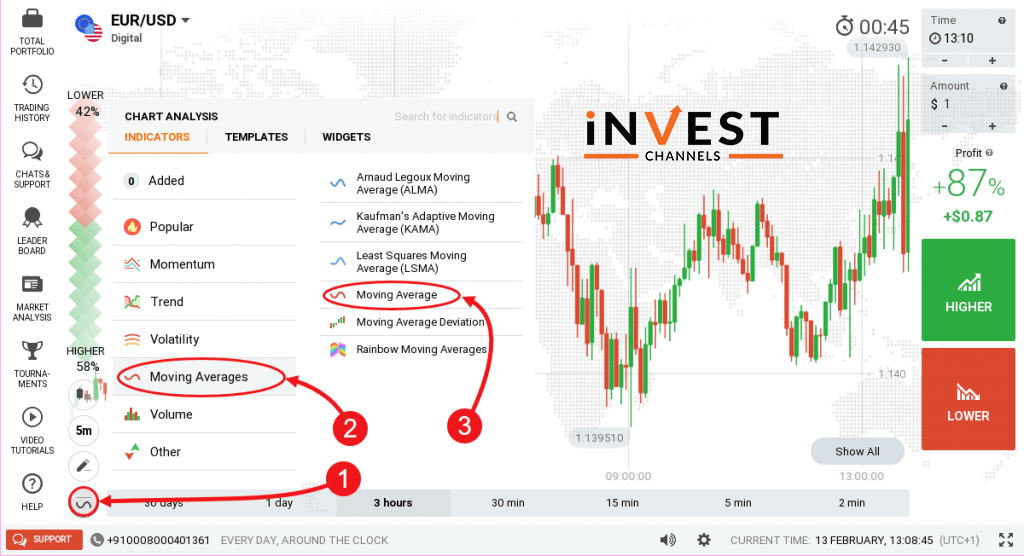

Setting up SMA4 and SMA30 on IQ Option

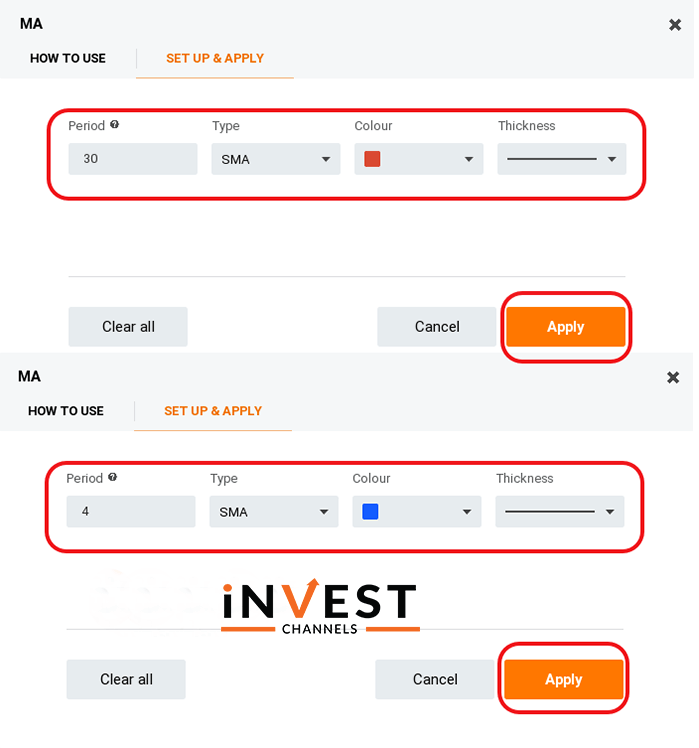

Once you’ve logged into your IQ Option trading account, set up the 1-minute Japanese candlesticks chart. Next, click on the indicators feature and select Moving Averages. On the MA window, select SMA for type and 4 for the period. Change the SMA4 line colour to blue.

Repeat the same process to set up the SMA30 line. Change period to 30 and colour to red.

Remember to click apply when you set up the SMA indicators. Also, your Japanese candlestick chart should have 1-minute candles.

Trading using SMA indicator pair on IQ Option

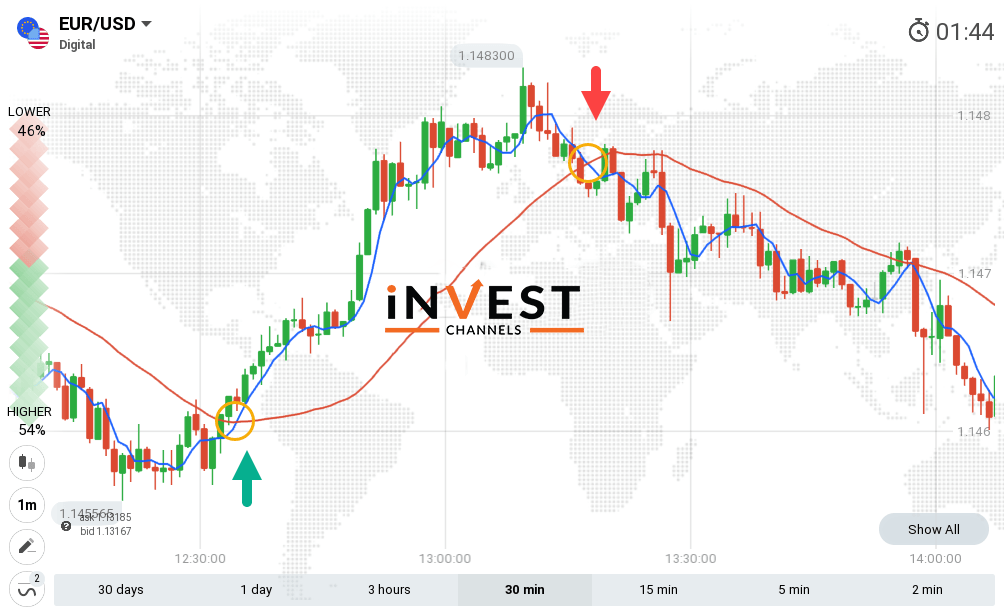

Once you’ve set the SMA indicators, your chart should look like the one below.

Enter a 5 minute buy trade when:

The SMA4 line (blue) cuts the SMA30 (red) from below and starts moving above it. Enter a 5 minute buy position as soon as the SMA4 touches the first bullish (green) candle.

Enter a 5-minute sell trade when:

The SMA4 line cuts the SMA30 from above and starts moving below it. Enter a 5-minute sell position when the SMA30 touches the first bearish (orange) candle.

This trading strategy works very well when the markets are trending. In instances of high volatility such as after a news release, this strategy is extremely effective.

Now that you’ve learned how to use the SMA4 and SMA30 to trade 5-minute positions, try it out in your IQ Options practice account today. We’d love to hear about your results in the comments section below.

Good luck!

Top 5 Trending

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]

The Psychological Line (PSY) Indicator is a versatile, oscillator-type trading tool that compares the number of periods with positive price… [Read More]

Have you ever felt like your trading approach could benefit from a little extra energy? That’s where the Relative Vigor… [Read More]