The morning star pattern is one of the best ways to identify the bottom of a downtrend. This makes it one of the most sought after patterns both by trend followers and price action traders. Whenever you see this pattern, it’s a signal to shift gears and go long.

This guide will teach you how to identify a morning star pattern. Then, you’ll learn how to use it to trade on IQ Option.

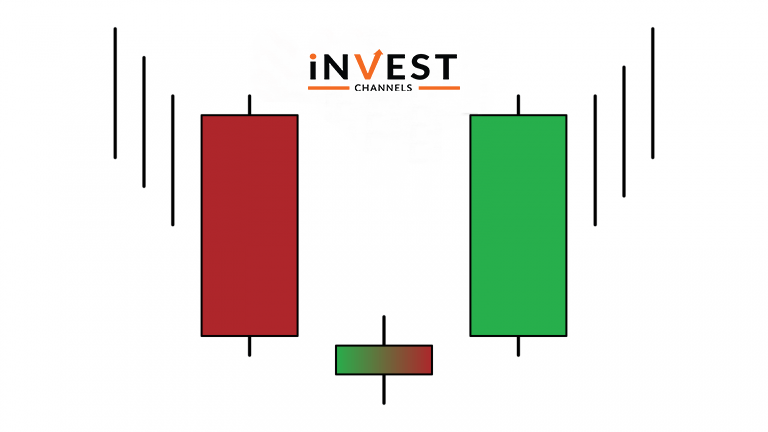

The morning star pattern consists of 3 candles. It forms at the bottom of a downtrend and signals a trend reversal. The first candle is usually a large bearish candle. This shows a large price drop as bears have control of the market.

The middle candle is a doji. It shows indecision where the bulls step in driving the prices slightly up. What makes this candle unique is that it has a relatively small body with wicks on both ends. The session’s low is usually around the same price level as that of the previous bearish candle.

The next candle is a bullish candle. It’s usually large-bodied signalling that the bulls have finally taken over the markets and are driving prices up.

Interpreting the morning star pattern

After the bears control the market for some time, the bulls will eventually start getting in to prevent prices from going down further. As both bulls and bears tussle to have control over the markets, indecision candle forms (doji). The bears lose the battle allowing the bulls to take control of the markets reversing the trend.

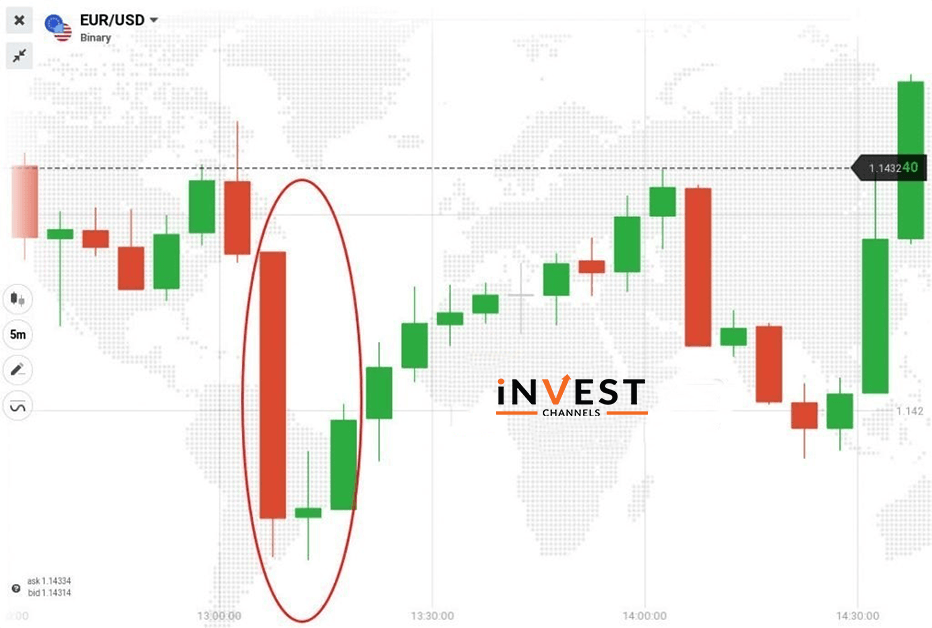

Using the EUR/USD candles pattern above, you’ll notice that the support is suddenly broken by a large bearish candle. However, the bulls step in creating indecision.

The next session begins with a solid bullish candle. Your trade entry should be at the high of the doji candle. Here you should place a long (15 minutes or more) higher trade on your IQ Option interface. Notice that Each candle represents a 5-minute interval so holding the position for 15 minutes or more is recommended.

That’s the morning star pattern at work. Now, try it out in your IQ Options practice account today and share your results in the comments section below.

If you have not Signed up for a Demo account yet, check here!

Top 5 Trending

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]

The Psychological Line (PSY) Indicator is a versatile, oscillator-type trading tool that compares the number of periods with positive price… [Read More]

Have you ever felt like your trading approach could benefit from a little extra energy? That’s where the Relative Vigor… [Read More]