Triangles are technical analysis tools that belong to continuation patterns when trading on the IQ Option platform. This pattern usually forms along with a trend. It’s hard to recognize one unless you draw it. Drawing a triangle pattern requires you to identify at least 2 highs and 2 lows along with the trend. Connect the 2 highs with a straight line and the 2 lows with a straight line. Extend the two lines until they connect forming a triangle.

In this guide, you’ll learn more about the 3 different triangles. I’ll also teach you how to use them in your trading on the Iq option platform.

Three triangle patterns you must know

There are 3 different types of triangle patterns: The ascending triangle, the descending triangle, and the symmetrical triangle.

As I mentioned before, each triangle must have at least 2 highs and 2 lows connected by 2 lines that intersect at the triangle’s apex.

Let’s have a look at all three triangle patterns.

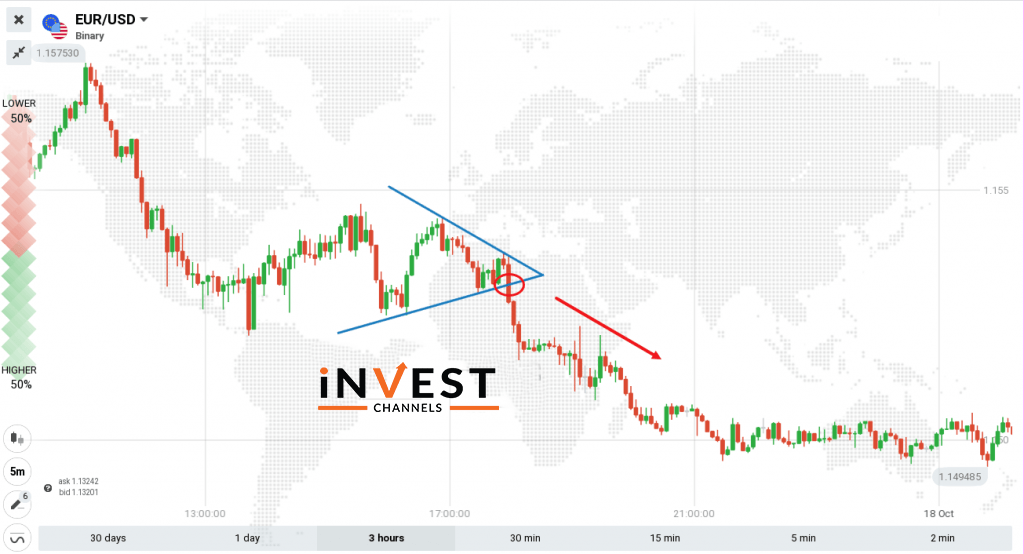

The symmetrical triangle pattern

This triangle pattern forms in a ranging market. The bulls and bears are undecided on which direction the market should take. If you connect the highs and lows, you’ll most likely find that the triangle’s angles are almost equal. However, when a breakout occurs, you’ll find that a strong trend is adopted. Studies show that most of the time, the breakout occurs in the direction of the existing trend.

So when do you enter into position? Immediately the breakout occurs, trade along with the new trend.

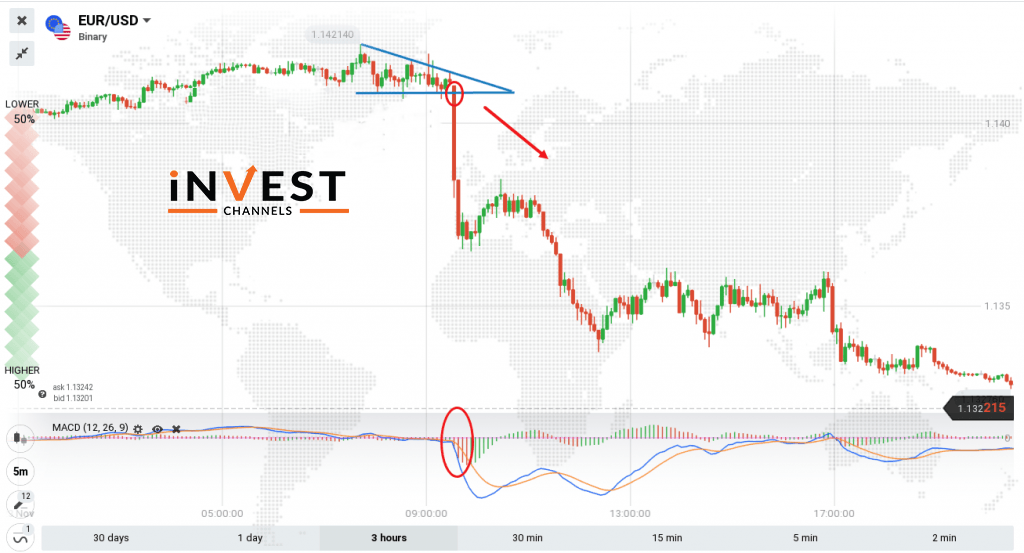

Symmetrical triangle pattern on 5-minute interval candles for EUR/USD ON the IQ Option platform

Using this image, you can easily enter a sell position that lasts 15 minutes or more.

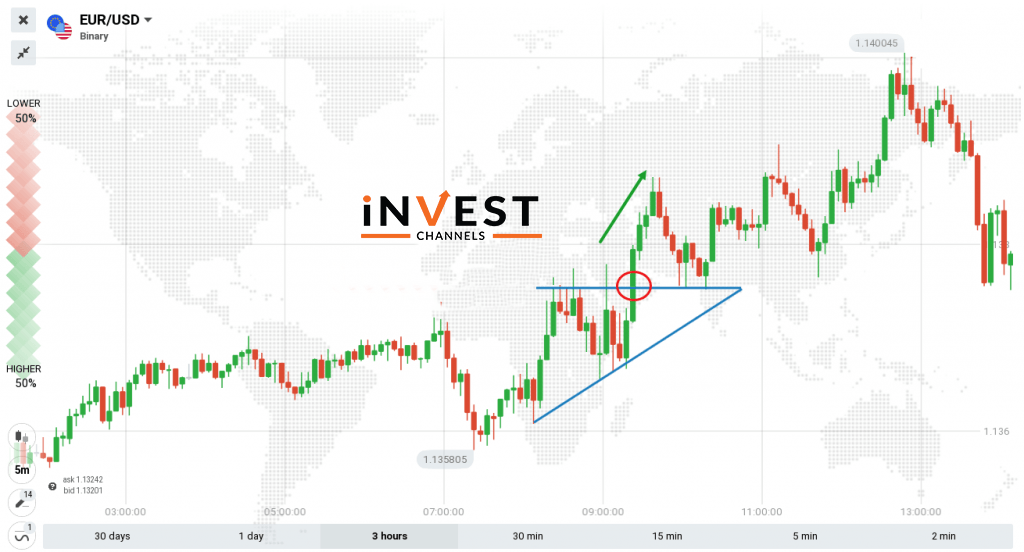

Ascending triangle pattern

This is a bullish triangle pattern that usually forms in an uptrend. The lows are connected by a trendline. However, the highs are connected by a horizontal line (resistance) that touches the highs. View the triangle formation in the image below. When this pattern forms, it’s very likely that the uptrend will continue.

So what is the best entry point? Right where the breakout from the resistance level occurs. At this point, you should enter a buy position that lasts 15 minutes or more.

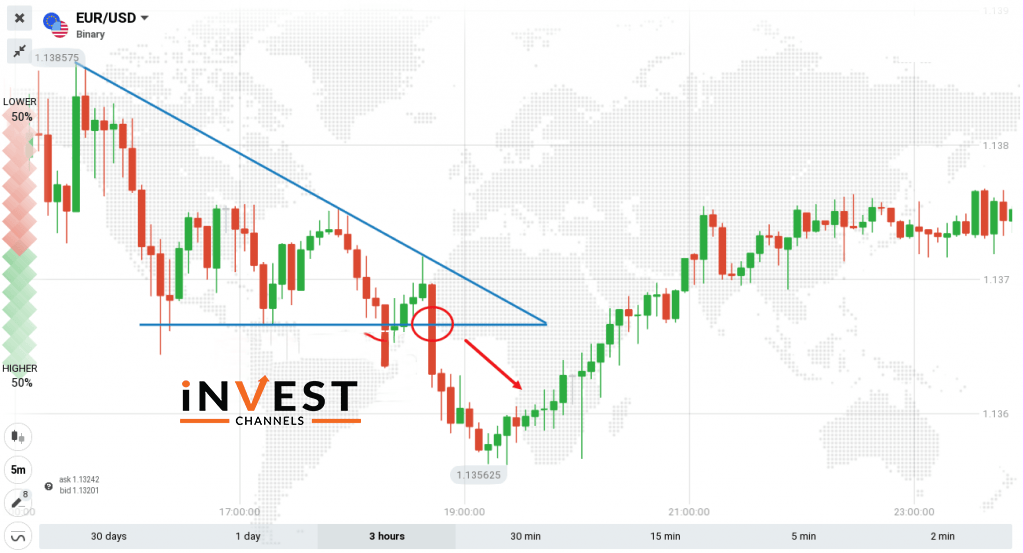

Descending triangle pattern on IQ Option

The descending triangle pattern forms along with a downtrend. To draw it connect the highs of the prices with a trendline. The lows are also connected but this time with a horizontal line forming the support.

The best trade entry point is right where the price breaks the support resuming the downtrend. Here, you should enter a sell position lasting 15 minutes or more.

Tips for trading triangle patterns on IQ Option

Triangle patterns are trend continuation patterns. When this pattern forms, it’s highly likely that the trend will continue in the same direction. Your main objective is to identify the point where prices will break out and start forming the trend.

The triangle patterns work best when you’re working with longer time intervals. That means you should use candles that last 5 minutes or more. Your chart should also cover a longer time frame of 30 minutes or more. This makes it easier to identify these patterns and enter longer trading positions.

Triangle patterns work well with indicators such as the MACD. In most cases, you’ll find that once a break out occurs, trading volume increases and the 2 MACD lines separate. This confirms the new trend. Take a look at the image below.

Now that you’ve learned how to use the three triangle patterns, head over to your IQ Options practice account and try them out. Share your results in the comments section below.

Good luck!

Top 5 Trending

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]

The Psychological Line (PSY) Indicator is a versatile, oscillator-type trading tool that compares the number of periods with positive price… [Read More]

Have you ever felt like your trading approach could benefit from a little extra energy? That’s where the Relative Vigor… [Read More]