Consider this scenario, you’re trading the EUR/USD currency pair. For several hours the trend was gradually going up then ranging. Then an interest rate increase in the US is announced. The result is a sudden drop in prices.

The price continues to drop like a lead stone in water. But considering the earlier bullish trend, you place a buy order. It loses, you still place a buy order resulting in a second loss. You continue doing so until your account is depleted.

Then the price goes up again. Trend followers always say – follow the trend. You never know when the trend will reverse. So why try to go against what the market says?

When should you religiously follow the trend?

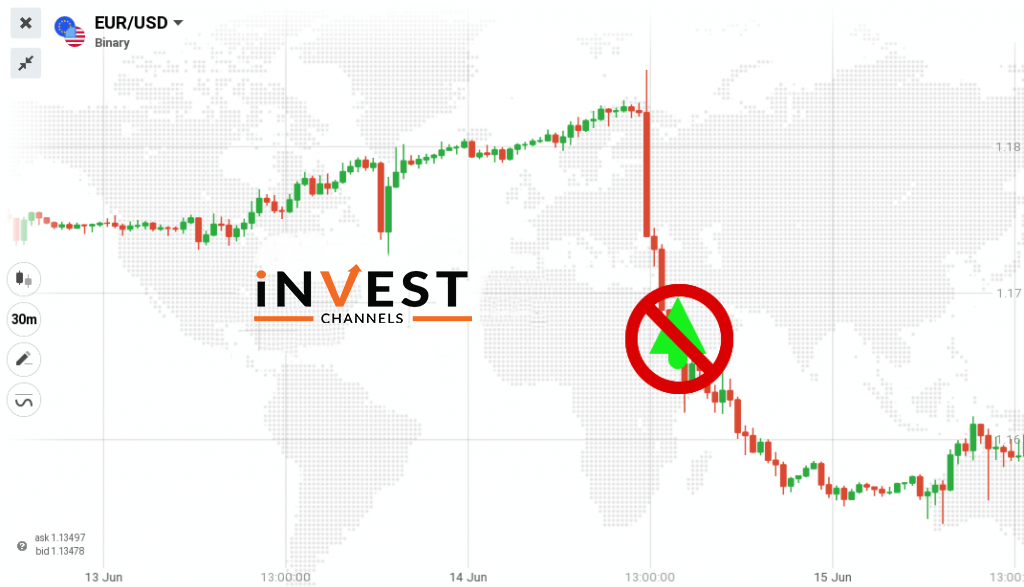

Consider the Iqoption EUR/USD chart below. The prices had been rising steadily from 13 June at 13.00. The uptrend continued for 24 hours before a sudden break resulted in a sharp drop in prices.

Now the sharp drop occurred over a 2 hour period before they started to stabilize (bearish candles were shorter). For most traders, this could be a signal for the trend reversing and they would have likely placed buy trades.

But the prices continued dropping creating new resistance. If you notice prices falling sharply and breaking previous support and resistance levels, it’s very likely that they will continue falling. At this point, it’s recommended that you go with the trend and place a sell order.

Eventually, the trend will reverse and the prices will form new resistance and support levels. At this point, prices tend to hit a certain price point before bouncing back. These are strong resistance and support levels. If the price breaks either, it’s time to trade with the trend again.

When trading with the trend is likely to lose you money

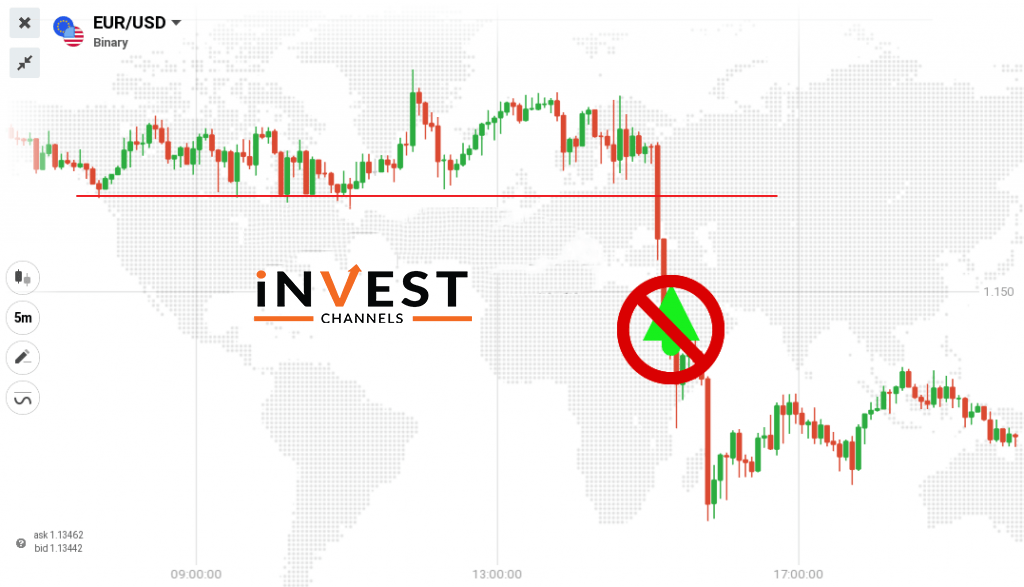

Now, look at the IQ Option EUR/USD chart below. You’ll notice that the prices tend to fall to a certain level (support) before bouncing back. There are small trends forming but they’re unlikely to be of much use if you’re not trading short time frames.

At this point, it’s best to sit at the sidelines and let the bulls and bears fight it out. But once this support is broken (a large bearish candle), you know for sure that a downtrend has developed. It’s time to place your sell trade.

The trend is your friend.

If you notice a trend forming, trade along with it. Never trade against a trend because you never know when it’s going to reverse or range.

Only the markets will give you the signal. Are you a trend follower? What strategies do you use to identify a trend besides the prices breaking support and resistance levels? Share them in the comments section.

Good luck!

Top 5 Trending

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]

The Psychological Line (PSY) Indicator is a versatile, oscillator-type trading tool that compares the number of periods with positive price… [Read More]

Have you ever felt like your trading approach could benefit from a little extra energy? That’s where the Relative Vigor… [Read More]