You will find trading based on candle colours one of the easiest strategies. This is a low-risk strategy. The main objective of yours is to identify a real candle and according to its colours place your trades.

Large bodied candles indicate the strong price momentum in a specific direction. Take an example, a large green candle shows a strong uptrend, so to make a winning position place a buy position after the green candle closes.

In this article, you will see trading 5-minute interval candles for the EUR/USD currency pair. Also, the use of the Martingale money management strategy to ensure that each trading session ends up profitable.

Guidelines for trading candle colours on IQ Option

If you do not have much knowledge about the Martingale system and Martingale Strategy if it is Suitable for Money Management in Options Trading? will get you started.

Keep reading to learn more about trading candles on IQ Option. This is an Ultimate Guide for Trading Candles on IQ Option

Here are some rules to follow when trading.

Once the real candle is identified, wait until its close. Then enter a trading position based on the candle colour. For example, if the candle is bearish, wait until the candle closes. Now, immediately enter a 5-minute sell position so that the next candle will close lower.

But, what if the trade loses? As soon as the candle will close, enter the same position at the opening of the next candle. Keep doing this until a similar coloured candle appears.

It is important to observe the alternation between green and orange candles. If your buy position ends up in the profit then wait until an orange candle develops. Enter the sell position.

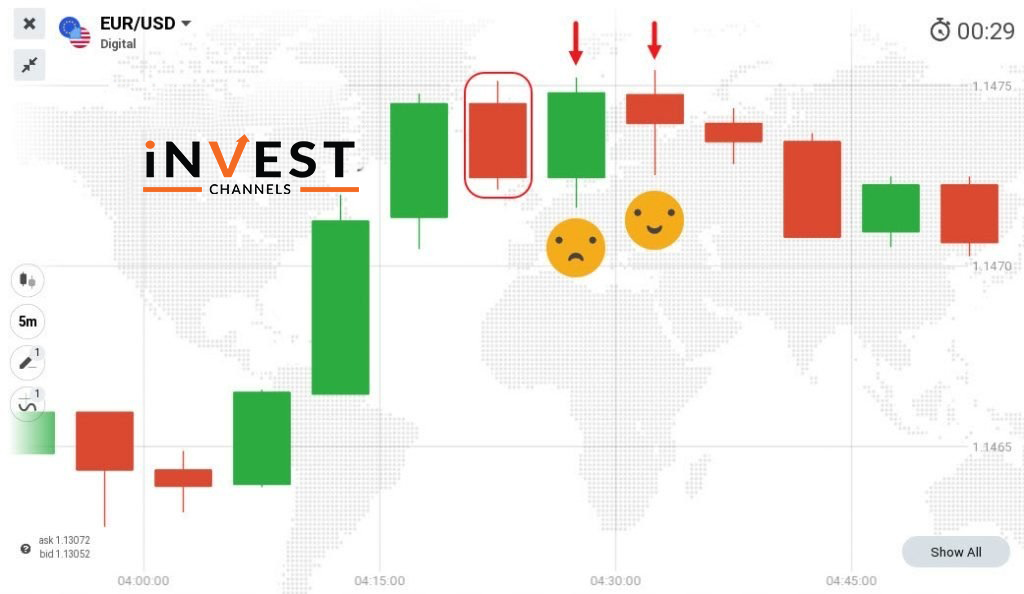

Take a look at the chart below.

How the trades went

There was a range in the market and no apparent candle was developing. However, a solid bullish candle started developing and at its close entered a 5 minute “higher” position to make the trade into profit.

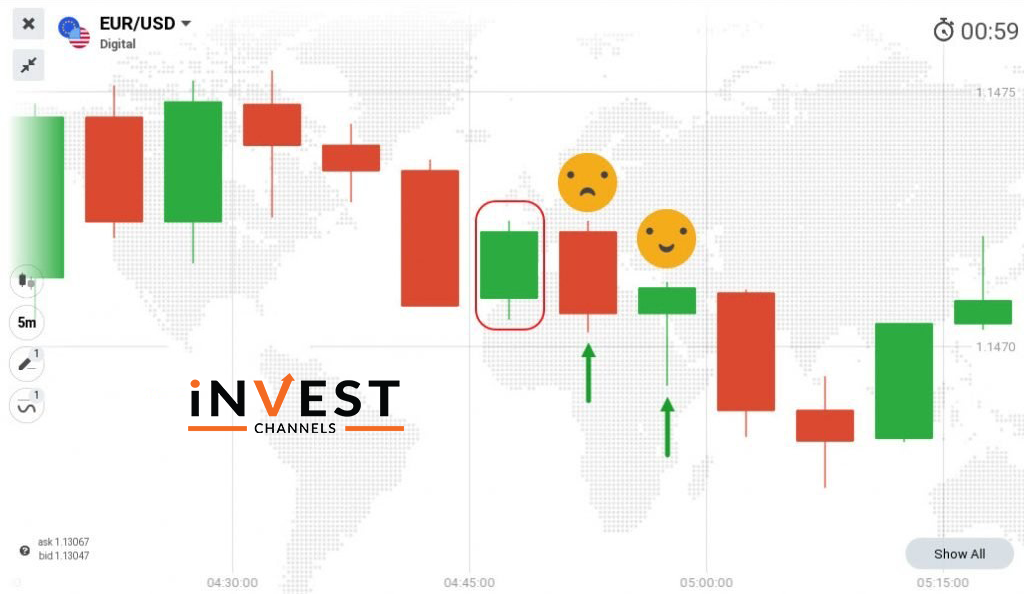

If the second trade didn’t go as expected. Rather than a trend reversal, the first bearish candle signalled price consolidation. The first 5 minutes “lower” trade wasn’t profitable. So, in this case, to make a trade in profit. immediately enter a “lower” position at the opening of the next candle.

After the bearish candle appears, at its close, enter a 5-minute “higher” position which results in a losing position. So, now at this point entered a similar “higher” position at the opening of the next candle. This trade ended up profitable.

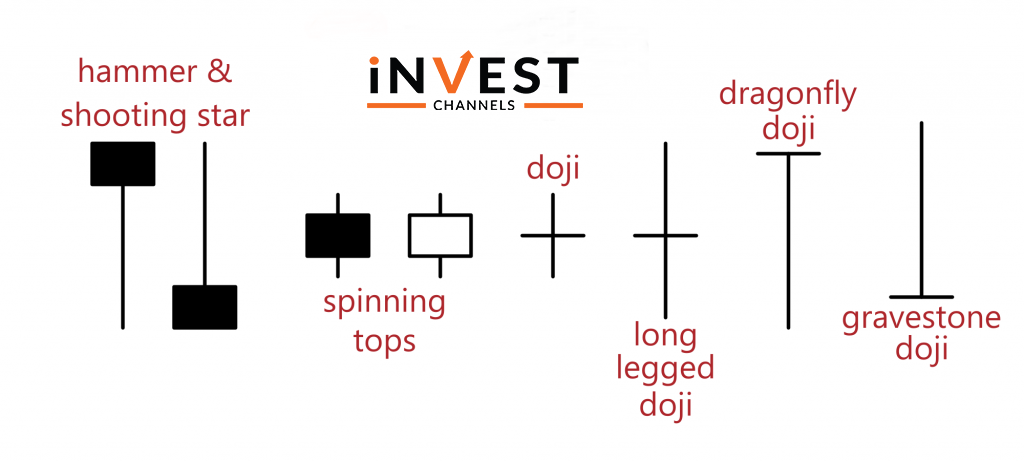

The candles to avoid when trading using this strategy on IQ Option

As mentioned earlier, candles to look out for should be true candles. These candles are large-bodied and have no wicks or small wicks. The candles that should be avoided are special candles. These have small or no apparent bodies as well as long wicks. Some of these are included in the image below.

You will find all the entry points at the opening of the next candle and the trade should last 5-minutes.

With the help of the Martingale money management strategy, the total trades are 5 where 2 are in losses and 3 are in profit.

Trading candles alongside the Martingale system is effective but has few returns

Since the trade did was 5 times, the cost was $121 and the second and fourth trades were unprofitable which means the loss was $44 and the cumulative profit for the three trades was $36.42.

This means that even though I made a profit, it was quite small compared to the total amount invested.

Trading with colour candles alongside the Martingale system is a simple and low-risk trading strategy and this low-risk trading strategy comes with low profits as you have seen.

Now that you’ve learned how this strategy works, try it out today in your IQ Options practice account. Good luck!

Top 5 Trending

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]

The Psychological Line (PSY) Indicator is a versatile, oscillator-type trading tool that compares the number of periods with positive price… [Read More]

Have you ever felt like your trading approach could benefit from a little extra energy? That’s where the Relative Vigor… [Read More]