Every trader has their story about how they almost or entirely wiped out their trading account. However, very few share these stories for fear of being ridiculed. I recently received such a story from one brave trader.

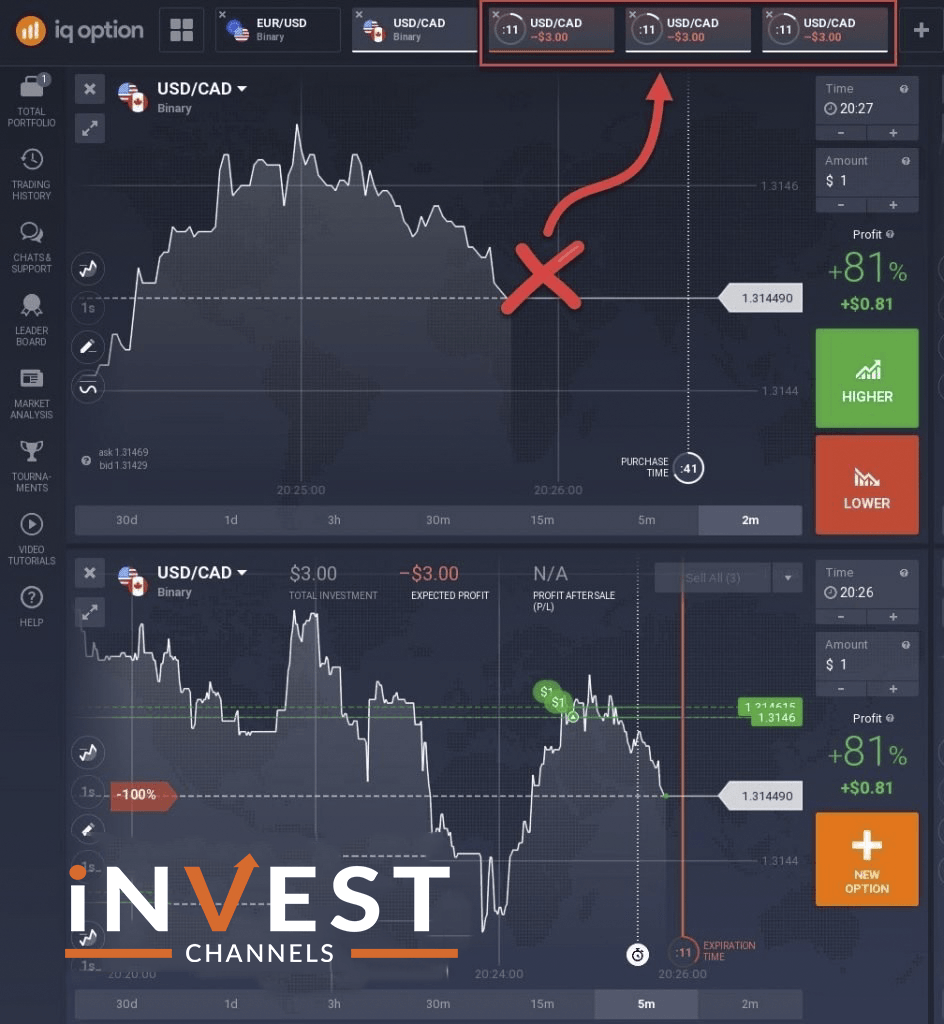

Sent via email, the trader simply stated “I JUST WIPED OUT MY IQ OPTION ACCOUNT”. Accompanying the email were two account snapshots which I’ve posted below.

It’s sad to watch a trader lose so much money in such a short amount of time. Before, writing this, I shared the snapshots with other traders.

The question many were asking, “How can a trader lose so much money in such a short amount of time?”

Of course experienced traders know the reasons simply by looking at the trading history. These are some of the fatal mistakes I’ll share with you in this article.

Fatal mistakes that will wipe out your IQ Option account fast

Investing a huge chunk of your account balance on a single trade

This fatal mistake goes like this. You have a gut feeling that the markets are going in a certain direction. Based on this gut feeling, you’re “sure” that you’ll make a profitable trade.

So you decide to take a huge risk, investing a huge part of your account in that single trade. The trade loses, and you’ve lost too much on a single trade.

That’s what the trader did. The first trade alone accounts for more than a quarter his initial account balance.

Now doing the same over and over again will definitely wipe out your trading account. Consider the trader’s second trade. It accounts for a third of the remaining account balance. Had the second trade not ended neutral (the price was the same as his trade entry so IQ Option refunded the $1000), he’d have lost a third of his remaining account balance.

This mistake stems from greed. You want to make a lot of money within the shortest amount of time. The only way to safeguard against this is to create a rational money management strategy. Most traders will not risk more than 2% of their account balance on a single trade.

The illusion of finding the holy grail of trading

Many of the traders who wipe out their account balances trade using tips. For them, tips represent the holy grail of trading. Most of these tips are provided by other traders but with a single twist – many are given too late to make a profit.

There is no such thing as a holy grail in trading. Many of the successful traders will agree. Successful trading is simply about minimizing losses and increasing winning trades.

It’s about emotional control, proper money management and knowing when to (or not to) trade. Successful traders also make losses. However, they aren’t too great to wipe out their entire accounts.

Fear is the emotion that drives traders to search for hot tips. Even if they have enough information to get into the market and trade profitably, they still fear that they might be wrong. So they’ll search out a hot tip from a guru.

When they eventually enter into position, the markets have probably reversed leading to a losing trade. The sad thing is that the person providing the tip has nothing to lose. You on the other hand are risking your own money. It therefore pays to take responsibility by making your own trading plans and following them through.

Trading against the trend

Trading against the trend is another fatal mistake that will wipe out your IQ Option account. Trends clearly show you the price direction. So why trade against it? Take a look at the sample trend below:

- The trend is clearly heading up. Essentially, you must place a Higher trade. But notice the trend line showing an uptrend. Just as the price hits it, the trader should have traded higher. But instead chose to trade against the trend. Hoping the markets will reverse some traders will actually trade against the trend like in this case. The last three consecutive trades placed lost him his account balance.

Two exact trades at the same price point: This mistake goes like this. You’ve placed a call or put at a specific price point. However, the trade goes against you and you lose your investment. You feel that the markets are wrong so you move to prove this by entering that exact same trade. The result? A second loss of the same amount. This type of trade is driven by anger. Always remember that the market doesn’t care about your emotional disposition. All it does is provide equal opportunity for all to make money.

If you look at the image above, the trader has two calls while the price clearly shows a downtrend.

Trading very short time frames

One of the attractions of options trading on the IQ Option platform is the shorter time frames. It’s an opportunity to make money fast. But there’s one shortcoming; you have lesser time to think rationally before you enter into a trading position.

This doesn’t mean that 60-second trades won’t make you money. In fact, they offer bigger returns than the longer time frames. However, if you can’t think rationally before trade entry, there’s a high chance that you’ll let emotions kick in.

This, in turn, increases the chances of losing a lot of money within a short amount of time. Remember the trader’s account snapshot? He accumulated a $4000 loss in five 1 minute trades.

Have you lost money trading on the IQ Option platform? We’d like to hear about the fatal mistakes you made and how you recovered from them in the comments section below.

We recommend that you always start trading with the FREE practice account you can open here

Thank you for visiting!

Top 5 Trending

In the world of online trading — often filled with risk and uncertainty — verifying the credibility of a platform… [Read More]

Starting your trading journey can feel overwhelming — there are countless assets to choose from, and it’s hard to know… [Read More]

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]