A plan for trading is really important. Without a plan, trading is like shooting in a dark. Many new traders are in complications to find a plan for their trade. It is risky to totally depend on your luck to make a profit as it never works when it comes to trading.

Many traders find difficulties in getting their trading plans as many of the details are not covered on the internet and many other important aspects.

This guide will help you with your difficulty. So, let’s get started!

What should go into your trading plan?

How long it will be in use

Before deciding on your trading plan, know how long will you use that plan. You can use your plan for 1 day, 1 week, or a month. A trading plan for a week is recommended as it will give you enough time to test your plan and analyze its efficiency. After testing your plan you will know if your plan is working for you or not.

As long as I’m using this plan, I will document all trades I entered into. Luckily, IQ Option provides the trading history feature. This comes in handy when I want to have a quick glimpse of how my trades for a particular day did.

The trading strategy to use

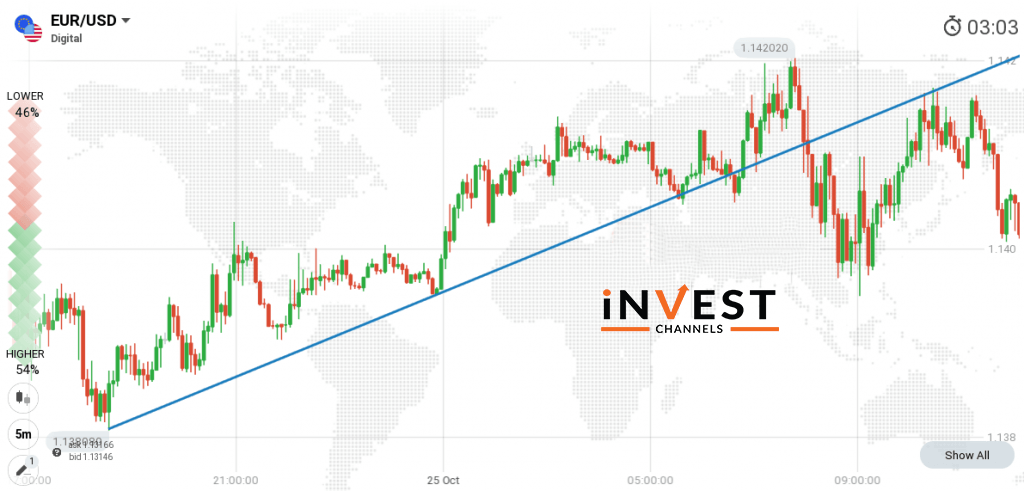

The test plan should have one trading strategy and there are a lot of trading strategies in the market for your test plan. In this guide, the TLS method coupled with support/resistance and the RSI indicator is used.

The reason for choosing the TLS method is that it is very simple to implement.

Asset and market to trade

Now decide which asset you will choose to trade in which market. You can choose a currency pair, stocks, indices, etc as an asset and forex, CFDs, etc as a market that will keep the track of your progress.

After deciding the asset and the market, it’s time to choose when to trade which largely depends on your time zone and your strategy.

Trading account

This covers three essential points.

First, your account balance will be the amount for the period of the trading plan. Your objective will be to deposit a specific amount and then use it to make money. If in case your amount is depleted then do not make another deposit until you’ve created a different workable plan.

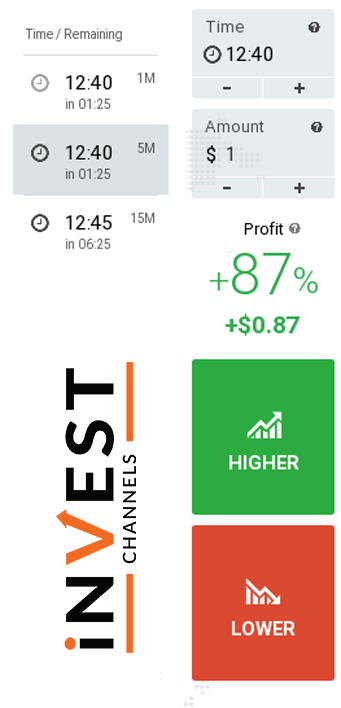

Second, the investment amount per trade. You can use your profit as an investment amount for the next trade or you can keep it fixed like $10 per trade.

At last, make a target for your profit. As you will have a profit target it will clear you on how much you want to make per trade as well as how many trades you need to do.

What to do when things don’t go according to plan

There are situations when some traders do not follow their plans. For example, If a trader is suffering consecutive losses and leading towards the depletion of the account balance at that time, changing the plan becomes necessary.

So what to do in such types of scenarios?

Should trading be continued or immediately stopped? Well, this will be a subjective decision that you can make but make sure that the decision you make enables you to protect your money rather than lose it trading on IQ Option.

By this, you will experience what decision you take when emotions start clouding your judgment. If you wanted to cover your loss, well you increase your trade amount? At this part, you will identify the trade actions that you must take to prevent emotion-driven trading.

This was just the basic feature of a trading plan. Note that, no plan is better than a bad plan.

Now!, 12 Questions you could ask yourself to write down your own personal Trading plan.

- How long will my trading plan be Used?

- Asset and market to trade?

- What trading strategy do I use?

- What expiration time do I use?

- What time frames do I Trade on?

- What extra tools do I use? >> Check our Free Trading Tools!

- Trading account Size?

- Money Management?

- Maximum Number of Trades per day?

- Maximum Loses?

- What are my Profit targets?

- What happens if I don’t make my targets?

Of course, your trading plan is personal, and you can adjust questions to yourself.

Kindly share your own trading plan in the comments section below, so other traders can learn from yours.

Good luck!

Top 5 Trending

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]

The Psychological Line (PSY) Indicator is a versatile, oscillator-type trading tool that compares the number of periods with positive price… [Read More]

Have you ever felt like your trading approach could benefit from a little extra energy? That’s where the Relative Vigor… [Read More]