Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they are just as valuable for anyone wanting to improve their trading strategy. Ready to add a bit of shine to your trading skills? Let’s dive into the ins and outs of diamond pattern technical analysis to see how these special chart shapes can help inform your trades.

What is a Diamond Chart Pattern?

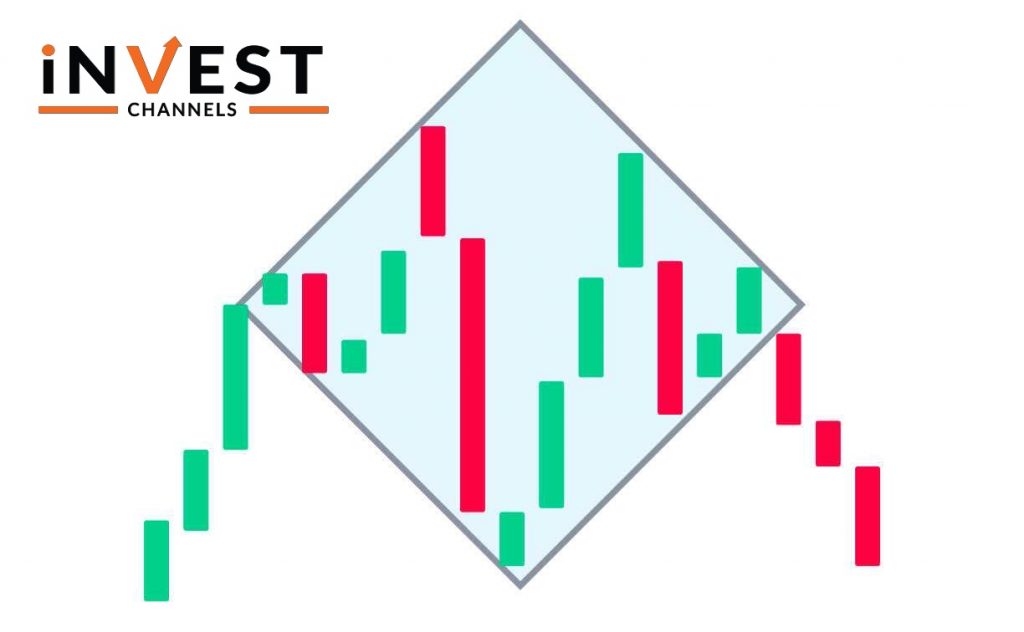

Diamond patterns are rare but powerful indicators of potential price reversals in a trading chart. When these patterns appear, they often signal a turning point, either up or down, and can guide traders to make well-timed moves. There are two types of diamond patterns: the diamond top and the diamond bottom. While their purpose is the same—highlighting a likely trend reversal—the conditions under which they form differ. Let’s explore these formations in detail.

The Diamond Top Pattern

A diamond top pattern, while uncommon, is a strong reversal indicator. It often forms at the end of an upward trend, hinting that the price is ready to turn downward. Traders may spot this pattern when an uptrend begins to level out, with price movements starting to stabilize or move sideways.

Recognizing the Diamond Top Pattern

Here’s how a diamond top pattern typically unfolds:

- Upward Price Trend: The price initially follows an upward trend, with higher peaks (top price points) and lower troughs (bottom points) as candles expand.

- Expanding Candles: At first, the price movements widen. Peaks rise while troughs sink, creating a broadening effect.

- Narrowing Phase: The price starts to reverse, with the peaks becoming lower and troughs higher, moving back towards the center.

- Diamond Shape Emerges: When you connect the highs and lows, a diamond-like shape appears on the chart. Note that this shape doesn’t need to be perfectly symmetrical and can lean slightly to one side.

The diamond top pattern signals a sell opportunity when the price breaks through the lower-right support line, confirming a downward reversal. Traders might also trade within the pattern, profiting from price fluctuations before the breakout.

It’s essential to distinguish the diamond top from the head-and-shoulders pattern, as they may look alike. Look closely to confirm the diamond shape and make a more informed trading decision.

The Diamond Bottom Pattern

The diamond bottom pattern is the opposite of the diamond top. This formation appears at the end of a downtrend and can signal a potential upward reversal.

Identifying the Diamond Bottom Pattern

To identify a diamond bottom pattern, look for these characteristics:

- Downward Price Trend: The price follows a strong downtrend, which is a crucial factor for spotting this pattern.

- Expanding Candle Movements: Similar to the diamond top, the price movements widen, creating a diamond-like shape. The difference here is that the price initially drops into the diamond from above.

- Converging Movements: After widening, the price action starts converging, with the peaks and troughs moving towards the center.

In a diamond bottom pattern, the main signal for entry is when the price breaks through the resistance line, indicating a possible upward trend. If the price breaks downward instead, traders may consider other patterns to confirm the direction.

This pattern represents a tug-of-war between buyers and sellers. Buyers push the price up, making new minor highs, while sellers bring it back down, widening the price range temporarily. Usually, the widening movements don’t last long, and a breakout often signals the end of the pattern.

Trading with Diamond Patterns

One of the keys to using diamond patterns effectively is understanding market trends. In an uptrend, look for diamond top patterns as signals to exit or go short. Conversely, in a downtrend, diamond bottom patterns can suggest a potential buying opportunity.

Identifying these patterns can be challenging, and it requires a strong understanding of both trendlines and chart reading. To confirm a diamond pattern, watch for the shape to emerge after a distinct upward or downward trend, followed by expanding price movement. Be patient and ensure the pattern has fully formed before making a move.

Important Tips for Trading Diamond Patterns

Here are a few extra pointers to keep in mind when trading diamond patterns:

- Practice Makes Perfect: Diamond patterns are not the most common formation, so it may take time to learn to spot them accurately.

- Risk Management is Crucial: No trading pattern, including diamonds, guarantees a successful outcome. Use proper risk management techniques to protect against losses.

- Stay Alert for False Breakouts: In some cases, price breakouts from the diamond pattern may not lead to a strong trend, leading to a false signal. Combining the diamond pattern with other technical indicators may provide stronger confirmation.

Conclusion

Diamond chart patterns can be invaluable to traders willing to master them, but they aren’t always easy to spot. These patterns provide a unique way to anticipate price reversals and adjust trading strategies accordingly.

Whether you’re a novice or experienced trader, learning to recognize and apply diamond pattern technical analysis can help you make the most of market movements.

Remember, however, that no pattern is foolproof, so always approach trades with a sound risk management strategy. With patience and practice, you can make these “diamonds” work for you in the market.

Top 5 Trending

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]

The Psychological Line (PSY) Indicator is a versatile, oscillator-type trading tool that compares the number of periods with positive price… [Read More]

Have you ever felt like your trading approach could benefit from a little extra energy? That’s where the Relative Vigor… [Read More]