Ever wonder what other traders are doing in the market? Trading philosophy dictates that you trade with the market, not against it. So when buyers are dominating the market, you should enter buy positions. Conversely, when sellers are dominating the market, you should enter into a selling position.

There are many ways to determine what position to take. These include trading along with the trend or based on a specific candle colour. IQ Option provides another useful tool to help you analyze current market behaviour. The Traders’ Sentiment widget.

This widget appears on the left side of your chart. It simply shows what percentage of the market is buying or selling. This guide will teach you how to set up and use the Traders’ Sentiment widget.

Setting up the Traders’ Sentiment widget on IQ Option

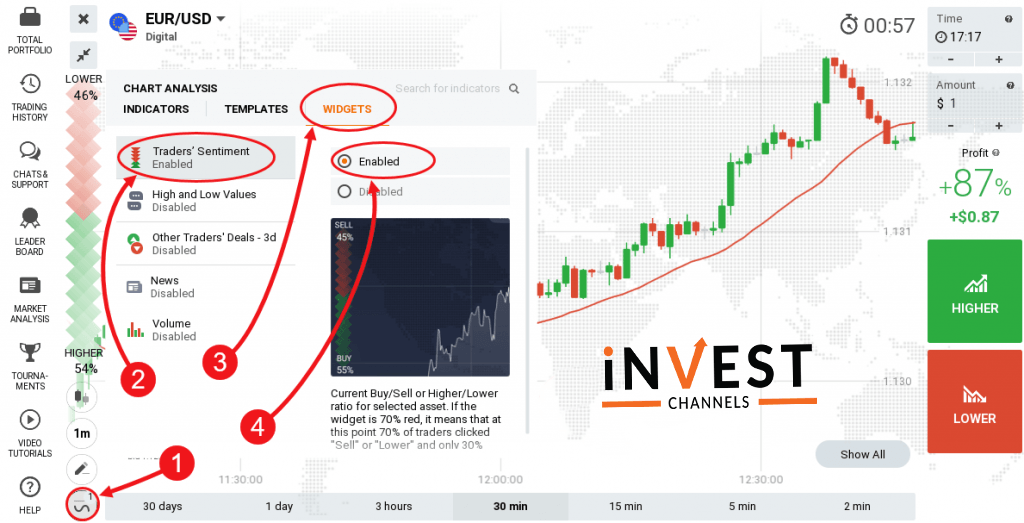

Once you’ve logged into your IQ Option trading interface, click on the indicators feature. Under the Widgets tab, select “Traders’ Sentiment” check the enabled radio button.

This widget will be displayed on the left side of your chart. The upper part is coloured red/pink while the lower part is coloured green.

Using the Traders’ Sentiment widget to trade on IQ Option

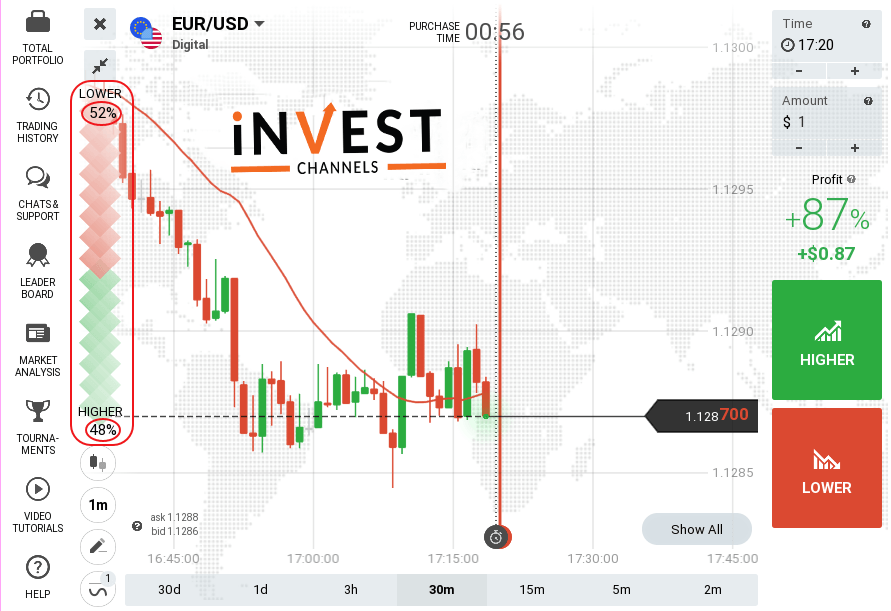

This widget essentially tells you what the majority of traders are doing in real-time. When the market is dominated by sellers, you’ll notice the red/pink zone get larger. This is accompanied by an increase in the “lower” percentage value and a decrease in the “higher” percentage value. If the markets are dominated by buyers, the green zone will get larger while the “higher” percentage value increases. At the same time, the “lower” percentage value will decrease and so will the pink/red zone of the widget.

How do you trade based on the Traders’ Sentiment widget?

There are two types of traders on the IQ Option platform.

The first type trades with the crowd. If the crowd’s sentiment is to buy, these traders will enter buy positions. So if the green zone on the widget is larger and the “higher” percentage is higher than 50%, these traders will enter buy positions and vice versa.

The second type is the conspiracy theory type. They believe that the markets are being manipulated by the broker. This group will usually trade against the crowds.

Whatever group you belong to, I suggest that before you trade based on this widget, take a look at what the price charts are saying. If the widget signals buyers are dominating the market and the charts point to an uptrend, it’s safe to trade with the crowds. If however, the chart tells a different story, trade against the crowd.

The Traders’ Sentiment widget provides a quick way to know how a good portion of the other IQ Option traders is trading. Now that you’ve learned how to use this widget, try it out on the IQ Options practice account. Share your results in the comments section below.

Good luck!

Top 5 Trending

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]

The Psychological Line (PSY) Indicator is a versatile, oscillator-type trading tool that compares the number of periods with positive price… [Read More]

Have you ever felt like your trading approach could benefit from a little extra energy? That’s where the Relative Vigor… [Read More]