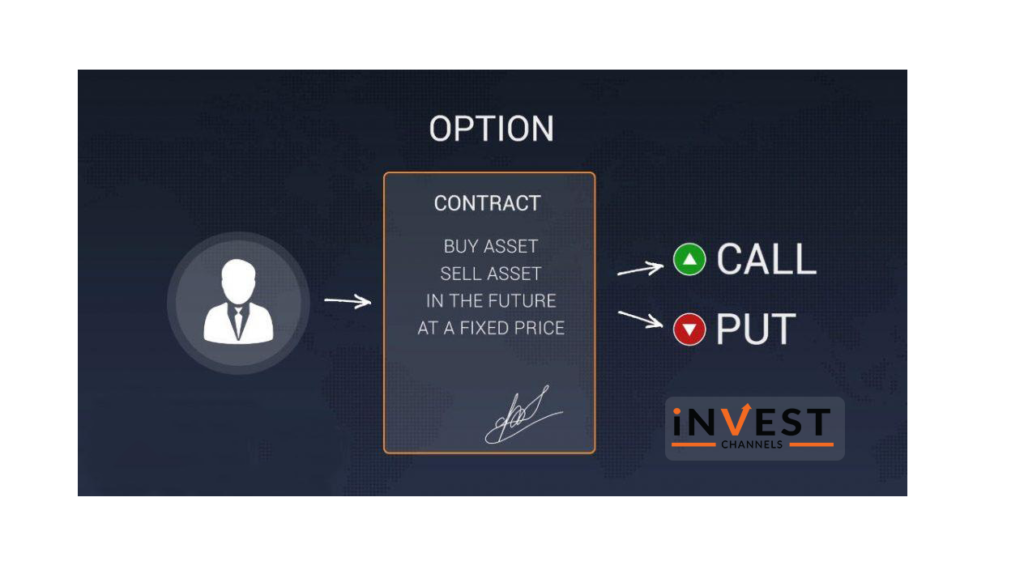

Definition of an Option

An option is a contract that allows you to buy or sell a unit of the underlying asset in the future at a fixed price. Options come in call and put varieties.

Example of an option

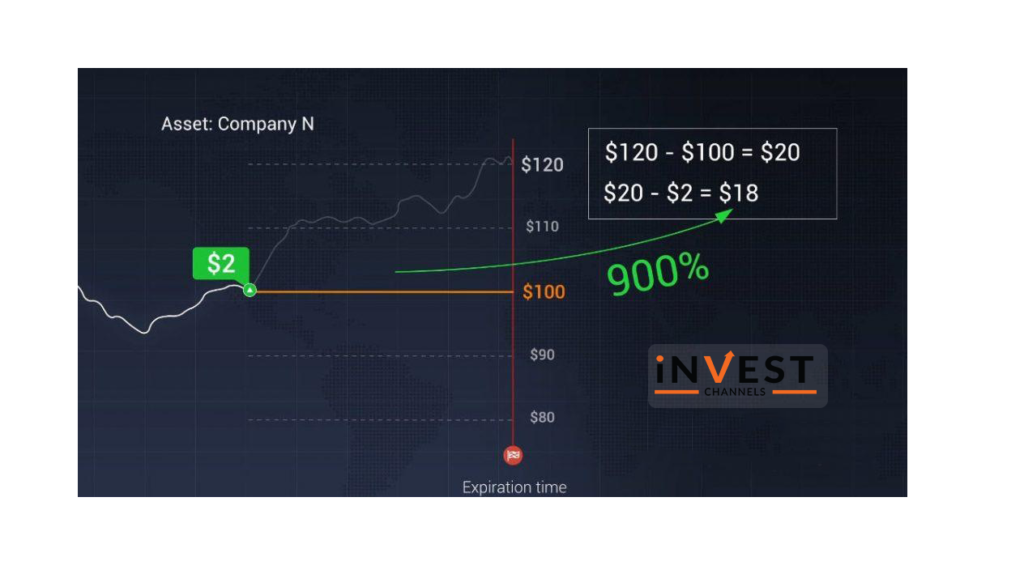

Let us consider a company whose stock value is one hundred dollars per share and suppose a buyer who wants to buy the asset and enters into a contract that grants the right to buy at one hundred dollars per share for a limited period of time.

Contracts like this are known as a call option and in the option contract, the set price is called the strike price. For this example, we will say that this contract costs two dollars. We can say that this is the option’s price.

Let’s look at three possible scenarios.

Call option – Scenario 1.

In the limited time period, the share price increases to 120 dollars. In this case, the buyer can utilize the option to purchase a share at one hundred dollars. And instantly sell them at 120 dollars hence making the total profit of eighteen dollars. This is 900 per cent of the 2 dollar investment.

Call option – Scenario. 2.

For instance, if the share price drops to 80 dollars, and purchasing shares for 100 dollars is not at all profitable to use the option. So, in this case, the buyer loses the two dollars invested in the option.

Call option – Scenario 3.

Now consider the situation in which the share price increases to 102 dollars, the profit will be 2 dollars and that will cover the amount paid for the option. This share price in which traders make a profit is called the break-even level for the purchased option.

A put option works just like the option but in the opposite direction. With the put option, the option holder can sell all the shares at a predetermined price.

As we have seen in the above example that the share price drops with a put option, the trader can buy the stock at 80 dollars and can sell at 100 dollars asset in the option contract. hence making a profit.

Exercising option before expiration

One of the major advantages of classic options is that there is no need to wait for the expiration time in order to exercise the option. For example, A trader bought a put option for the same two dollars and after some time the price of the asset fell to eighty dollars. Now, a trader can sell the option whenever he wants in order to make a profit.

The strike price of an option

As we know that the fixed price of buying and selling shares under a contract is the strike price. As we have discussed in the previous example, for a call option the strike price was 100 dollars. We can say that the higher the strike prices the cheaper the option.

The reason behind this is that the possibility of the price is less to reach a higher strike price although the profit is higher.

Let us suppose a call option the strike price is below the current share price. Options having strike prices like this are called in the money options. But the probability of profit percentage is lower and the cost of such options is higher.

For a put option, everything works but opposite. The higher the strike price the more expensive the option. The lower the strike price the cheaper the option.

Expiration time

The expiration time is the deadline for using the right to buy a call or sell put the asset at a fixed price the strike price. Expiration usually occurs at the end of the workweek.

let us take an example to understand this, you are able to buy an option in the week, for the end of the current week or for the last week of the selected month.

The option may be the more expensive if the expiration is from the current date and the price moves in the direction the buyer wants. The cost of options is determined by the market.

There are many factors on which the market conditions depends: price volatility in the past, time to expiration, supply and demand among traders, and more.

We wish you successful trading on the IQ Option platform.

Top 5 Trending

In the world of online trading — often filled with risk and uncertainty — verifying the credibility of a platform… [Read More]

Starting your trading journey can feel overwhelming — there are countless assets to choose from, and it’s hard to know… [Read More]

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]