This material is not intended for viewers from EEA countries. Binary options are not promoted or sold to retail EEA traders

An option is nothing but a contract that gives you the right to buy or sell an asset at a preset price at a particular time.

Example of an option

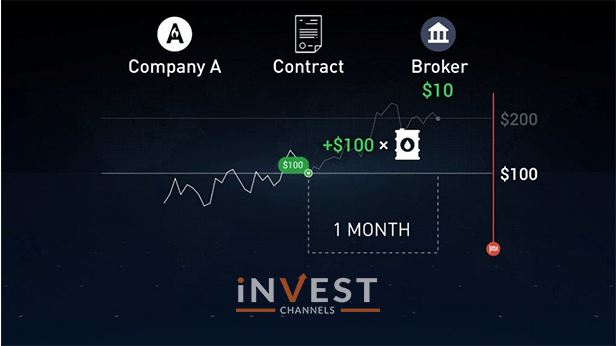

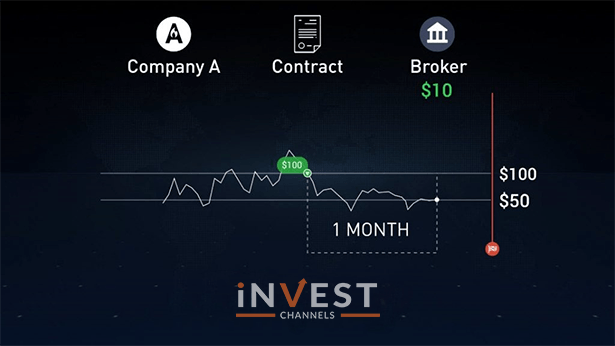

There may be many questions related to option like how does the contract of an option work? Let us take an example, the cost of oil is 100 dollars per barrel. Suppose a company goes to exchange and conclude an option contract with a broker for the same price oil next month.

So, the company have to give the price which is also called option premier to its broker. It also has two scenarios. Let us study one by one.

First scenarios, after a month, if the cost of oil increases to 200 dollars per barrel, but the company has the option contract or purchasing the oil at one hundred dollars so, the company buy oil at the agreed price of 100 dollars.

But if we look at the second scenario, the price of the oil drops to 50 dollars then in this case there is no point to buy oil at the agreed price of 100 dollars

Let us consider another example:

1. When you have profit from stock price with very limited risk and low buying stock.

Example: You buy one stock at 25 and pay $1. The stock then moves up to $28 so, your option will gain at least $2 in value, which will give you a 200% gain versus a 12% increase in the stock.

2. A situation when profit from stock price with very little risk and low cost than shorting the stock.

Example: Suppose you buy one Oracle 20 put at 21 and you pay $80 for that. ORCL drops to 18 and you have a profit of $1.20 which is 150%. The stock lost will be 10%.

3. When you earn profit from sideways market by selling options.

Example: Suppose you own 100 shares of General Electric (GE). You sell 35 calls for $1 with the stock at 34. the stock remains unchanged at expiration, which is 34, the option will expire and you will make a 3% return on your holdings in the market.

4. Protect your positions

Example: You own 100 shares of a stock at 190 and need to save your position, then you buy a 175 put for $1. The stock will drop to 120, you are saved from 174 down and your loss is only $16 instead of $70.

Specific terms for trading options

Options trading has its specific terms:

- When the trader buys an option, that is the purchase time.

- The predetermined point in the future is the expiration time.

- Options Premium is the price of an option contract.

- target level that the opening price of an asset should go above or below for the position to close in the money is the strike price.

Main types of options at IQ Option

Options have two main types:

Call option “calls” and the put options “puts”. A call option gives the holder right to buy a stock and puts options gives the holder right to sell a stock.

Payoffs for call and put options:

Calls

At the time of entering the contract, the buyer of a call option pays the premium in full. Later, the buyer earns a potential profit and the market moves in his favour. There is no chance option for generating more loss beyond the purchase price. This is a great feature of buying options. The buyer can secure unlimited profit potential with a limited loss, for a limited investment.

Let us consider a situation that the spot price of an asset does not rise above the option strike price prior to the option’s expiration, well, then here the investor will bear the loss they paid for the option. If the price does not exceed the strike price then the call buyer makes a profit.

Put

The profit which buyer make o the option depends on the spot price of an asset at the option’s expiration. If the strike price is above the spot price, then the put buyer is “in-the-money”. But if it remains higher then the strike price, the option expires un-exercised. The option buyer’s loss is again limited to the premium paid for the option.

Options trading at IQ Option

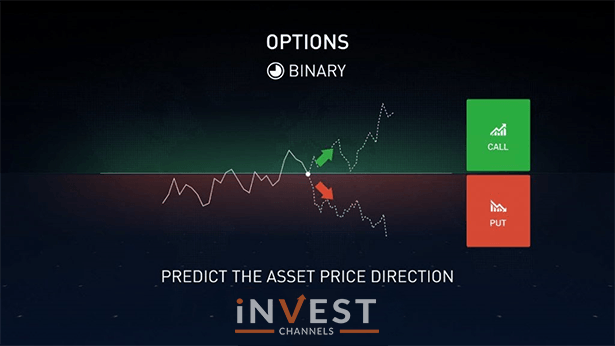

As we know that an option is a contract which gives the holder a right to buy or sell an underlying asset or we can say it is a popular trading instrument that has many variations at IQ platform. If you are choosing a binary options trading then it will be good if you predict the asset price direction weather it will go up or down compared to the opening price.

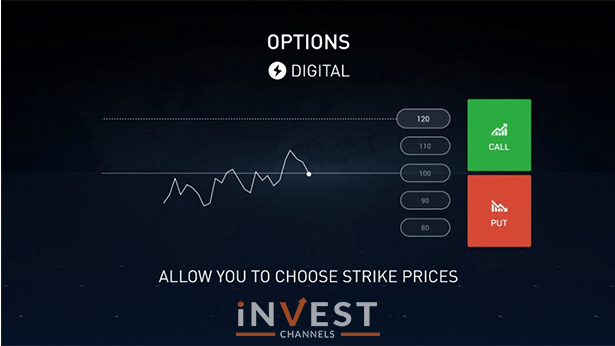

If the underlying asset moves past the predetermined threshold or strike price then the options contract has a fixed payout. The maximum loss for the option is called an upfront fee or the premium for digital options. Also, you can manage your risk efficiently as digital options allow you to choose strike prices.

Have a great trading experience.

Top 5 Trending

In the world of online trading — often filled with risk and uncertainty — verifying the credibility of a platform… [Read More]

Starting your trading journey can feel overwhelming — there are countless assets to choose from, and it’s hard to know… [Read More]

"Why do I keep losing money in trading?" This is a question every trader has asked at some point. Experiencing… [Read More]

Trading indices is more than just a financial pursuit; it's both an art and science, demanding attention to detail, a… [Read More]

Forget Tiffany’s—there’s a diamond that traders treasure even more. Diamond chart patterns may not sit on a ring, but they… [Read More]